The Last Day of CoinDesk’s Consensus is Upon Us, Will Crypto Rally Soon After?

Will Crypto Rally After Consensus? Or, Will a Lack of Consensus Result in Bulls Being Forked?

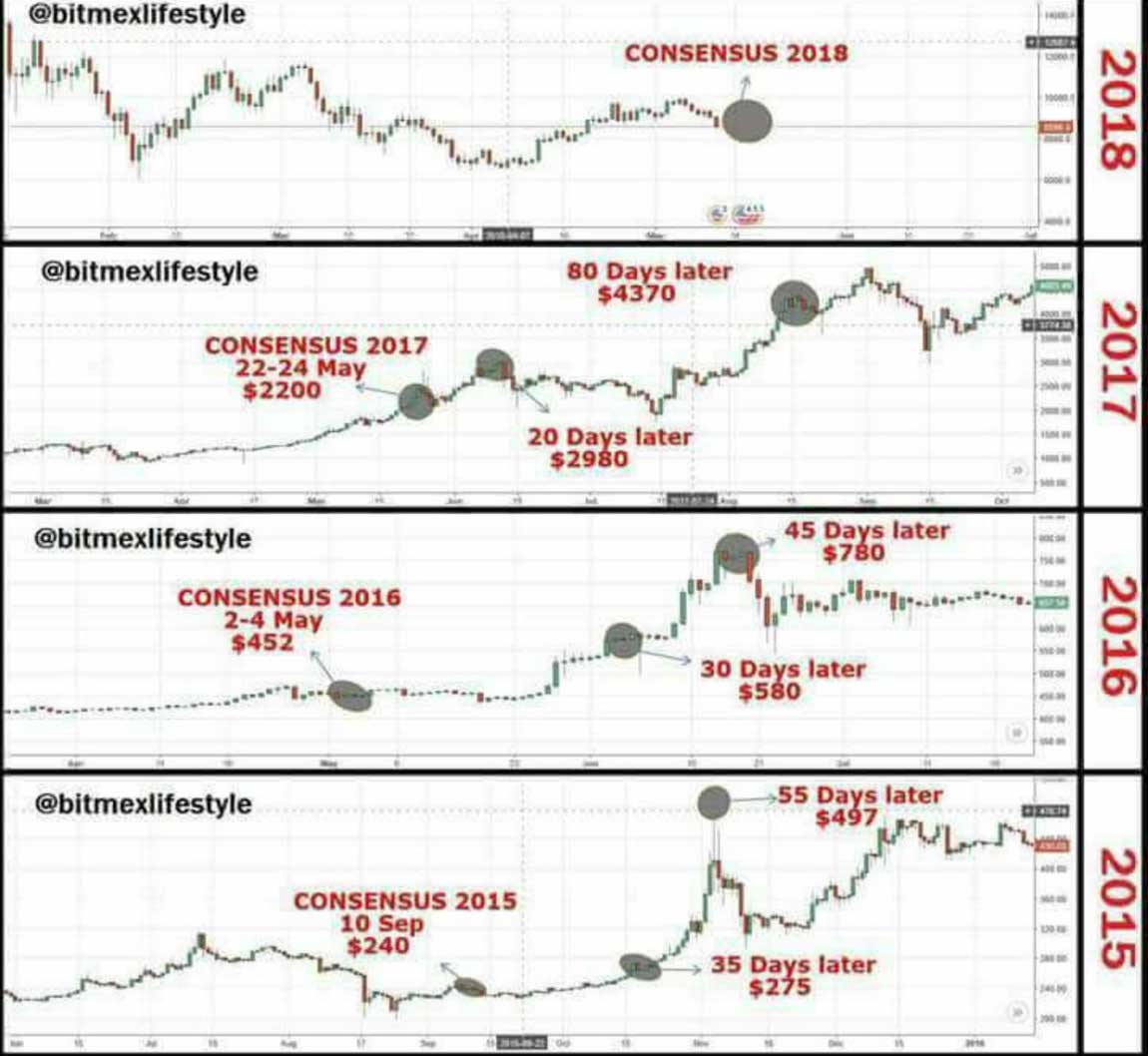

Today is the last day of CoinDesk’s Consensus 2018. Some have pointed out that crypto rallies tend to occur after Consensus each year (within a month of Consensus).

