Crypto Investing Strategy: “Buying the Dips”

“Buying the Dips” in Cryptocurrency

A basic investment strategy can be phrased as “buy the dips.” This doesn’t mean go all in while an asset’s price is going down, it means average in as it goes down and/or buy after it settles.

Further, this strategy is much safer to use in a bull market or a stagnant market, where the general trend is up or sideways (as opposed to a bear market where the general trend is down).

With that said, to buy the dips one might do one or more of the following:

- Buy incrementally as the price goes down, creating an average position and aiming to buy more as the price decreases further.

- Wait until the price settles, and perhaps even shows signs of recovering, and buy at that point (buy a reaction off of support).

- Set buy orders at lower prices and let them fill. Setting buys just before historic support levels, large “buy walls,” and psychological levels is an especially good strategy (as prices tend to do at least a quick bounce off these levels).

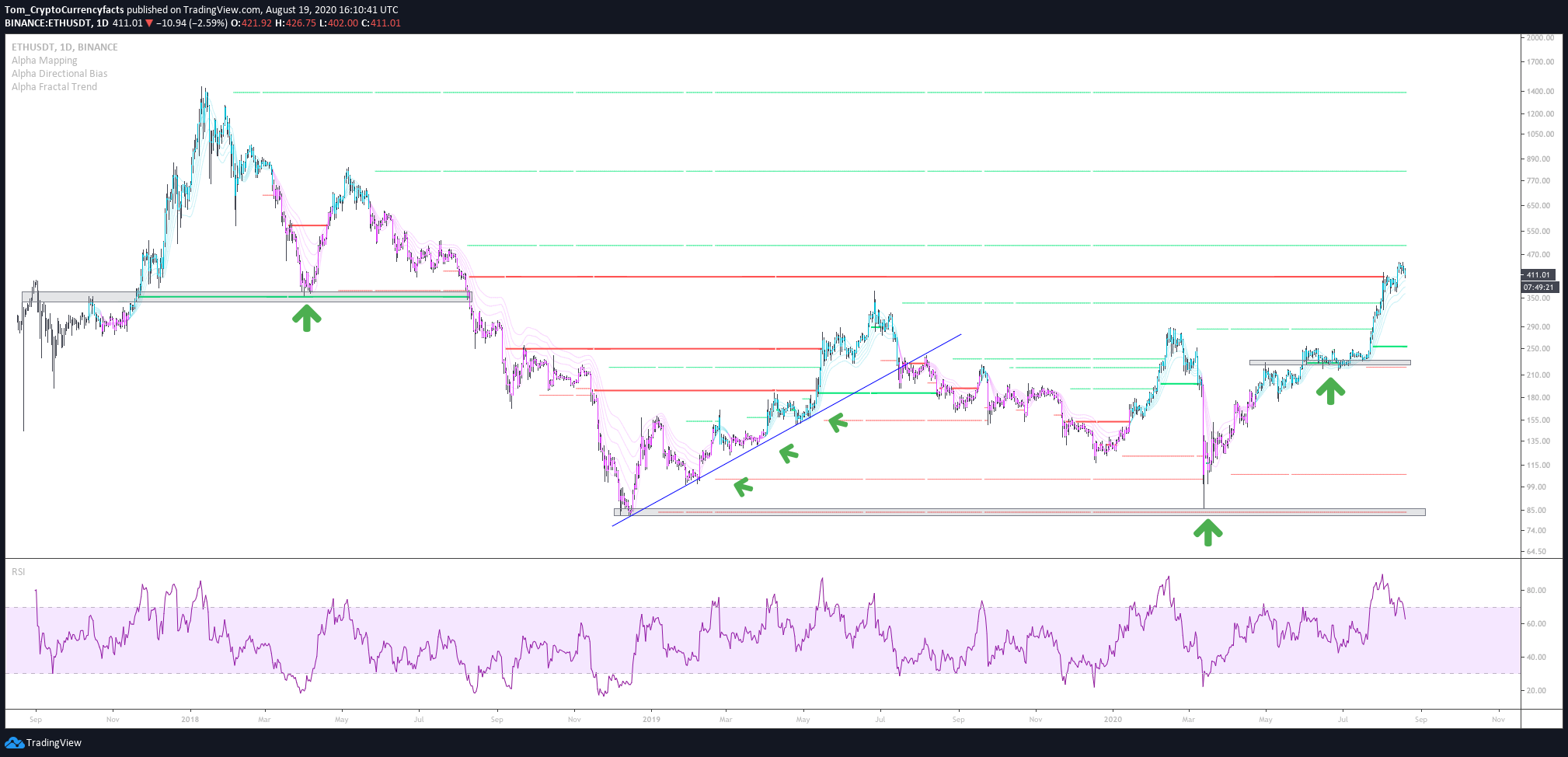

Note: See the chart below for examples of support levels. In this case, these are horizontal levels where price has previously consolidated and sloping trendlines that price is reacting to as it moves up. These are logical places to buy the pullback (AKA “the dip”). Front-running clear support levels with a stop below the level is often more effective than just blindly buying every dip.

With that all noted, and as you can see on the chart above, one can “buy the big dips” (or buy when the price has gone well below the average), or one can “buy the little dips” (or buy when the price comes down from wherever it last was).

One can “buy the dips” to sell quickly for a profit, to build a long term position, or to incrementally take gains.

In all cases, the concept is the same, aiming to buy at a lower price when price consolidates or corrects.

Although there is logic in buying into strength, even in a bull market it is often a better tactic to buy pullbacks than it is to wait until prices are high (when many other people will be rushing to buy) and thus exposing yourself to pressure to sell low.

i.e. buying the dips > FOMO buying at the top or panic selling the bottom.

