What Does “HODL” Mean? The Origin of “HODL” and a Guide to “HODLing” Bitcoin and Other Cryptocurrencies

The term “HODL,” a misspelling of “hold” from a 2013 Bitcointalk forum post that became a Bitcoin / cryptocurrency meme.[1][2]

A good way to think about it, and a way people have thought about it since shortly after the original post was created, is as “Hold On for Dear Life.” Or, perhaps more generally, “Hold On for Dear Life through cryptos ups and downs” (not taking profit “high” or panic selling “low”).

The core concept of the original post is “if you know you aren’t a good trader, then you can HODL through a downtrend to avoid mistiming the market.”

The core concept of what HODL has come to mean is “crypto is volatile, but the long term trajectory has been up, thus if you hold through the volatility you [hopefully] will be rewarded at some future date; so, don’t panic sell!”

FACT: The term “HODL” originally comes from a Bitcointalk forum post from December 18, 2013 where the title “I AM HODLING” contained a misspelling of the word “hold.” Below is an excerpt of that post.

“WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader and I KNOW I’M A BAD TRADER…. You only sell in a bear market if you are a good day trader or an illusioned noob. The people inbetween hold. In a zero-sum game such as this, traders can only take your money if you sell.”

– An excerpt from “I AM HODLING” by GameKyuubi, December 18, 2013; These eventually worked out to be wise words (and sort of funny)… Which is why it became a meme.

HOW TO PRONOUNCE HODL: HODL is pronounced “HOD” “L,” in other words it is meant to be pronounced like it is spelled. It is a meme, pronouncing it that way is essentially part of the meme.

FACT: Sometimes people say HODL means “Hold On For Dear Life“… the first known instance of this is in the comments of the original post. So there is merrit to this, but first and foremost the original post by GameKyuubi offers its meaning. It is referring to “not selling in a bear market if you know aren’t a good trader… because you believe Bitcoin will come back.”

The HODL Post Vs. the Reality of HODLing

While the original post has some logic to it, the term HODL is somewhat of a joke/meme and has been since it started.

First off, it was written by a drunk trader at the onset of the bear market.

Second off, logically speaking, while HODLing through a temporary short term correction is often a solid play, and HODLing on the way up during a bull market can be a great move, HODLing everything through an extended bear market is hardly ever an ideal move.

The ideal move in a downtrend is to sell at least part of your stack once the longer term technical indicators clearly point toward a downtrend, and then buy again when the trend reverses.

Likewise, not taking any profit at an all-time-high (for example a high that has been tested twice and failed), is generally not an ideal move.

That said, the post itself covers the above in many ways. The post eludes to the idea that while the “ideal” move might be to sell when the tides turn against us and then to buy back in when things are looking cheery again, those who don’t, don’t trust themselves to, or won’t can always “just HODL” and “buy the dips” in hopes of future rewards.

The bottomline being, and as GameKyuubi, the commenter who originated the meme, points out, HODL can end up being a solid long term strategy for those who know they aren’t pro traders who can make those ideal short term moves.

After all, in terms of the major cryptos so far, history tells us that those who are willing to HODL through even long bear markets are likely to be rewarded for their strong handedness over time. Meanwhile, those who sell risk mistiming the extremely volatile, 24/7, fast moving crypto markets. If you miss out on 10x – 30x gains even once, or if a trade like that goes against you, it is hard to come back from (where a HODLer can’t mess up unless the market never recovers or they fail to ever sell).

NOTE: You don’t owe taxes on HODLing. You only owe taxes when you sell. So that is another point for HODLing.

