Understanding The Bitcoin Investment Trust (GBTC)

Tips for Trading GBTC (the Bitcoin Investment Trust) in 2024 and Beyond

Grayscale Bitcoin Trust (GBTC) is the world’s largest Bitcoin ETF. It also has higher fees than other Bitcoin ETFs

This article will cover GBTC’s long history and how it went from a volatile trust to the ETF it is today.

The History of GBTC

The Bitcoin Investment Trust (GBTC) used to be the only choice for investors to trade Bitcoin on the stock market. For this investors used to pay a premium.[1]

However, as of Jan 10th 2024 GBTC was converted to an ETF from a trust and was joined by many other Bitcoin ETFs. While GBTC is now the largest ETF, it also has the highest fees. Things can change, and it is with that in mind you should consider that a lot of what is said about GBTC below has changed. We will update this page over time, but keep in mind the premium and discount are likely to go away.

Below we explain the Bitcoin Investment Trust (GBTC), the pros and cons of GBTC, and why GBTC is a better investment than Bitcoin in some ways (but not in others). Keep in mind this section discusses GBTC as a trust, its state prior to 2024.

What is a trust? A trust (an investment trust) is a company that owns a fixed amount of a given asset (like gold or bitcoin). Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. In a gold trust, 1 share might be worth 1/10th an ounce of gold. With the Bitcoin trust, 1 share is worth about 1/1000th a Bitcoin (it was about 1/10th). The trust is managed by a company that charges a fee, in the case of GBTC that company is Grayscale.

Is GBTC the only Bitcoin stock? GBTC was for a long time the only stock offered on NASDAQ.com or any United States public stock exchange that holds bitcoin as its primary asset. It was also one of the only choices for investing in Bitcoin without buying Bitcoin directly. However, that has all slowly been changing over the years as other competitors came to market and companies like Microstrategy acquired more Bitcoin. GBTC isn’t the only way to invest in Bitcoin. GBTC is however currently one of only a few choices for investors who wish to use the stock market to trade cryptocurrency aside from the other Grayscale trusts. The other trusts are The Ethereum Investment Trust (ETHE), The Ethereum Classic Investment Trust (ETCG), The Litecoin Trust (LTCN), The Bitcoin Cash Trust (BCHG), and The Digital Large Cap Trust (GDLC). Please check the Grayscale site to see current premiums before you buy these trusts! A small premium is okay, a large premium adds a ton of risk. Learn other ways to invest in cryptocurrencies like Bitcoin.

What is GBTC?

GBTC is the ticker symbol for The Bitcoin Investment Trust, a trust run by Grayscale that holds 638,906,600 shares representing 0.00094950 Bitcoin per share as of January 2021 (it was 1,868,700 shares of 0.09242821 Bitcoins as of August 31, 2017, but the stock split; see the update and explanation below; also see current holdings here).[2]

In other words, the trust holds about 63,890 Bitcoins, and people can buy shares of that trust, each of which represents the ownership of a little under 0.001 Bitcoin (so if you own 1000 shares, you own a contract that represents just about 1 Bitcoin). This changes over time due to fees and Grayscale adding Bitcoin and other adjustments, but that is the gist.

This is similar to GLD, which is a gold trust; where each share of the gold trust represents about 1/10th a share of an ounce of gold held in storage.

GBTC Stock Split 2018: GBTC trust’s stock split 91 -1 in January 2018. Each share used to represent about 1/10th of a Bitcoin now each share represents about 1/1000th of a Bitcoin.

The Specifics Are Subject to Change: The amount of BTC held by the trust and the amount of BTC per share is subject to change over time due to factors including shares issued and the 2% annual fee paid to the trust. For example, as of August 2019 shares outstanding is 244,951,500 compared to 175,984,800 in Feb 2018 and Bitcoin per share is 0.0009775 as opposed to 0.00100721 in Feb 2018.

Is GBTC a Good Buy? – Understanding the GBTC Premium

NOTE 2022: GBTC has traded at a large discount since 2021. The discount is so constant and deep it is something that has to be considered with the rest of this article. Back before this the discount would ebb and flow in a way that made GBTC a bit more viable. Still, one consideration is that over the long term buying BTC at a discount could be a great move.

GBTC is, very generally speaking, a great buy for a casual investor who doesn’t want to trade cryptocurrency on an exchange (but wants to trade Bitcoin). With that said, at times it can trade at a pretty intense premium (due to high demand and limited supply).[3][4]

The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers.

In short, the premium makes GBTC bought at a high premium a risky bet (even riskier than Bitcoin itself).