At its simplest then, this strategy involves buying when the price is lower than the last high. At its most complex, it involves studying charts, paying attention to short term and long term moving averages on different time scales, identifying historical support levels, laddering buys, and placing stops. Whatever your level of skill is, however, the concept is generally the same.

In crypto, we see many little dips, and then every few weeks or months we tend to see some very big dips (we might call “corrections” or “crashes”). Both little dips or big dips can make sense to buy depending on your investing strategy. If you are range trading, then little dips are great to buy, if you are a long-term investor, then the bigger dips can be rewarding for building a long position (but of course you have to be careful about how you time your buys).

Of course, timing the bottoms of those dips is next to impossible… and that is why it can help to buy incrementally as the price falls.

The bottom line here being, there is more than one way to “buy the dips” (with crypto or any other asset). However, all versions of this strategy aim to buy at low prices rather than high ones by buying when others are selling.

This means one has to use a little counter-intuitive logic and fight off some emotions. Specifically, one must:

- Put aside the fear that comes when everyone is selling during a correction.

- Put aside the impulse to buy high when it seems everyone is buying.

The strategy isn’t guaranteed to be successful, but it is a smart and simple investing strategy that doesn’t take much skill or technical know-how to implement.

Meanwhile, as eluded to above, if you want to add technical aspects, you can look at things like moving averages, support levels, RSI, and volume to get a sense of how low a price might go and get a sense of when recovery is likely.

With the technicals added in, “buying the dips” can become a pretty solid strategy with a high success rate, without them, it is still generally better than FOMO buying the top or panic selling in a stagnant or bull market when the price pulls back (as it WILL pull back, crypto is volatile).

The graphic above which shows little dips should explain everything you need to know. Here are some additional tips and tricks:

