How to Set Limit Orders and Conditional Orders on Bittrex

How to Set Market Orders, Limit Orders, and Stop Orders on Bittrex: Or More Generally, How Limit Orders and Conditional Orders Work

We explain how the different order types work on Bittrex. This will include how to set limit orders and how to set stops using conditional orders.

First I’ll give an overview of how the order form works on Bittrex, then I’ll go over how to set different order types. If you already understand how to place an order, skip to the next section.

NOTE: There are other great guides out there, but I haven’t found one that explains all the order types on Bittrex. Thus, here is a guide that does that. Feel free to search around for other guides to augment this.

NOTE: I wrote this guide before Bittrex updated its layout. I edited the page for the new layout, but if I missed something and some terms are slightly off I apologize. Feel free to ask questions below if anything is unclear.

How Order Forms Work on Bittrex

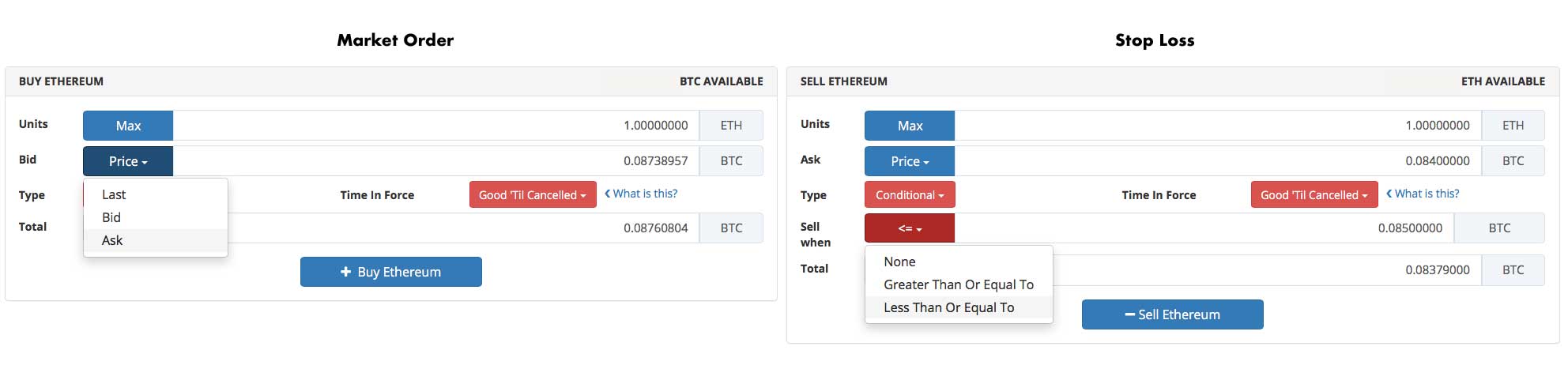

I’m not going to go over every element on the screen on Bittrex, but here are the key elements you need to understand to set limits, stops, and other order types:

- The order forms are under the “order book” headline under the chart on a given trading pair (for example ETH/BTC) in the middle column. The order form includes “buy” and “sell” options. This is where you place orders. You can toggle between buying and selling by clicking the “buy” or “sell” button. Double check you have the right one highlighted before you submit the order.

- Also under the “order book” headline are two columns, one on the left and one on the right, that show the “bids” (what people want to buy for) and “asks” (what people want to sell for).

- On the order form you define the units (amount of a given coin) you want to buy or sell, the price you are willing to pay (bid) or sell for (ask).

- You also define the order type, either “limit” (which is just an order that sits on the books at a given bid or ask price) or “conditional” (which, when paired with a “condition type,” triggers a limit order when conditions are met).

- Thus, you are only ever really placing limit orders, and everything else is just a matter of how those limit orders are placed.

- When you click the bid or ask price button on the order form, you’ll get a drop down. Here you can have Bittrex autofill the last, bid, or ask price. This is helpful if you want to buy the current price (see the next section).

- When you click the “type” button you can toggle between limit and conditional orders (explained more below).

- The button at the bottom of the form is time in force. You can toggle between “good ’til cancelled” (good for 30 days) and “immediate or cancel” (either it gets filled immediately or cancelled; it may do a partial fill, but if it does the rest of the order won’t stay on the books). Generally you’ll just leave the default good ’till cancelled for most trades.

- The “condition” part of the form appears when you set a “conditional order.” This allows you to trigger a limit order when certain conditions are met (when the price is either “greater than or equal to” or “less than or equal to” it sets a limit order at the defined bid or ask price; you’ll use this to set stops, as explained below).

- The order book (the orders in the right and left columns) and the market history below these columns can be used to understand what orders are likely to fill, how much demand there is for the coin on the buy and sell side, and whether there are currently more buyers or sellers. The visual of the order book above the columns can help too. That is useful information that can be greatly enhanced by even a basic understanding of “technical analysis.”

- Lastly, you can toggle the buttons on the price chart to get a sense of the historic price or to overlay technical indicators to get a sense of price and volume trends.

That should be enough information to allow you to follow the next set of steps. Obviously there is a lot more useful information on the screen, like studies and candles… but let’s save that for another day.

