The Crypto Bubble is Popping; But Crypto isn’t Over

Understanding the Jan – Feb 2018 Bubble, Cryptocurrency Bubbles, and Economic Bubbles in General

Clearly cryptocurrency went through a price bubble phase and now the bubble has popped. However, this is only one phase in the history of crypto.

In other words, this January – February 2018 crypto bubble and bust isn’t “the bubble” it is “a bubble,” not the first (that is a fact) and likely the last (that is an educated guess). We explain that position below.

Bubbles in General and Some Notes on the Bitcoin / Cryptocurrency Bubble

Before we dig into the Jan – Feb 2018 cryptocurrency bubble, let’s review some notes.

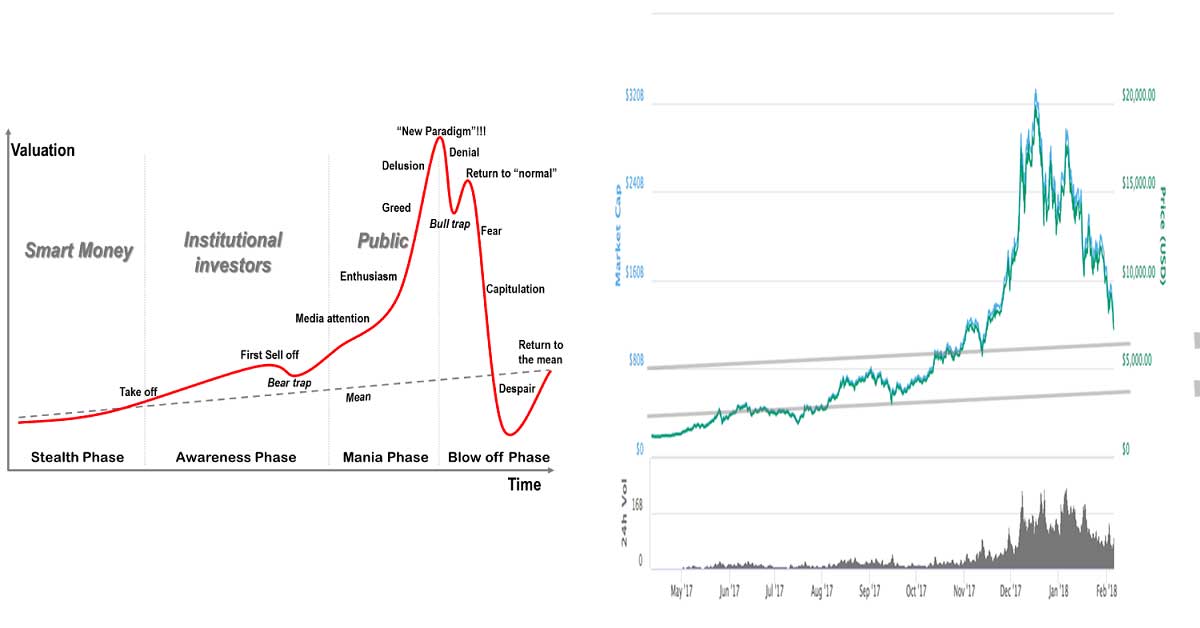

What is an economic bubble? In simple terms, an economic bubble is when prices get pushed up higher and higher (beyond an asset’s fundamental value) due to rampant speculation. Generally, everyone is betting on making more money, often fueling the rise with credit (margin trading, credit cards, etc) rather than pricing an asset based on fundamentals and investing with caution. When investing turns to gambling and a period of strong gains give way to weak knees and a lack of resilience. To the last point, to have a bubble you need to ultimately not only have prices pushed up, but to have the bubble pop. When prices come back down quickly to at, below, or around the price they started at before the speculation ramped up, you can pretty safely say “the bubble has popped.” We had that with crypto from Nov 2017 – Feb 2018, so we can safely assume we had yet another crypto bubble (this time a rather big one on par with 2013 – 2014). See this breakdown of classic bubbles for information on bubbles.