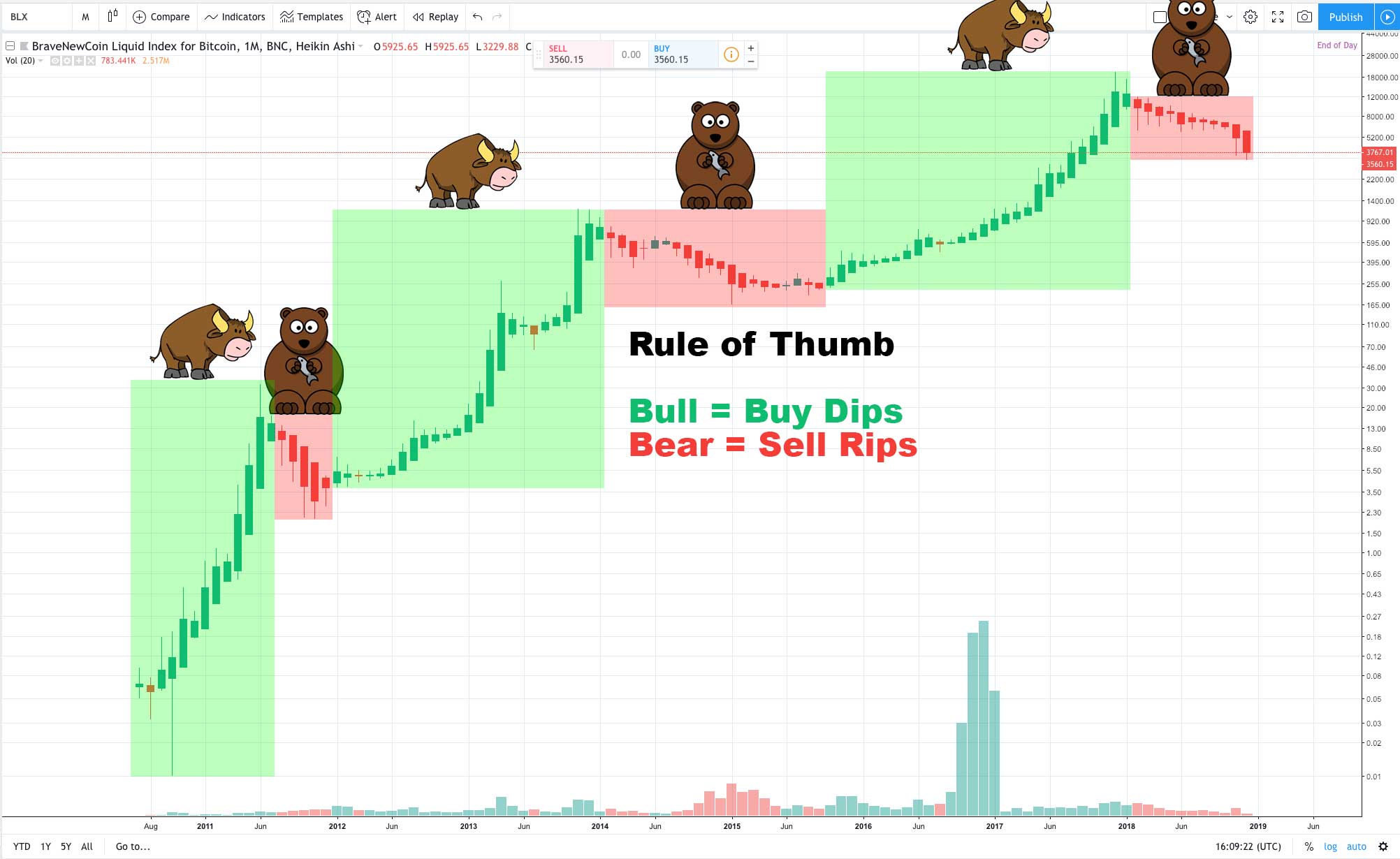

- Know if the overarching trend is bullish or bearish. General wisdom says “buy the dips” in an uptrend and “sell/short the rips” in a downtrend. In other words, trading the trend is smart, and thus buying the dips is for bull markets. Bull markets are forgiving because they go up until they don’t. Bear markets are unforgiving and don’t reward dip buyers who aren’t also good traders in the short term or sometimes ever. Of course, to do this you’ll have to learn how to tell a bear market from a bull market.

- If you can figure it out, use MACD (the divergence and convergence of moving averages), or another such tool on a higher time frame to help you understand if we are in a bull or bear market, to help you understand why the price just dipped or shot up. Other indicators are very useful, but MACD is particularly useful for the tactic being discussed because it gives you a quick visual of the current trend. The trend is your friend, DO buy dips in a bull market, but watch out in a bear market!

- Understand why the dip happened. Did the dip occur due to some rumor that will likely have a temporary impact? Was the crypto overbought and now it needs some time to cool off? Did it just fail an all-time high twice and now we are likely headed for a longer-term correction? If you have this answer, then you can better gauge if you should be buying the dip. To this point, also keep an eye on the news. Bad news can cause a correction to deepen, good news could result in a quick turnaround (making it hard to get buy orders in if you are waiting for signs of recovery before buying).

- Ideally, you’ll want to use a proper exchange like Coinbase Pro to do this. Buying via a broker like Coinbase is an option, but great deals can be hard to manage without being able to trade quickly and set limit orders… thus a more robust exchange like Coinbase Pro often makes sense to use.