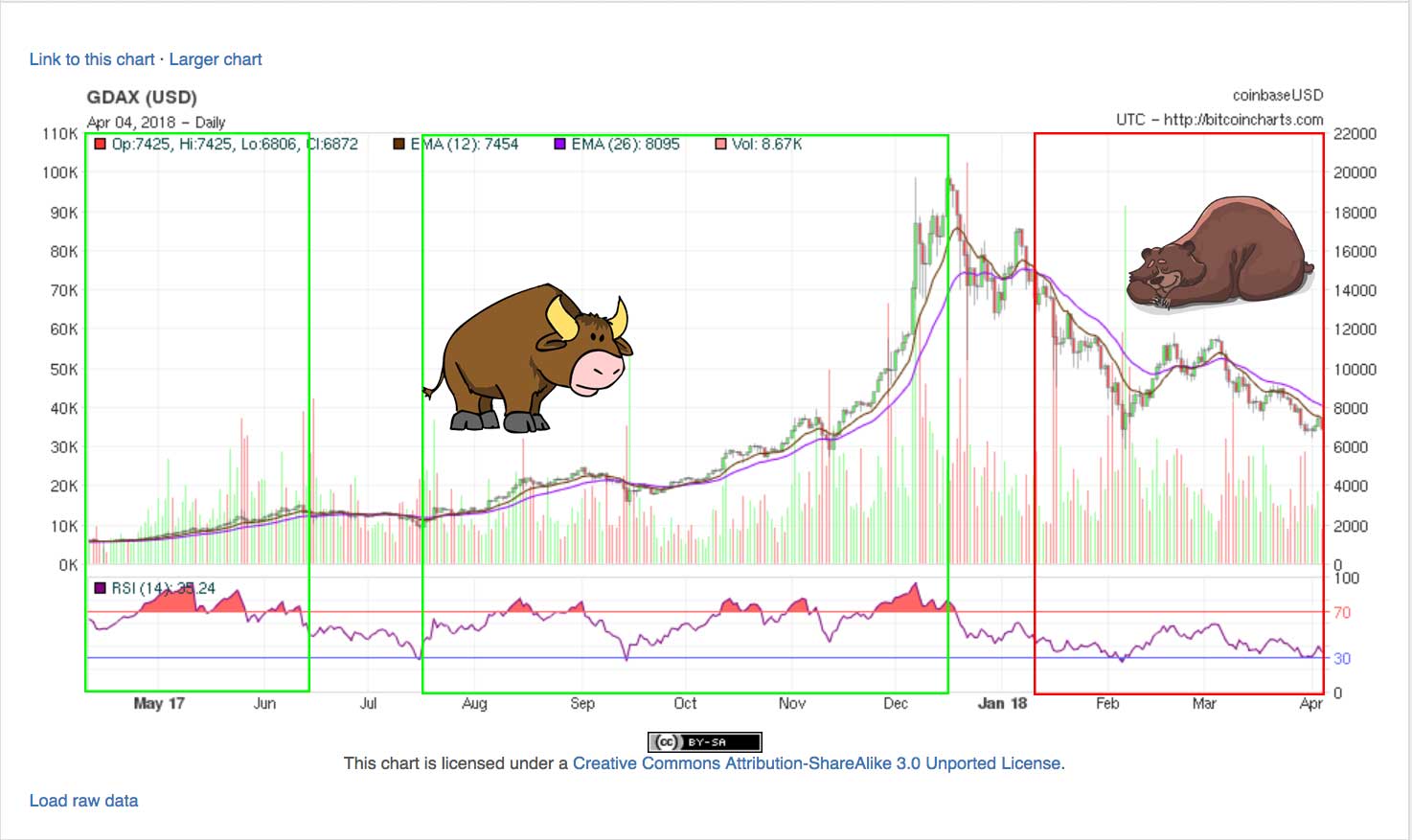

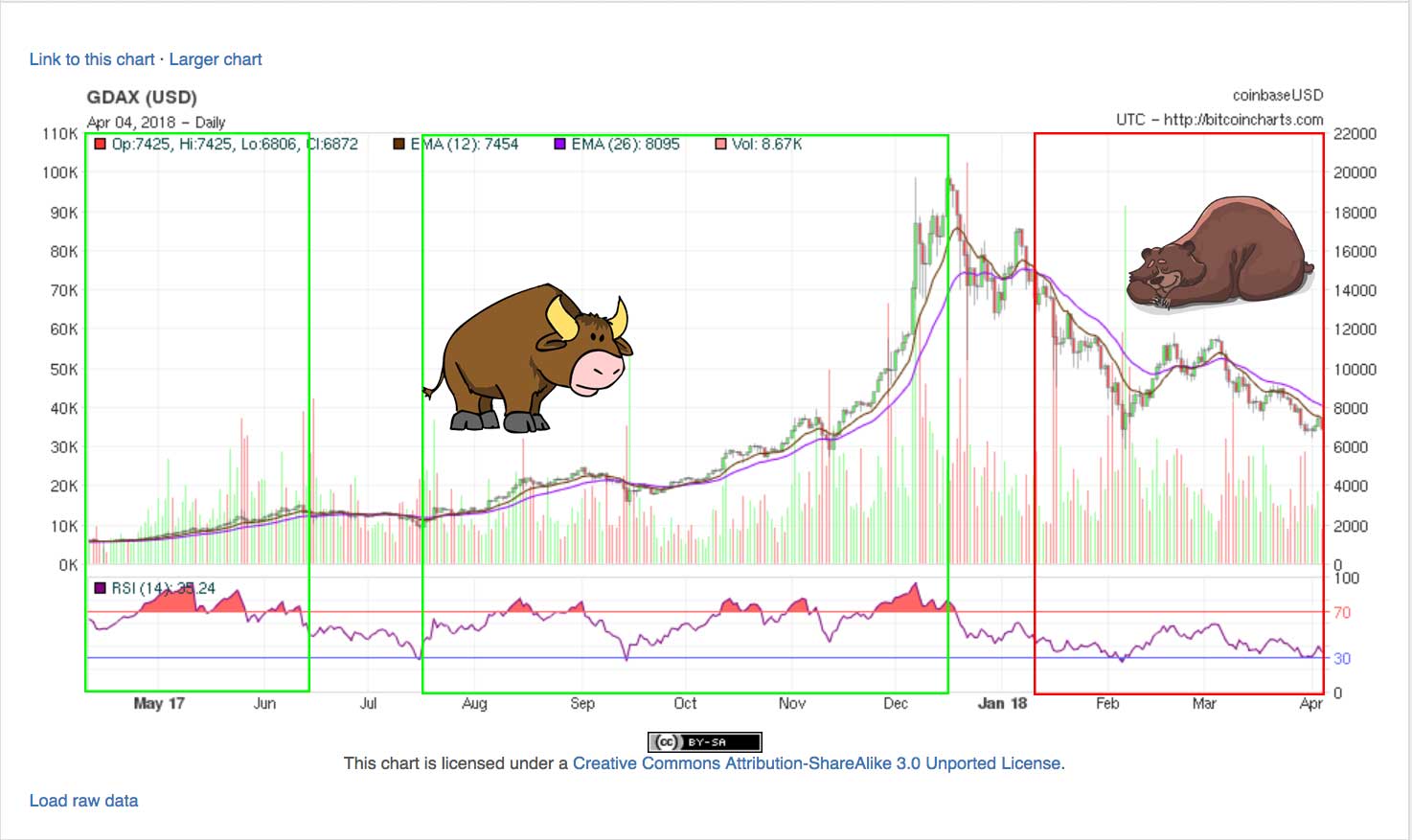

TIP: See the images below which shows Bitcoin prices from 2010 to 2018, that is why HODLing is a thing. The market can be very volatile, but ultimately the trend has been up.

Bitcoin is essentially a bullish log fractal, 2010 – 2018… you know, so far.

Knowing when to HODL em and knowing when to FODL em: I think I’ve made the case for the logic behind HODLing vs. FODLing. However, it is only proper to also try to help one understand the benefits of not HODLing past a bull market and into a bear market. In the image below you can see a bull market and bear market. Ideally one would HODL during a bull market, but be willing to take profits in a bear market (ideally at its onset). Those who don’t think they can do this can HODL through the bear market, but be aware this will open most people up to the pressure to sell low (as most people can’t actually handle 80% – 90% losses on paper without capitulating). Crypto trading can be complex, and there are bull traps and bear traps everywhere… but those who HODL need to be aware that 90%+ losses are a reality of bear markets! If you HODL’d and regret it, consider learning about Technical Analysis (TA) and consider adopting a slightly more nuanced strategy for next time (a personal favorite of mine involves averaging in and out of positions in a way that sort of ignores the historic volatility and focuses on accumulating the underlying asset over time).