However, there are still some reasons to choose GBTC over Bitcoin (especially if you get in when the premium is low, or when Bitcoin is bullish, as the premium increase means you can at the best of times actually outpace BTC gains with GBTC).

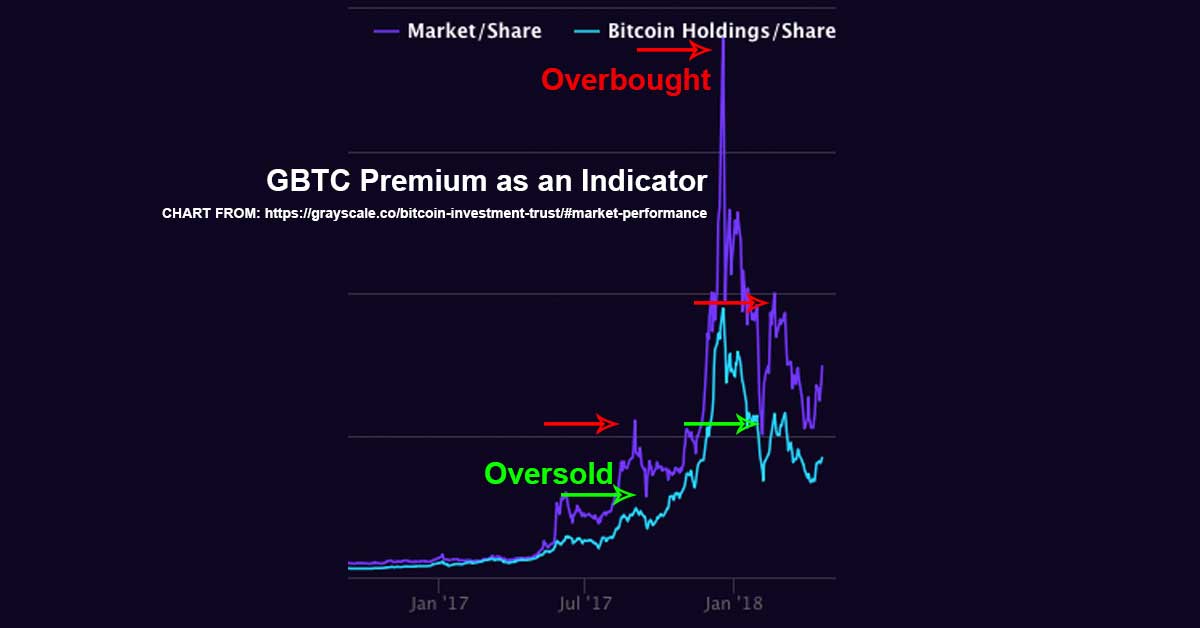

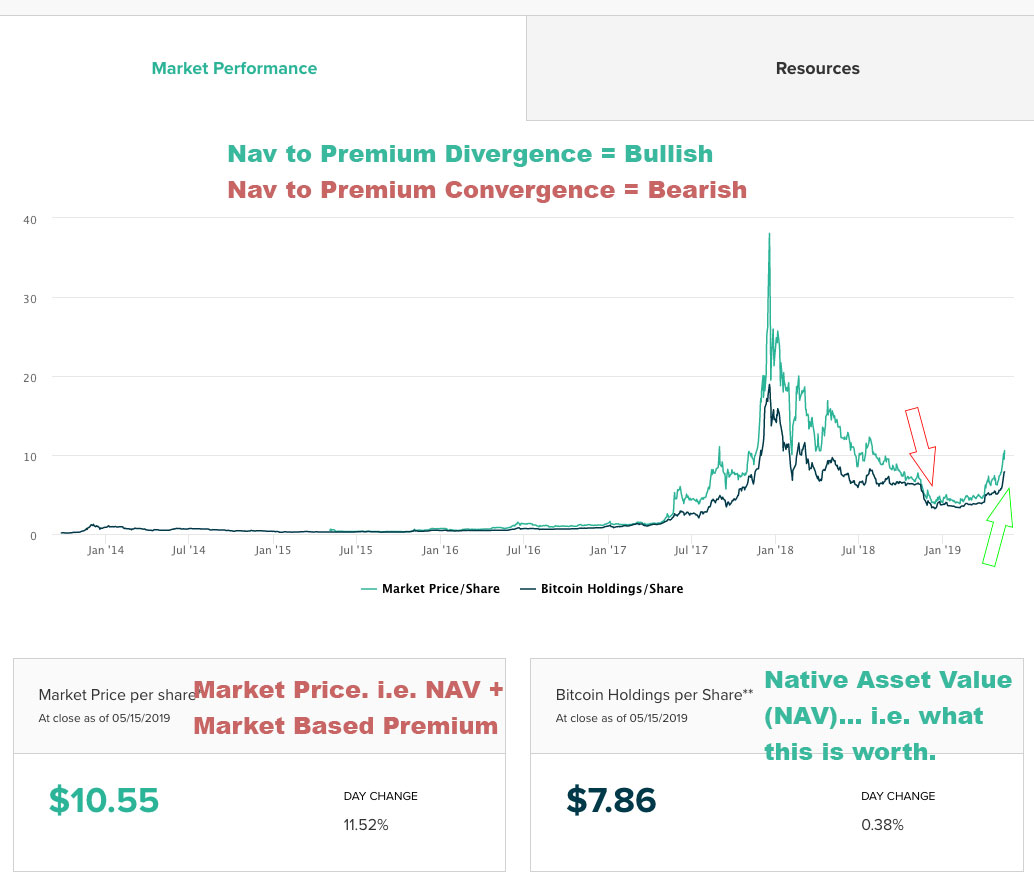

In short, I think of the premium as an indicator, where the basic rule is this:

- The Native Asset Value (NAV) to Premium Divergence (premium is increasing) = Bullish / Becoming Overbought

- Nav to Premium Convergence (premium is decreasing) = Bearish / Becoming Oversold

TIP: The same logic applies to ETHE and ETCG (the Ethereum and Ethereum Classic Trusts).

TIP: Check out the chart above and two below where I show the Native Asset Value (NAV) vs. Market Price. When the market price is higher than NAV (i.e. when the price the market is willing to pay is higher than the underlying price, or what the holdings are actually worth), that is a “premium.” The same logic applies to ETCG as well.

Consider these reasons to be cautious of GBTC:

- In early September 2017, before GBTC shares split 91-1, Bitcoin traded at about $4.5k and GBTC $1k for the rough equivalent of 1 BTC. That means GBTC was trading at over 100% premium. In other words, you could have bought 2 Bitcoins for every 1 Bitcoins worth of GBTC. Meanwhile, later that month GBTC went on to drop below $500 while Bitcoin stayed above $3k (making GBT a much better buy at that point than it had been). Thus, as the story illustrates, you have to not only look at Bitcoin’s market, but at the premium, you are paying for GBTC. UPDATE: GBTC’s price has changed over time, but it has historically traded at a premium. This was true before the split, and it remains true after the split. In early February 2018, GBTC was trading at roughly $14.50 (priced like Bitcoin was worth $14.5k), even though Bitcoin’s value was roughly $8.7k. In January 2021, we saw $44.82 GBTC and an equivalent value of $37.81 BTC. As you can see the premium never went away fully, but it does ebb and flow giving better and worse times to enter and exit depending on the overarching trend.