- Be super careful with market orders when the price is flying all over the place. If the market is too chaotic some pretty gnarly slippage can occur. This is one reason to have limit orders already placed around supports in anticipation of the dip.

- A conservative strategy is to wait until a price starts going back up to buy and then wait until it starts coming back down to sell. You’ll miss part of the run and you’ll miss your chance to sell at the highest possible price, but you’ll be taking safer bets a lot of the time if you wait for some confirmation of an uptrend or downtrend. This is generally true even though you could end up missing some buying opportunities this way.

- You won’t always have time to buy once the price starts recovering (or to sell when the price starts dipping). With the last point in mind, sometimes cryptos can rally or correct by 10% or more in a matter of moments after a harsh dip. It can be next to impossible to buy into some rallies once the price starts recovering or to sell once it starts dropping (without a market order and some slippage at least). It is from this perspective that it can be a solid strategy to mistime the bottom rather than waiting for the price to go back up. Sure, it is more conservative to wait for a trend to be confirmed, but this method can work much better after a very harsh dip down to a key support level you think the price will rebound off of quickly.

- As noted above, a solid conservative strategy is to average into a dip, increasing your buys as the price goes lower. This can help you to build a long position or to make a quick buck when the price and volume pick back up.

- Look at what the price has done over 1 hour, 24 hours, 1 week, 1 month, 3 months, 6 months, etc., and set limit orders just under highs and lows. For assets that are somewhat stagnant, this can net you solid buying and selling opportunities in the short term. This strategy essentially mimics Fibonacci retracement levels, but requires none of the technical knowledge.

- Set stops as needed. We always want to make the right moves, but no one is right all the time. If you need to, be ready to take a loss with a stop. If you have profits, consider taking some profits. No one can time every bottom or top perfectly, so lock in some gains when you have them.

- Long downtrends in bear markets can last weeks or months in crypto (and Bull markets can last a long time too)… so be aware of the overall trend! Meanwhile, dips in a bull or stagnant market can last hours or days, and rallies in a bear market can last hours or days as well. It is general wisdom that one should avoid being a bull in a bear market, and avoid being a bear in a bull market. The trick is understanding what market we are in, in a long-term bear market you’ll want to buy slowly and be willing to take profits, in a short dip in a bull market you may want to spam the buy button. If you don’t know which type of market we are in, slowly creating a position and planning for the worst is far more conservative (assuming the asset is going to zero, and making sure you have enough cash on hand to buy all the way to zero, is about as conservative as it gets). You could buy dips from 2015 – 2017 and get rich in crypto, but in 2018 dips would leave a long term investor with heavy losses (NOTE FROM 2021: Turns out 2018 HOLD’rs were rewarded, still my point is, it doesn’t always have to be this way… dip buyers are not guaranteed a reward).