The Origin of “HODL”

Above I offered an excerpt of the GameKyuubi post that the HODL meme comes from. In a way the easiest way to understand the term is to read the original post. Here is that post and the origin story of our hero and at the time Drunken Master GameKyuubi:

The True Origin of HODL, from Bitcoin talk.org Dec 18, 2013 [clean version]:

|

December 18, 2013, 10:03:03 AM

|

|

I type d that tyitle twice because I knew it was wrong the first time. Still wrong. w/e. GF’s out at a lesbian bar, BTC crashing WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader and I KNOW I’M A BAD TRADER. Yeah you good traders can spot the highs and the lows pit pat piffy wing wong wang just like that and make a millino bucks sure no problem bro. Likewise the weak hands are like OH NO IT’S GOING DOWN I’M GONNA SELL he he he and then they’re like OH GOD MY A-HOLE when the SMART traders who KNOW WHAT THE F- THEY’RE DOING buy back in but you know what? I’m not part of that group. When the traders buy back in I’m already part of the market capital so GUESS WHO YOU’RE CHEATING day traders NOT ME~! Those taunt threads saying “OHH YOU SHOULD HAVE SOLD” YEAH NO S-. NO S- I SHOULD HAVE SOLD. I SHOULD HAVE SOLD MOMENTS BEFORE EVERY SELL AND BOUGHT MOMENTS BEFORE EVERY BUY BUT YOU KNOW WHAT NOT EVERYBODY IS AS COOL AS YOU. You only sell in a bear market if you are a good day trader or an illusioned noob. The people inbetween hold. In a zero-sum game such as this, traders can only take your money if you sell.

