The Difference Between a Bear Market and Bull Market

Bear Means Down, Bull Means Up

In simple terms, a bear market is when the trend of prices is down, a bull market is when the trend of prices is up.

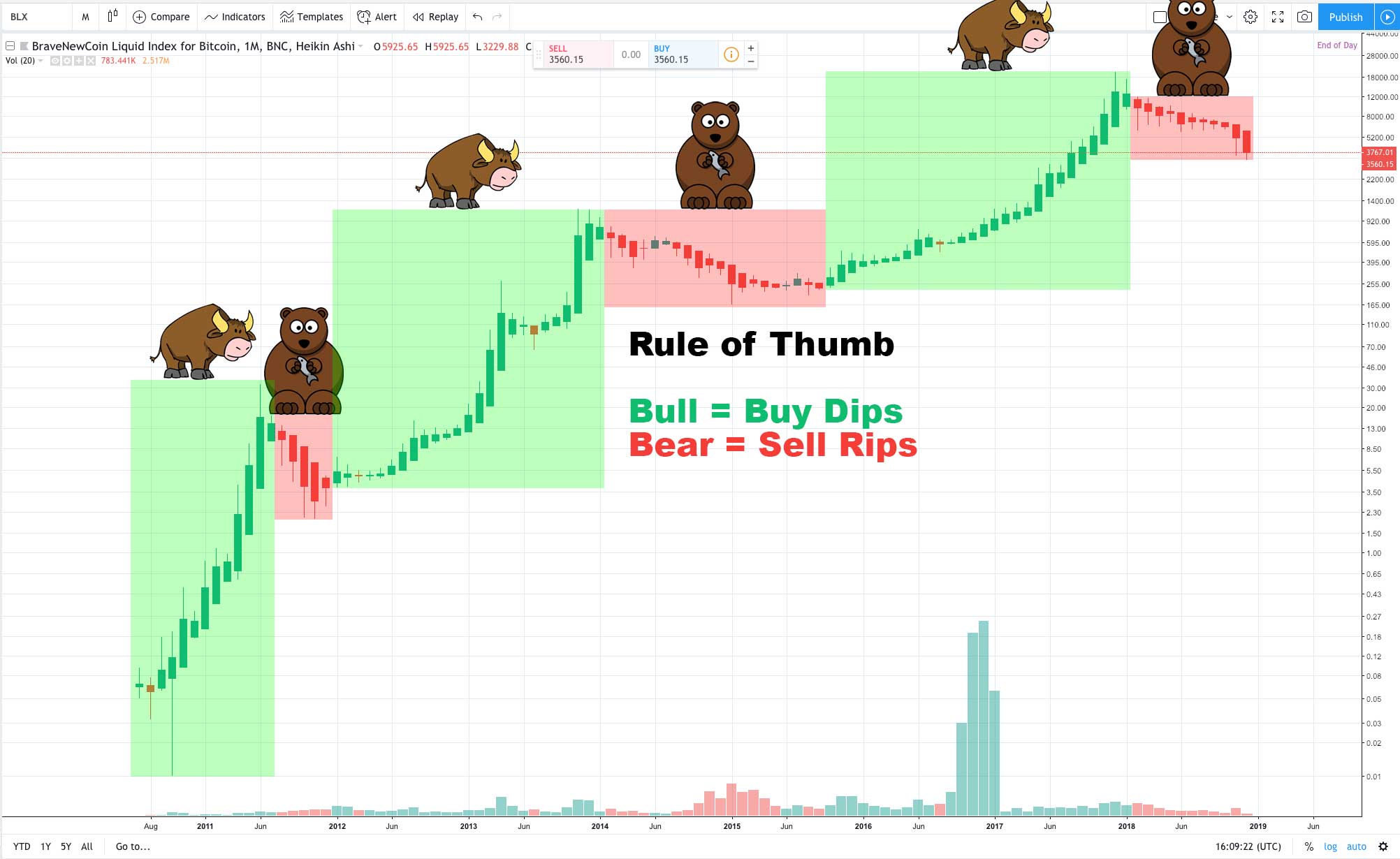

In the graphic above you can see Bitcoin’s price in 2017, and you can draw an upward line through Bitcoin’s price. This is a bull market, the trend is up. this is an “uptrend.”

Meanwhile, in 2018 you can see the general trend is down, and if you drew a line through the middle of the prices it would point down. This is bear market, this is a “downtrend.”

You can see the same thing in the version of the chart below which looks at 2011 – 2018:

Bitcoin, bull vs. bear. 2011 – 2018.

Really it is as simple as that, be we applying the logic to a single asset (like Bitcoin) or asset class (like cryptocurrency).

Another important indicator aside from price is volume, if volume is declining, it is generally bearish. If it is increasing, it is generally bullish.

Another indicator would be the market cap of an asset or asset class, that would tell us about how bullish or bearish that asset class was.

Bull and bear markets don’t really speak to what is happening in the moment in terms of price, volume, market cap, etc, they speak to trends over time.

In general one can look at a daily, weekly, or monthly chart (where all price action in a day, week, or month is contained in a single green or red candle) to get an idea of the current trend.

With that in mind, we can also look at indicators to get a sense of bullishness or bearishness.

When you look at the chart the price action seems trapped under moving averages, short term averages have regularly crossed under long term averages, RSI is gradually moving down, price is declining, and volume is declining… then we have a proper bear market. If vice versa, then vice versa.

There isn’t one magic indicator that tells us the market type, instead the terms bear and bull describe general trends we find assets or asset classes in.

The difference between a rally and a bull market and correction and bear market: Terms like rally or run can be used to describe short term upward moves. Meanwhile, a term like correction can be used to describe a short term downward move. In a bull market we can see a number of rallies and corrections. Likewise in a bear market we can see rallies and even some nice runs. Bull and bear markets are overarching trends, and within these trends we generally expect to find ups and downs. See a more detailed look on how to trade a bear market vs. bull market.

Semantics: The terms bull and bear are pretty generic and are applied to a number of situations in investing and trading. A lot of the time understanding meaning is just a matter of context. In general, bull means up and bear means down. I could describe a small rally as bullish, or I could describe a year long bear market as a correction. At the end of they day, while terms have specific meanings (for example correction is a 10% downward move and crash is 20% or more)… often terms are used loosely by investors, traders, and talking heads.