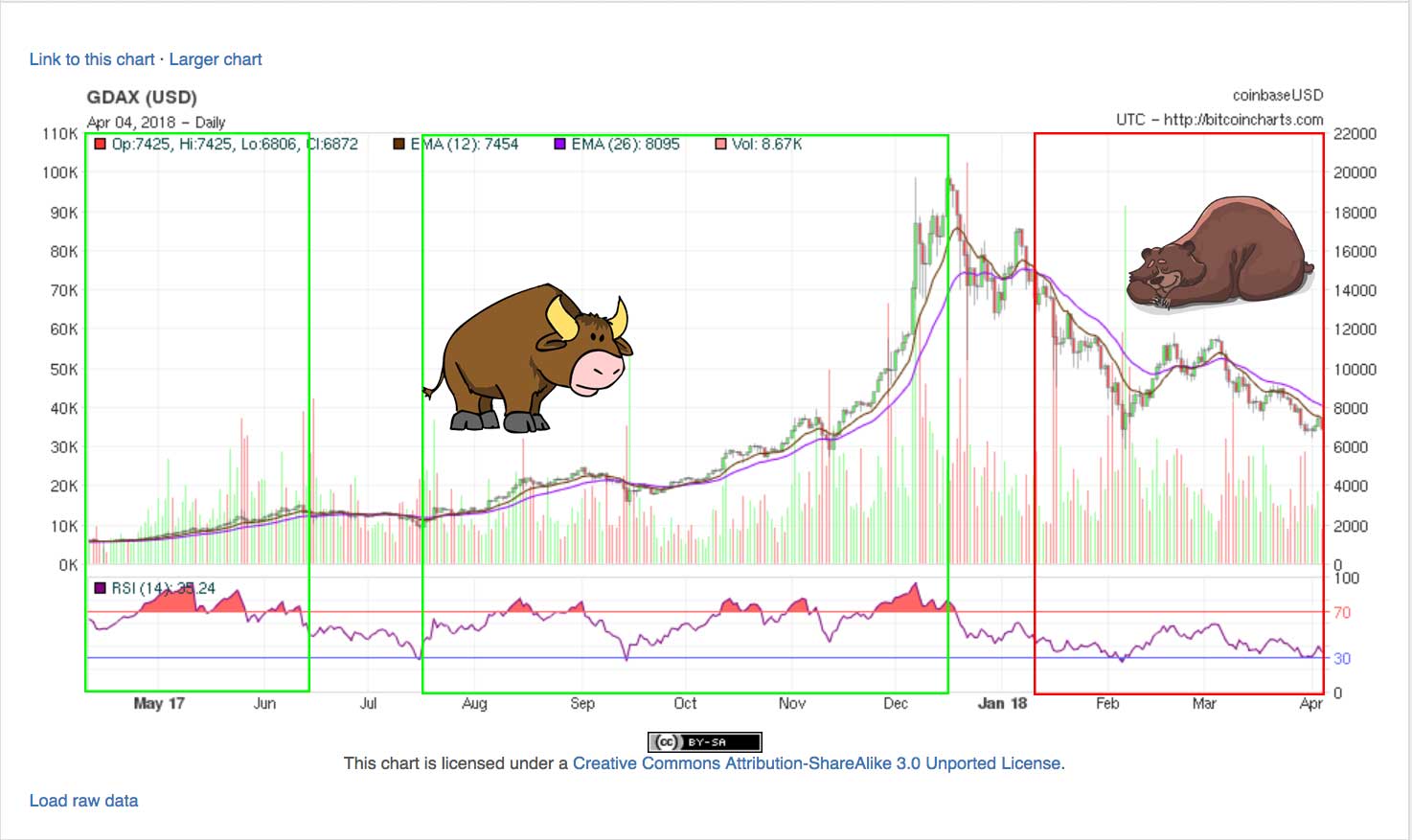

NOTE: The image below shows daily candles on a 1 year BTC chart. When the short term 12-day exponential moving average crossed under the longer term 26 day in January 2018, it pretty clearly marked the start of a bear market in retrospect (a true correction, not just “a dip”). You can see that buying the dip and holding in this time was not ideal (not the worst move perhaps long term, and not a bad move for short term trades, just not ideal for a buy and hold strategy as far as we know so far). That overarching bear market is an example of a market in which one has to apply a bit more nuance to their “buy the dips” strategy.

TIP: The charts below will give you another way to look at bull and bear markets. Take heed dip buyer, dip buying is best suited for bull markets!

Nasdaq bull vs. bear 1985 – 2018.

Bitcoin, bull vs. bear. 2011 – 2018.

TIP: In cases where the price of a coin (or another asset) is plunging slowly towards its doom, buying the bottom of a dip can be hard if not impossible to pull off (i.e., buying the dip in a crash can often be a fool’s errand). In cases like this, you more so end up dollar-cost averaging down the side of the mountain. Watching any asset lose value is stressful, but there is a lot of precedent for this paying off in cryptocurrency when we are talking about buying the dips on top coins like Bitcoin, Ethereum, and Ripple. No plan is foolproof, but the logic here is this: It is better to mistime buys at the bottom than to mistime buys at the top. Thus, buying the dips trumps FOMOing on the rallies, even under the worst market conditions.

TIP: If the RSI is really high (like 70+ on all time frames), then the asset is considered “overbought” and the rally probably only has so much longer to go before a dip. If the RSI is really low, like 30 or less on all time frames, we are “oversold” by that indicator. There is no actual limit to how high or low the RSI can go, but you can see in the chart above (which shows the RSI on daily candles) that the oversold and overbought states are not the norm and are generally not sustained for long. Simple indicators like this can help you time your trades when timing your trades. Just remember, indicators help you analyze historic data, they can’t predict the future!