so i’ve had some whiskey

actually on the bottle it’s spelled whisky

w/e

sue me

(but only if it’s payable in BTC)

Looking Deeper at the Meaning of “HODL” as Used in Crypto Culture

With the basics covered, let’s discuss HODL as used in crypto culture (meaning, as you might hear it in conversations on social media in the present day).

Although the term “HODL” was originally referring to Bitcoin, generally speaking it now refers to holding any cryptocurrency.

Specifically, as eluded to above, it refers to holding onto a cryptocurrency through a correction because you already missed the opportunity to sell high but refuse to sell low (although these days people use it as a rallying cry for holding through temporary corrections and holding on the way up too).

The original idea however is speaking more to the fact that one needs to rationalize to themselves holding onto internet money they bought high or didn’t cash out as they watch their on-paper wealth drop by 80% or so while everyone else brags about selling at the top or shorting or says “I told you so.”

FOMO + Bad Life Choices + Jealousy + other people’s Schadenfreude is not a good mix. So, you repeat the mantra “HODL,” rationalize, and most of all stop yourself from panic selling in the despair phase of a bubble (long after you should have sold).

You didn’t play the short term like a pro, you let the medium term pass you buy, but you believe you’ll be rewarded in the long term. With Bitcoin, this ended up being so true in the past that it really popularized this meme.

Thus, from that more positive perspective, “HODL” implies that the general trajectory of cryptocurrency is going to be up over the long term and although it can be tempting to sell high or cut losses, doing so means having to find a re-entry point or losing out on future gains. Thus, an inexperienced trader may “HODL” rather than trying to time the market.

The logic here is, although it feels bad to have made bad life choices in the moment, it is potentially even a worse life choice to sell now and miss the next rally whenever it may be (consider, the person who sold at the top of 2013 but didn’t re-buy actually underperformed the one who bought the top and held since 2013).

Thus, unless you know what you are doing, it can be better just to hold and wait out bear markets (markets where price trends are down or stagnant).

The idea behind all these concepts is the same.

Cryptocurrency is insanely volatile and we see 80% corrections almost as often as we see 400%+ gains. Meanwhile, traders who aren’t experienced tend to not be able to capitalize on the fluctuations of the market and stand to lose money by trading frequently.

Thus, historically it has been an option to suffer through the 80% losses to enjoy future gains than it is to try to get clever and sell and then buy again.

People new to the crypto space tend to think that “HODL” means don’t take 100% gains, and instead wait for 400% gains or even 1,000%. After-all, there have been times when those sorts of gains were real!

However, that is a misinterpretation. If anything, “HODL” means: because you didn’t take gains, and now you are taking losses, if you want to stay in the game, all you can do at this point is hold (thus the incorrect interpretation is rather ironic; but it stands to teach those who misunderstand an important lesson: HODL when you mess up, or when you see no evidence the bull run is over, not when you get it right and have an opportunity to actually get that dang lambo that very few actually get).

With that said, remember, you don’t have to go all in or all out. If you notice long term bearish trends, it is OK to average out of a position (here you would be taking some money off the table, but HODLing the rest, this is a nice middle ground strategy even for an inexperienced trader).

Most investors and traders will lose money on crypto, so if you can take some profits here and there, it is rarely a bad move.

The Bottom Line on the Origin Story of HODLing (With its Origin Considered)

The term originates from the place where its true meaning lies, that is, it is a reminder for those of us who horribly mistimed the top (by buying or not selling there) that not giving up and bearing through the correction / crash is always an option.

And, more positively, it is a reminder to not sell early in a bull market.

If you sell early in a bull, you can miss out on fortunes. If you sell late in a bear, you can end up regretting it for a long time. If you just HODL, you limit the amount of things you can mess up.