- An annual 2% fee is paid to the sponsor of the trust. That means the value of the trust is diminished over time.

- Grayscale adds to the trust over time. There is about 5x more Bitcoin in the trust then when I started the article back in 2017.

- GBTC is the only Bitcoin stock on the market. The second there is an alternative, GBTC is likely to see its price drop (if there were more Bitcoin products, one could assume that GBTC would lose some of its premium; that poses a risk for GBTC investors).

- GBTC trading tends to be more emotion-driven than the already volatile Bitcoin. I’ve seen the price of GBTC change wildly while Bitcoin stagnated and I’ve seen GBTC stagnate while Bitcoin’s price changed wildly. A stable trust would ideally track the price of Bitcoin, but GBTC tends to exaggerate the price of Bitcoin some days and not react at all on other days.

- GBTC only trades while the market is open; the cryptocurrency market however never closes. If cryptocurrency crashes on the weekend, there is no way out until the opening bell on Monday.

- Bitcoin has instant transactions once you are set up and running with an exchange, which means you can sell and buy rapidly 24/7 on a cryptocurrency exchange, but are much more limited with GBTC and a brokerage account.

- Some banks/brokers, like Bank of America / Merrill Lynch, have at times banned crypto-related purchases (including the purchase of crypto stocks like GBTC). This can make investing in cryptocurrency and cryptocurrency-related products tricky, and it can mean there are fewer buyers and sellers in the market to trade with. This is to say, liquidity can be an issue, partly due to only a limited number of brokers allowing their clients to trade GBTC. If your broker doesn’t charge a fee, GBTC is notably one of the only ways to trade Bitcoin without a fee.

Consider these reasons to buy GBTC anyway:

- The cryptocurrency world is a bit like the wild west, you’ll need a digital wallet, and you’ll need to upload personal information to an exchange, then you’ll be able to convert USD to cryptocurrency slowly as exchanges limit your spending and slowly draw your money from your bank. Meanwhile, GBTC is immediate, and your spending isn’t limited.