What type of bubble is Bitcoin? One could argue that the Bitcoin bubble (or crypto bubble in general) is more like the dot-com bubble than the tulip bubble or South Sea bubble. We have an excitement over a new technology that people don’t know how to price, and we got an over eager market pushing the price up too quickly in a speculative fervor (and then others taking advantage of that; pushing the price up even more, and then down even more later). This is opposed to tulip futures or spoils from the South Sea, where the underlying assets ended up being essentially worthless (the demand for tulip bulbs wasn’t there, the South Sea ships never actually made a successful voyage; one could argue crypto, like dot-coms, is an important and emerging technology and market). Also, unlike Tulips, cryptocurrency is a proven market and in that market bubble and bust patterns are VERY common (there was only 1 tulip bubble, not 1 bubble every year for a years in a row after discovering the tulip). The bubbling nature is because the market is young and thin (low volume). In a thin market pushing prices us is too easy, and panic selling can drop the price very quickly. This environment of thin market, hard to price tech, and lots of excitement allows for bubbles to form frequently. Cryptocurrency is thus a bit like dot-coms. It is also a bubble and bust economy in hyper speed. As, everything that happens in crypto happens faster than it does in traditional equities markets (consider, crypto exchanges are their own little ecosystem). Like we have thus far, we will likely continue to see this pattern of bubbles and busts (but an overall upward trajectory) over time until more adoption occurs (that doesn’t mean we’ll always see higher prices; just that this is likely not the end). In other words, online global exchanges, thin markets, lots of excitement, and a history of bubbles within the ecosystem is the character of cryptocurrency; it would be like if .coms had had their own exchanges since day 1. With that in mind, see: Here’s how bitcoin is dwarfing housing and dot-com bubbles. Notice how the chart looks the same as other bubbles, but the number of days it took to happen is far less than it was with other bubbles. If this pattern holds, the rest of the chart should look the same, but will occur faster. Assuming it is like the .com then, we could see the true growth (and potentially another bubble) come rather quickly. An analyst from the Wall Street Journal said what I’ve been saying (as have others), this is like the dot-com bubble at about 15x speed. So look at what that means below. It means part of the bubble has popped… but it also means we could be gearing up for the next phase before anyone even really has time to shed too many tears over it (or well more specifically, if it fully plays out like that it could be a good year or two before a full recovery, so there will be time for tears, but compared to the dot-come, not all that much time; see a chart of where Bitcoin is at now to get a sense of what I’m saying).

If this is anything like the .com bubble. It is the next part of the chart we want to keep our eye on. Hello fractals. Keep in mind Bitcoin’s bubble is forming in a much quicker time frame, so the next part would be expected to form in that same time frame as well (i.e. 2019 or so we would see a larger version of what just occurred… although hopefully a tempered and more stable version).

TIP: It is very doubtful Bitcoin’s chart will follow the .com chart to a T. The entire crypto market might (where we would compare .coms that went bust to altcoins that go to zero), but BTC is much more likely to itself rally higher. Past performance of Bitcoin and most cryptos hint that the bottom won’t be a mythic $2k and is more likely above or around the $5k range. Still, one can’t deny that what has occurred thus far can safely be called a type of bubble and bust cycle (as time rolls along we’ll have a better sense of what occurred).

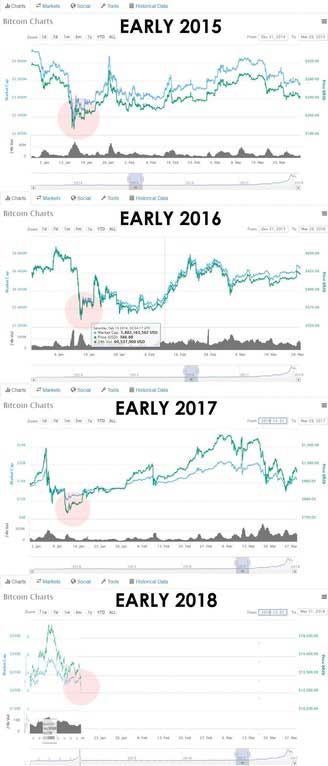

NOTES: See the Bitcoin bubble by looking at the chart of Bitcoin from the start of 2017 to February 5 2018. Feel free to compare that to 2013 – 2014. You can see an informational graphics above as well. In the header graphic we show the standard bubble chart (found here) and compare it to the current Bitcoin chart (found here). The other chart compares the Bitcoin Bubble to the .com Bubble. As you can see, even if this is a traditional bubble that plays out like clockwork, we are nearing the end of the correction (from a slightly optimistic view, in terms of historic bubbles, one would expect it to steady out between $3k – $5.5k depending on how you read the chart, although it could of course dip below that or stay above those levels). With that last statement in mind, one should note that in cryptocurrency trading coins almost never give back everything when a price bubble busts (they give back a lot, but not everything). So a higher bottom of $6k – $6.5k might be more likely (as if we are looking for patterns we want to look within the category “cryptocurrency” and not just within the category “economic bubbles”). For some detailed in the moment analyses see TradingView.com.