HODL is essentially a rallying cry for action through non-action. In this way GameKyuubi is both a sage and the patron saint of moderate crypto investors who are smart enough to know their skill level (those who know enough to stay in the game, but not enough to avoid going down with the ship).

Of course, knowing all of this… does it not inspire you to level up your game a bit? I hope it does, as that would be the hidden lesson of master Kyuubi (in this case you want to learn from the master, not imitate him).

Point being… learn everything you can from HODLing, and apply it as needed, but ideally in your journey you’ll want to learn how to avoid losing 90%+ of your net worth every few years on paper. 😉

This was too good on opportunity though. Surely it was pretty easy to react to the bad news from China?

I sodl half my coins at $730 and i’ll get em back at a later date when this all stabilises.

I was planning to hodl through everything with my Bitcoins after I had a bit of a panic during a previous crash. But seemed crazy not to sell this time…

If anything, I probably should have cashed them all out but you can never be sure about anything with BTC so half seemed the “safest” thing to do. win/win.

– Comment on the I AM HODLING thread that discusses the China FUD of their day and “the previous crash…” If this person bought back in, they outperformed Kyuubi and probably slept better at night. Selling half your coins when the market turns bearish and ACTUALLY buying them back is a good move if you can pull it off.

TIP: The guy in the story above kept some Bitcoin and planned to buy the rest back later. This is a solid move. Assuming he never bought back, he still HOLD’d enough to make him happy years down the road. If he did buy some back lower than $750, even better. Heck, he could have bought back at $1,500 or higher and been fine. You know who properly times markets? Almost no one… which is why many HODL.

People forget that the Spartans died in the end

– A comment on the thread that is referencing the fact that people were making HODL memes with pictures of 300.

A Guide to “HODLing”

With the origin story and some insight in mind, here is “a guide to “HODLing” in bullet point form:

- It helps to believe in cryptocurrency. If you have a Bitcoin, you always have a Bitcoin. The dollar value will change, but 1 Bitcoin will always be 1 Bitcoin. If having a hundred million Satoshis gives you no comfort, then “HODLing” might not be the right choice for you.

- It helps to have a basic grasp of TA. If all the short term Moving Averages have crossed under the long term averages, and they are all sharply pointing downwards… there isn’t really much chance of the price spiking up quickly. It’ll take work to recover, and thus there is a high probability you can start exiting positions safely. Averaging out when the signs clearly point toward sell, and then averaging back in as they reverse is a much better strategy than “HODL” if you can wrap your head around it.

- Going all in at the top is never a good idea. But the FOMO is real and sometimes people buy the top. If you bought the top, then you rode the crypto coaster all the way down, this is the time when you can invoke the “HODL” a mantra to strengthen your resolve. At this point you are saying, “well, I guess I’m in for a short or long winter, either way, I’ll be waiting for the next wave… I won’t be known as the weak handed investor who was shaken…”

- If you haven’t gone all in at the top, then your goal should be to avoid it. To do this, dollar cost average into a position and be willing to take gains next time you see a parabolic upward trajectory (so you can buy the dip; be patient, you may have to wait weeks or months). You can always hold a portion of your crypto long term, but in a volatile space like this you either have to accept 80% losses on paper once in a while or you have to be willing to sell high. If you build a position over time, but hold and it goes down, you still end up effectively “all-in” and with limited options.

- Some people will hold for tax reasons, and it isn’t the wrong move. Long term capital gains in the U.S. are taxed at a lower rate. To get those you must hold for more than a year. To hold for more than a year is to hold through corrections of 25% – 80%, and to hope for gains that offset that. Everyone holding for long term gains since 2017 just lost the same $13k a Bitcoin those who bought at the top did (only difference is one type of person lost principle and the other lost profit); everyone in that position is “HODLing” right now.

- If you commit to “HODLing” your resolve WILL be tested. People tell themselves they will “HODL” when they are up 1,000%, but then when they are down 90% they start getting the fear. When you get the fear you risk selling. If you would sell low, do not “HODL.” To “HODL” is to accept going down with the ship. If you won’t go down with the ship, then sell ASAP. The person who held BTC from 8 cents to 1 cent almost went to zero. The person who held Fairbrix (a shh coin from back in the day) literally went to zero. I’m not saying you shouldn’t sell when it goes back up, clearly I said incremental selling to take profits (especially when the uptrend is parabolic) is a good move, I only said that you shouldn’t sell when it goes down more if you are “HODLing” as “HODLing” implies holding through corrections. If you are just investing or trading, it is also OK to be more conservative and use stops or take money off the table if certain price conditions are met. You can always set a stop-buy at the price you sold at.