- When you trade Bitcoin (for other currencies or USD) you often pay fees. The fees paid can quickly exceed the 2% fee paid to the trust (which is paid from the trust, not per transaction). If you aren’t paying fees with your brokerage, or your fees are low, GBTC might be cheaper in this respect.

- GBTC is the only Bitcoin stock on the market. You either get GBTC, or you don’t.

- Even with the premium, GBTC has performed very well at times. Despite its occasional inconsistency, it can be profitable if your timing is right.

- Sometimes the premium works in an investor’s favor. If you buy when the premium is low, and wait until it is high, you can sometimes outperform Bitcoin with GBTC (although be warned, it can work the other way around too).

Now, consider these unknowns:

- On GBTC and Bitcoin Cash (and other forks): GBTC was holding all their Bitcoin when Bitcoin did a hard fork and split into a second asset, Bitcoin Cash. That means GBTC was sitting on “a ton” of Bitcoin Cash (when a cryptocurrency forks like that, all holders of the coin get a proportional amount of the new cryptocurrency alongside their existing coin; i.e., they get what some call “free money”). There have been many potential Bitcoin forks since Bitcoin Cash. It is likely the trust will liquidate each fork and pay out those who hold the trust at specific dates. Thus, this could be an added benefit to holders of the trust as time rolls along. Read our updates on how GBTC is handling forks (Bitcoin Cash was sold and distributed, as was Bitcoin Gold; it is likely this will be how other forks are handled as well).[5]

- GBTC was the only Bitcoin stock that managed to get onto the market. All the rest have been rejected. Sure “if” another entity can get an ETF out there it will hurt GBTC… but as the Spartans said, “if.” In other words, so far there haven’t been other ETFs and thus concerns over other ETFs diminishing GBTC’s value have been without merit thus far.

TIP: See our page on “should I buy GBTC” for more.

TIP: The liquidity and limited supply are what is driving up GBTC’s price. Anyone who claims GBTC should trade at the value of Bitcoin (cough; Andrew Left) may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. A 120% premium is arguably absurd, but the trust trading at or below the price of Bitcoin itself is even more absurd than that. One might assert that a 20% premium or less would be more reasonable a premium to trade at until other Bitcoin ETFs come out (but of course the market sets the price, not logic). “If” more cryptocurrency-based ETFs come out on the stock market, expect GBTC to trade at or around its “Net Asset Value (NAV).” Until then, one should look at the history of volume and price, that history shows us the premium is likely here to stay until more competition comes around. It also shows us the demand for Bitcoin is high, even if not everyone takes that demand to the traditional Bitcoin markets.

OPINION: One could argue that GBTC trades well above its NAV because it is trading based on future value. While this argument has some weight to it, especially considering it is the only Bitcoin stock on the market, the idea that future value justifies the premium isn’t a very compelling argument in my opinion. GLD doesn’t do this with gold to any great extent (generally speaking, if you want to trade the future price of gold, you trade gold futures and options, not a gold trust). In other words, you could argue GBTC’s current price reflects future prices but that alone, in my opinion, doesn’t justify the premium. Trading Bitcoin’s value today is risky enough, never-mind trading its future value. If you want to trade the future price of Bitcoin, you can trade Bitcoin futures.

GBTC vs. Buying Bitcoin – The Bottomline

Trading GBTC means paying a premium for quick no limit trading. Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transaction fees.

Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Or do you want way better profit margins with slower trades, transaction fees, a bigger learning curve, and some additional risks, but be able to trade instantly and at cost?

There is no good answer to what is better. My general suggestion would be to do both (but to remain cautious and not invest your life savings; someone suggested 1% of total funds to invest, that might be about right). There is no doubt that GBTC is overpriced in early 2017, but that could change. Still, one can make money on an overpriced asset; no rule says you can’t.

Bottom line: The closer GBTC is to the cost of Bitcoin (the closer it is to its NAV), the better buy it is. It has historically resisted going below a 20% NAV, so that is worth considering. All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative Coinbase. If you understand the risks of GBTC, it can be a worthwhile bet if you understand what you are buying. If you are holding $14 GBTC, you are essentially betting Bitcoin will be worth $14k+. That is possible, and might even sound laughable if I don’t update these numbers quickly enough, but the point isn’t that. The point is, you need to realize the bet you are taking with GBTC before you make your choice.

TIP: Don’t knock GBTC until you’ve tried dealing with the cryptocurrency exchanges. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. The average person might not have the extra time to deal with the 24/7 cryptocurrency market and all its learning curves. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make (after-all, market demand is causing the current premium, not Grayscale, so the proof is in the pudding).