TIP: Notice how I say we have to compare this bubble to past cryptocurrency bubbles? Well, that is because crypto bubbles and busts all the time. We’ll discuss this more below. The point here is that, since this is true, it makes the fact that the current bubble formed and popped far less distressing. Pair that with our knowledge of how the .com bubble played out and the fact that cryptocurrency tends to form patterns in hyper speed… and it takes a lot of the potential worry out of gradually investing in a top coin like Bitcoin or Ethereum as a long term investment (even if some of your buys are above the current levels). For a better sense of what I mean, see: Crypto Corrections are Never Fun For Holders… but They are Common and A Guide to Holding Crypto – What it Means to “HODL.”

On Cryptocurrency Bubbles and the Jan – Feb 2018 Bubble

With that introduction covered, let’s zero in and focus on cryptocurrency bubbles and the Jan – Feb bubble.

First off, it is important to realize that cryptocurrency has been rather bubbly since day 1 (see: historic Bitcoin corrections, it is a topic that you can Google, because it is so common).

It has regularly bubbled, busted, and then bubbled again. Even this pattern of a December boom and January – February correction is common in crypto!

Throughout those bubbles and busts the top coins have withstood the test of time to make some of the best gains of any assets in history, while the lesser coins have gone to the crypto graveyard.

In that cycle of bubbles and busts we have seen big bubbles, like 2013 – 2014, and we have seen countless little bubbles in-between.

Meanwhile, within those cycles we see countless other cycles. We have seen bubbles and busts in the prices of coins and we have seen a rotation of which coins bubble and when.

Its really, all down to predicting this bubble and bust, a bunch of self similar patterns repeating (i.e. very fractal-y).

Some of this is pump and dumps, but some of this is a thin and new market where everyone piles onto the same coin at the same time. Either way, the effect is the same.

We have many cycles, many patterns, and many bubbles and busts. Some epic, like this one is shaping up to be, some dinky and short in retrospect, like the one back in November.

This cycle repeats over and over in crypto and likely will continue to until wider adoption occurs and more trading volume occurs within a day.

At the current point of the cycle, in terms of historic economic bubbles, we are likely somewhere towards the end of the bust stage.

Essentially we are in-between capitulation and a return to the mean (heading toward despair), likely with a few more bounces and dips and perhaps one recovery that doesn’t last.

If this was the stock market, I’d suggest seeing a shrink to help you cope.

However, this is crypto, so by the time you book your appointments and coordinate with your insurer, you might have to be going in for mania, as the depression phase will likely be over.

What I mean is this, crypto years are like dog years. It took 15 years for the .com bubble to form, bust, and then for the good companies to become the giants of today. In crypto it’ll likely take anywhere from weeks, to months, to a year for us to be at the height of the next bubble again.

Recovery was a little slow after 2013 – 2014, taking all the way to 2017 to come back, but that was because it was really hard to buy crypto in that time (even Woz had problems buying in that period… and he created the devices many of us buy Bitcoins on).

Today buying crypto has become easier, and a range of new products are launching in 2018 putting crypto at the fingertips of the many retail and institutional investors (see our blog).

You can look at the bubble pop and be fearful, or you can look at the 400% gains before that and the all time high and think, “man I want to be on the next wave.”

It is the new exciting technology, the history of crypto, and the desire to be on the next wave that makes this popped bubble less worrisome than it might otherwise be.

Sure, there is room to see more bust before it gets better. And we might be in for a long bear market. But at some point crypto is likely to rally again for the same reasons it did before. That is what we want to be keeping an eye out for (and if you can stomach it, buying the dip for too).

Until the volume is there to prevent speculators pushing the price up to quickly, we are likely to see more quick bubble and bust cycles in crypto.

Since crypto has repeated so many patterns and cycles in its history, it is hard to think “this time it is the end.” As, if it is the end, then “this time it is different,” and so far, this time has not been different at all.

TIP: If you would have bout Bitcoin at $20k, do yourself a favor and gradually buy the dip and hold. Crypto could go down, it could go up, in the short term I don’t know. I only know that averaging into crypto (slowly and gradually with money you can afford to risk) starting in a dip /correction is way smarter than waiting until its at all time high. That is just basic logic.