Is the bullish consensus on Consensus correct? Or will the bears manage to break down the next support and start a longer term bear trend before that gets a chance to happen? Only time will tell.

Since no one has a crystal ball with which to see the future, we are forced to rely on current and historic data to find trends.

The data we do have, can be summed up by the following points (each related to an embedded Tweet from the Fundstrat Twitter feed):

1: Attendance at CoinDesk’s annual Consensus event (an important annual crypto event with many big players speaking) has a record high turnout this year. Each year turnout has grown, each year this has correlated with an increase in the price of crypto and the popularity of crypto (although, please note here these events start in 2015, a year after the epic 2013 – 2014 bubble popped; so we don’t have data from that period).

CRYPTO: #Consensus2018, organized by @Coindesk, impact on crypto market will be much larger in 2018, given the sheer increase in expected attendance. 2017 was +1,250 additional attendees but 2018 should see +4,250 additional. 3x the impact… next week an interesting week pic.twitter.com/J9z4o1COil

— Thomas Lee (@fundstrat) May 8, 2018

2: Historically crypto has rallied after Consensus and dropped during Consensus. Right now there is a lot of dropping going on, so the pattern is playing out thus far and the set-up is there for a post Consensus rally (within the next 30 – 60 days if not sooner; but be ready for some further shakeouts first).

Be prepared Bull Run soon @coindesk #Consensus2018 #btc #zil #xrp #xvg #ltc #crypto @pierrejovanovic @maxkeiser @fundstrat @CryptoAnalyseFr pic.twitter.com/6hEmXWZ6Fg

— FrenchCryptoTrader (@FrenchCTrader) May 13, 2018

Historically crypto has followed trends, but of course it has also offered up a few upsets and surprises.

The whales (bears and bulls who control the market) are like boats floating down a rapidly flowing river. They do paddle, but only when they need to, otherwise they take the path of least resistance.

When crypto has been paddled by bears, a bounce at a support level creates a flow in the opposite direction (after some Wyckoff accumulation; like in the $6ks last time), and when vice versa, vice versa (after some distribution; like in the high $9ks last time).

When we hit the $6 double bottom, and Thomas Lee made his tax day rally prediction, it was so.

When we hit the psychological $10k, the bears (up until then mostly dormant), coordinated their attack and the bulls retreated (knowing that it would be easier, and way cheaper / more profitable for them, to distribute some coins high and then let the market cycle take its course).

This push and pull (which one might say is part manipulation, and part market cycle) is ever present in all markets. However, it is present in the crypto markets especially (because crypto markets are quick moving and speculative, lack fundamentals, and are less subject to regulations than other markets). This largely explains the volatile wave-like patterns in crypto charts (especially here in 2018 with all the new bears; thanks futures contracts).

That said, it just so happens that we will be hitting a few important support levels, right about the time a consensus rally should kick in.

Will this materialize as another run to $10k or further? Will the anticipation of such things lead to a rally even sooner than 30 days? How could anyone say?

All we can say is that in the past we have seen post-Consensus rallies (the water is flowing that way), Thomas Lee predictions have been on point lately, especially when they correlate with supports and other technicals (so the water is flowing that way), and generally speaking there is only so far the bears tend to push before they hit their own $10k (where it becomes expensive for them to flood the markets with crypto only to be met with eager buyers; so the water may be flowing that way as well).

Of course, historically we are talking about having to wait as long as a month… if the pattern occurs at all. Thus, taking too many bets too early could have you in a bad place for the short term regardless of which way the water ultimately flows.

NOTE: We can’t ignore the reality that 2018 could still be another 2014. In 2014 there was no Consensus event, thus there was no rally, and there is nothing to analyze in that respect. That said, in 2014 we generally saw a gradual decline in crypto prices. In every year since 2015 we have seen a post Consensus rally. However, we have also seen a gradual increase in price in crypto in every year since 2015 (aside from 2018). So there is another pattern there worth noting. Ultimately, until we see another wave of retail investors enter the market, it all really depends on how aggressive the bulls and bears are when it comes to paddling as we hit upcoming resistances and supports.