Should I Buy GBTC?

Insight For Those Considering GBTC

Some might ask “should I buy GBTC?” Others might ask “should I buy GBTC or BTC?” That is, “should I by the Bitcoin stock or actual Bitcoins?” Here is some insight.

- Bitcoin is, in most respects, the world’s most popular cryptocurrency. Bitcoin’s price has been volatile, but its general trajectory has been up over time despite a few hard dips and longer term corrections. It’s a risky, but potentially exciting, bet for investors who are set up to trade it quickly or want to go long at a low price or build an average position over time (plus it is useful as a digital currency).

- The Bitcoin Investment Trust (GBTC) is a trust run by Greyscale that holds about 170,000 bitcoins. Investors can buy shares of the trust. A share represents just under 1/10th a Bitcoin (due to fees and such). In a perfect world GBTC would mirror Bitcoin’s price movement and value perfectly, like GLD does with Gold, but so far that has been far from the case.

UPDATE FROM 2018: GBTC trust’s stock split in January 2018, each share is now worth about 1/100th of a Bitcoin. Please also note while prices change, and in cases may be used as examples below, the basic logic behind the article has not changed since it was written back in September 2017. The gist of GBTC is still the same, it trades at a premium, loosely tracks the price of Bitcoin, has preformed very well, and generally has pros and cons to consider.

With the basics covered, the bottom line is that these are both good choices for investors, as long as investors understand what they are buying. Here are some things to consider:

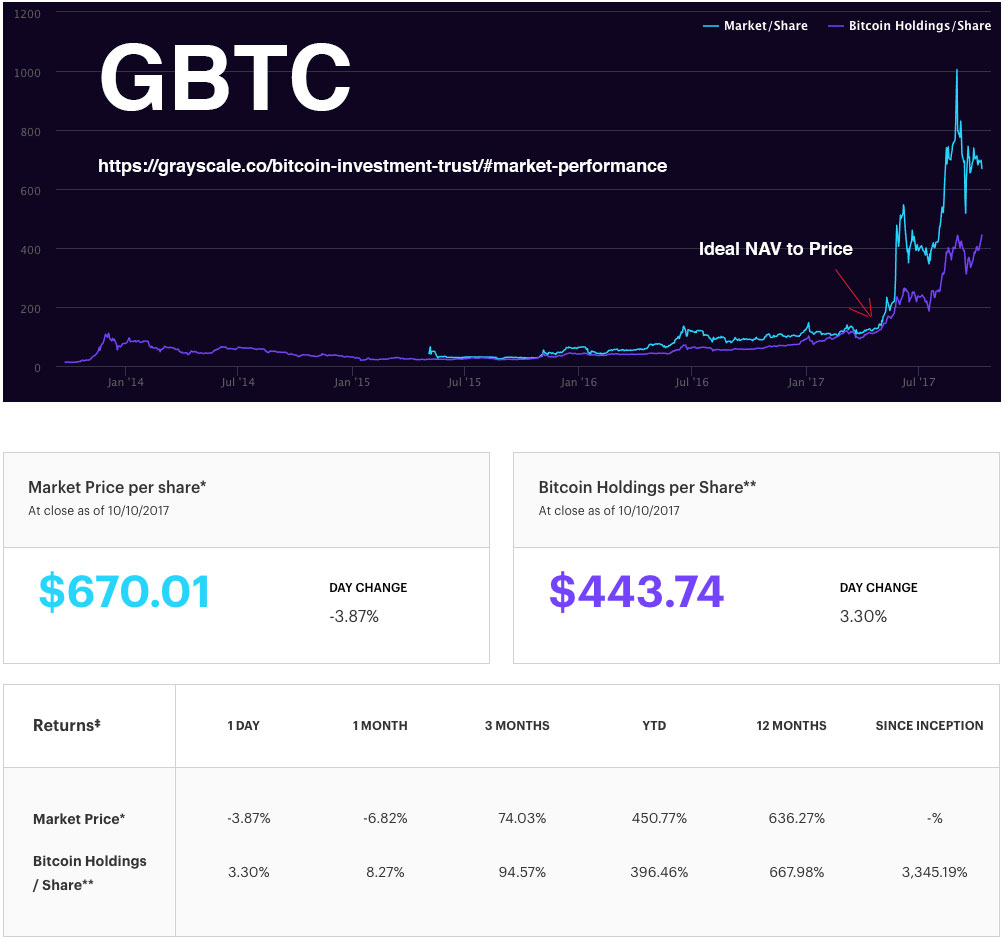

- GBTC has historically traded at a large premium to its NAV or Native Asset Value (meaning it has been trading for more than its worth on-paper historically). You can track the GBTC premium directly on Greyscale’s website. On the site, “Market Share” is the cost of shares of GBTC and “Bitcoin Holdings” per share is the current underlying value of the Bitcoin.

- BTC generally trades for what it is worth, because it is itself. Although what it trades for can differ by country and exchange.