How to Set Different Types of Orders in Bittrex

How to set a market order on Bittrex:

There is no market order on Bittrex, so to buy the market price set a limit order for the current “ask” price and to sell the market price set a limit order for the current “bid” price. Meanwhile, if the price is moving quickly, you’ll like want to set it above the ask or below the bid to ensure your order fills (otherwise it’ll just sit on the books).

TIP: Bittrex will always give you the best price it can. You are really only defining the lowest amount you will sell for or highest amount you pay when you set a bid above an ask or ask below the bid, if a better price is on the books, it’ll fill from that order first. Thus, it is more like you are defining the maximum slippage of a market order and less like defining a limit order. #lifehacks.

How to set a limit order on Bittrex:

The main order type you’ll use on Bittrex is a limit order, to set a limit order use the buy form to set a “bid” price below the current “ask” price or use the sell form to set an “ask” price above the current “bid” price.

The bid price will be filled when there is a seller, the ask price will be filled when there is a buyer.

NOTE: If you set the “bid” above the current lowest ask, or the “ask” above the current lowest bid… then it’ll essentially result in a market order (use conditionals to set orders like this that you don’t want to fill right away).

TIP: Make sure to learn about the studies and the order book so you can better understand what orders are likely to fill. If you want to buy the market price, use a limit and follow the directions above.

To set a stop loss on Bittrex (“sell when less than or equal to”):

To set a stop loss on Bittrex you’ll use the sell form and set the “ask” to the price you want to sell at and then set the type to “conditional” and then set the “sell when less than or equal to” to the price you want the “ask” to trigger at (you are placing a limit order when a price condition is met).

- Set the ask price to the lowest price you want to sell at.

- Set the type to conditional.

- Set the “sell when” to “less than or equal to.”

- Set the “sell when less than or equal to” to the price you want the market order to trigger at.

TIP: If you don’t leave enough spread between the “sell when” and the “ask,” then your order might not fill. This is especially true if the price is moving down quickly. Since the whole point of a stop is to automate your sell order, you’ll generally want a fairly wide spread between your “sell when” condition and “ask” price. If you make your “sell when” and “ask” price the same, its very likely your order won’t fill if the price drops quickly (remember the condition is simply triggering a limit order which is then going on the books). Your order will fill at or above the ask price you define, and will be placed on the books when the conditional price is triggered (so you could end up selling for anywhere between those two prices, but will at least sell at the ask price if the order fills).

To set a conditional stop sell above the current price on Bittrex (“sell when greater than or equal to”):

A stop sell is good for taking profits. Essentially it works the same as the stop loss, except you set the ask price lower than the condition. It would read like this: if the price is “greater than or equal to” a certain price, “then place a limit order at the ask price.”

- Set the ask price to the lowest price you want to sell at.

- Set the type to conditional.

- Set the “sell when” to “greater than or equal to.”

- Set the “sell when greater than or equal to” to the price you want the market order to trigger at.

Make sure to always set your sell price lower than the condition to make sure it fills. It is the same deal for all conditional sell orders (as you’ll see below conditional bids are the opposite, you always make sure your bid is higher than the conditional price the order is placed at).

To set a stop buy on Bittrex either above or below the current price (“buy when greater than or equal to” or “buy when less than or equal to”):

Stop buys where you “buy when greater than or equal to” are good to use if you know you want to buy a coin if it breaks out of its current range. Meanwhile, stop buys where you “buy when less than or equal to” are good to use to “buy the dips.”

To set a stop buy (a conditional “buy when” order), you’ll essentially do the same set of steps as the “sell when” orders, but with a few slight differences.

The only real difference is that since you are buying, you want to set your Bid higher than your conditional price to ensure your order fills (the rest of the differences are just a matter of semantics).

Even though it essentially works the same as a stop loss, to set a stop buy at a lower price:

- Set the bid price to the highest price you want to buy at.

- Set the type to conditional.

- Set the “buy when” to “less than or equal to.”

- Set the “buy when less than or equal to” to the price you want the market order to trigger at.

Even though it essentially works the same as its selling counterpart, to set a stop buy at a higher price:

- Set the bid price to the highest price you want to buy at.

- Set the type to conditional.

- Set the “buy when” to “greater than or equal to.”

- Set the “buy when greater than or equal to” to the price you want the market order to trigger at.

Why set conditional orders instead of limit orders? Setting a stop loss is pretty straight forward, you set it to limit losses. You can’t do this with a limit order, because it would immediately fill if it were on the books (as your ask would be less than the current bid). It is the same deal for a bid that is higher than the current ask, if you tried to set it as a limit order, it would fill immediately. However, some may question the purpose of some of the other conditionals that could just sit on the order books without filling immediately. Although they each have a purpose (generally explained above), the general idea is that using conditionals allows you to avoid having your limit orders show on the books and thus showing your hand to the market. Keep in mind, this implies that many orders are hidden and set to trigger when conditions are met. Thus, you won’t always see the true “buy walls” and “sell walls” on Bittrex.

Hopefully that all makes sense. If you have questions just “ask” me. The goal was to make this simple, but if clarification is needed I’m happy to add it and improve this guide to buy and sell orders on Bittrex over time.