- Consider only “HODLing” top coins and coins you strongly believe in. Since you have to be willing to go down with the ship, you should aim to ensure you are on a ship that looks like it can weather the storm. Top coins with higher volumes also tend to follow the rules of TA over the long term much better than lower volume coins (as higher volume coins are not as susceptible to sudden and large price increases and decreases).

- Don’t put so much money in crypto that it will destroy you if you lose it… or have to hold for 4 years. It will crush all our souls if crypto goes to zero. But we still need to be able to pay our rent. 4% of investable capital is aggressive, 10% is a lot, 1% is conservative, if you have way more than that in crypto, consider taking some money off the table and holding the rest. The money you take off the table can be used to buy the dip if you really don’t want to do this. Your call, just friendly advice.

- Be honest with yourself. If you know you aren’t going to be able to HODL down to near zero without panic selling, then consider not HODLing in the first place. If you bought on FOMO high, the sooner you take enough money off the table to HODL comfortably the better. Humans have emotions and the market changes moods. Months of correction will wear on you, the further down we go, the greater the impulse to sell will be. You must prepare for this in advance and plan accordingly.

In other words, if you are “HODLing,” then ideally it is because you are building an average position in great coins over time and aiming to make some long term capital gains and/or sensibly not getting caught up in day trading because of your skill level. If this is you, then “HODLing” through corrections is a must (as they are too common to avoid).

It is true that learning to take profits and to cut losses tactfully is a better strategy than just holding once your skill level is there.

However, if you don’t get that part right or aren’t there yet, and you find yourself in a position where you are sitting on losses, you can always embrace the mantra of our patron saint and “HODL.”

Also, if you are an investor who doesn’t want to realize short term capital gains taxes, you can call that HODL.

Namaste.

TIP: To invest in crypto long term is a good life choice that requires “HODLing.” Many traders will hold their long term plays throughout even harsh corrections for tax purposes. Meanwhile, sometimes you’ll end up mistiming the top and will have to revert to holding even after you have your chops down. There are good and valid reasons to “HODL” proudly, just like there are lots of reasons for traders to set stops. However, buying and then immediately seeing 400% – 1,000% is not when you want to invoke the “HODL” mantra. Not selling after seeing giant on-paper gains is called greed. If you got greedy and are now suffering, invoke the mantra, but learn the lesson for next time. Take some gains when you have them, then hold the rest, then if the market turns against you like it so often does, you have money to buy the dip. Likewise, if and when the market turns against you over a longer period of time, it is OK to sell part of your stack to ensure you have money to buy further dips. The point being, there are lots of reasons to HODL part of your stack, but just HODLing everything no matter what is happening in the market is rarely the best move in the short term (in the long term, well, we all have our fingers crossed!) Still, again, if you don’t trust yourself… then you revert to HODL and leave the nuance to the better traders!

P.s. let me leave you with this last nugget from the summer of 2017:

I found this 2 year old story in Reddit about the origin of HODL and its meaning.

How you need to Hold On for Dear Life for the good of the then tiny Bitcoin community

How selling at $1100 was a bad idea ?

We’ll need remind ourselves when BTC hit $3000 again or when it hits $4000 or $5000

When you have doubt about the HODL strategy , remember this story

– The origin of HODL, Steemit.com post.

In other words, there are lots of reasons to HODL tactfully, especially in a temporary correction… but remember “HODL” is a meme that speaks to bad life choices, inexperience, and regret. So if you are “just HODLing,” you probably want to continue to put work in to refine your strategy. In most cases HODL should be part of your strategy, not the single word that defines your entire strategy.

I hoped this in-depth examination into what it means to HODL cryptocurrency helped. We all love those lambo memes, and they are fun, but it is real talk that is going to help you get to the finish line.

BOTTOMLINE: “HODL” comes from a Bitcointalk post and has a few different meanings. At its core however, it is less about HODLing while the price goes up (a good move with a little bit of risk mixed in), and more about HODLing as the price goes down (generally not a great short term move once a bear market has set in… but a potentially rewarding move long term due to the way crypto tends to come back strong after a bear market). The meme version of HODL = Lambo kind of sucks, but the real version of HODL is a solid move for most traders (because most traders are bad traders and crypto gains can come sudden and quick).

Article Citations

- What’s The Backstory On The Word, HODL? Medium.com.

- I AM HODLING. Bitcointalk.org <— Original Post