- GBTC can be traded via a traditional brokerage account, so you can for example use your 401K to buy Bitcoin indirectly this way.

- BTC requires you to set up wallets and exchanges or use a broker. In other words, it requires setting up a program such as Coinbase/GDAX. That means there is a learning curve and another exchange to watch over if you are going to trade that way.

- Buying and Selling BTC can result in hefty fees if you don’t use an exchange. Your broker will often have lower fees.

- GBTC doesn’t perfectly track Bitcoin’s price. Sometimes this is good as GBTC can be less volatile on down days or can exaggerate gains on up days. However, other times GBTC will fail to track a Bitcoin run and that can be frustrating

- BTC is always the best buy on a dip, because if and when it recovers, the recovery is certain to be enjoyed by the investor (not true for GBTC). In other words, when the price of Bitcoin dips, the price is good (assuming it bounces back again, as it has in the past).

- GBTC becomes a better buy the closer it gets to its NAV. It doesn’t necessarily become a good buy in a dip, because it is trading above its NAV. That can make timing a buy really complicated.

- As noted, GBTC has historically traded for a premium. That premium has ranged from about 30% to over 100%. The average premium has, very roughly, been about 50% – 70% since crypto took off mid-2017. So, if you are looking to buy GBTC and you see premiums above 100%, then it might be wise to be more cautious, and if you see them closer to 30%, you might consider GBTC to be at a historically attractive price in terms of its premium. You can go to the Greyscale website to see a graph of its premium over time. NOTE: Of course, when thinking on the premium, one must remember the longstanding and widely applicable disclaimer, “Past Performance Is Not Indicative Of Future Results.”

- If you have Bitcoin and it forks into a new crypto, like Bitcoin Cash or Bitcoin Gold, then you get “free coins” (that is, you get one cash or gold for every BTC you have).

- Greyscale had initially been a little unclear on what they planed to do with their forked coins, for example with their Bitcoin Cash. That was nail-biting, but eventually they liquidated their Bitcoin Cash holdings and paid that out to holders of the trust. The same sort of action was then taken for Bitcoin Gold. This tells us GBTC is likely to do this for all major forks that have value and trade on popular exchanges (not all forks), so investors can rest easy knowing that Greyscale will likely take repeat these actions for any subsequent forks of value. Read our updates on how GBTC is handling forks. NOTE: To get the distribution from the fork you must hold GBTC on the “Record Date” as announced by Greyscale. Each fork will have its own “Record Date.”

The above of course isn’t professional investing advice, it is simply some considerations as to what to think about when considering buying GBTC or BTC.

The bottomline being, GBTC is a valid way to get exposure to Bitcoin and so far they have been good about forks, but the premium and the fact that GBTC doesn’t always track Bitcoin’s price are important factors to consider before buying.

All-in-all, there is a lot of logic behind choosing GBTC, but it’s important to understand exactly what you are getting for the price.

UPDATES: Obviously things can change over time. Initially GBTC shares were worth about 1/10th of a Bitcoin, but now are worth about 1/100th. What happened was that in January 2018 the GBTC stock split 91 – 1. This truism can make researching past performance of GBCT a little confusing, so keep that event in mind. In January 2018 BTC traded at $11k and GBTC at $19.00. At its height before the split, BTC traded for $20k and GBTC for $3.5k (the equivalent of about $32 after the split, or more specifically $3.5k split 91 times).

Rich DePaolo

Please provide simple way to calculate the premium between the bitcoin trust and bitcoin price

Thomas DeMicheleThe Author

Greyscale does this on their site. You can see it here: https://grayscale.co/bitcoin-investment-trust/#market-performance

Market share is the cost of the stock, Bitcoin Holdings per share is the current underlying value of the Bitcoin.

Mike

What happened if we don’t answer to this notice ? https://grayscale.co/wp-content/uploads/2015/09/BIT-Consent-Request-October-17-FINAL.pdf

Thomas DeMicheleThe Author

It is treated as though you accepted the terms if you do nothing (according to the document). The date has already passed, so it is essentially already a done deed.

In general you never HAVE to respond to anything like this from any type of security. Often if you have voting shares you’ll be asked to vote for or against, or offer feedback, on changes. If you do nothing, then you miss your chance to vote, but it has no negative effect on your ownership of the asset.

Mike

Your comment is awaiting moderation.

NOTICE TO SHAREHOLDERS OF BITCOIN INVESTMENT TRUST DATED OCTOBER 4, 2017

YOUR PROMPT RESPONSE IS REQUESTED

Failure to respond will be deemed your consent to the matters

addressed herein, as described below

What will be the best answer to this notice ?

Thomas DeMicheleThe Author

He is referring to: https://grayscale.co/wp-content/uploads/2015/09/BIT-Consent-Request-October-17-FINAL.pdf

I have to go over it and think on it and work through the implications of the language. My first impression is that this is partly about what they should do in regards to the forks. My stance is that they should simply hold all coins from forks (mirroring an investor who held).

Not 100% though that this is what it is referring to, comments welcome.