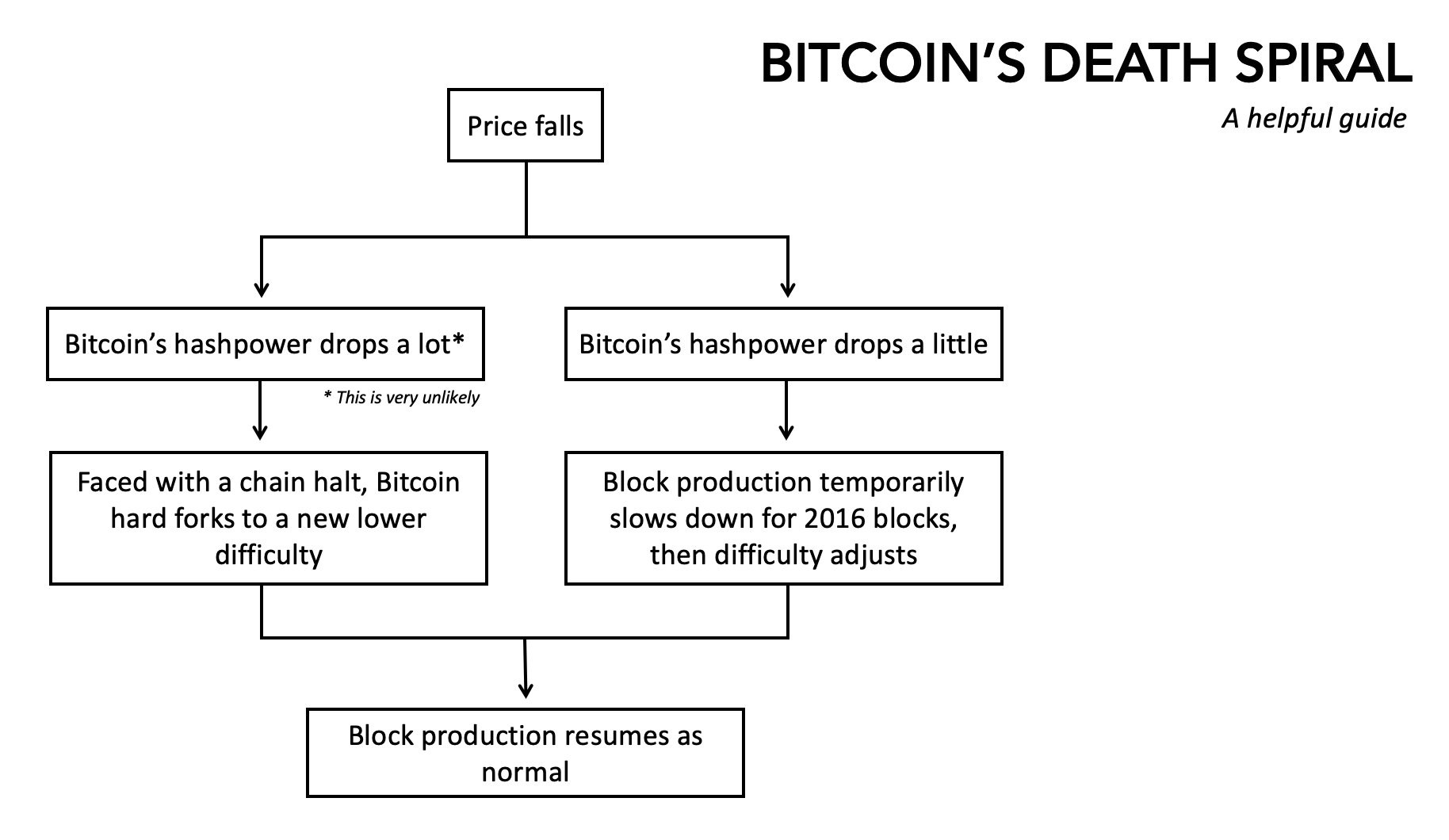

Difficulty Adjustment and the Mining Death Spiral Myth

Logically Speaking, There is No Price at Which Mining Costs Break Crypto

The mining death spiral is a myth. There is no “mining cost price floor” (a price at which a crypto shuts down because it is not profitable to mine). This is because of difficulty adjustment.[1][2]

In simple terms, the amount of energy it takes to mine a coin is based on competition (the amount of computer power dedicated to mining).

Again, in simple terms, the more computers trying to mine, the harder it is to mine. The less computers trying to mine, the easier it is to mine. This is called “difficulty adjustment,” and it is a feature of all crypto systems modeled after Bitcoin (which is most of them).

To the point of the article, what happens in theory and in practice is that if a crypto drops below the cost of mining, more and more miners shut down their rigs, and the lower competition reduces the cost of mining.

As the cost of mining is reduced, smaller players fill in the gap and take the place of bigger players, and those with lower costs in general take the place of those with higher costs.

If the major miners can’t afford their warehouses and fancy hardware, then Joe picks up the torch and mines at home on his GPU.

If Joe’s new GPU isn’t cost effective, then Steve fires up his old CPU and takes Joe’s place.

Simply put, if enough miners shut down, then older and cheaper hardware run by people with less and less overhead can be used to mine.

What is the cost of running an old CPU, in a region with cheap energy? Next to nothing… and a heck of a lot less than maintaining a warehouse full of ASIC rigs.

In essence, even if Bitcoin went back to a penny, difficulty adjustment would result in it being profitable to mine.

Meanwhile, if hash power drops (if miners drop out and not enough computing power takes its place), Bitcoin can even fork (update the algorithm via the consensus of existing miners) to adjust the difficultly “manually.”

And on that note, the key factor here is that people are driven by incentive, and thus logically people would continue to mine Bitcoin at any price.

Or at least, this all works in theory. In reality you could have some players who are willing to take a loss mining, forcing the difficulty higher (especially in the short term major miners can and might do this). This could consolidate power into the hands of fewer miners, but at an economic cost to those miners. And then the consolidation could lead to an attack or a malicious fork.

With that said, attacking the networking and creating a bad chain are both sure fire ways to devalue the chain, so this is actually less likely to happen than you might think (why would the entity who spent the money to control the chain then devalue all their BTC and their hardware in a heartbeat by playing bad actor).

The reality is, even in that improbable case where competition ramps up as the price drops, the network doesn’t die… as the network only cares about miners maintaining the ledger, not about how profitable or unprofitable those miners are or who those miners are.

In sum, there is no price at which Bitcoin or any other crypto enters a mining death spiral. Although a big drop in hash rate or price can have some pretty drastic effects in the short term.

NOTE: The image above is one I found online, happy to credit whoever created it. Since I don’t know who created it, this note is just to note that I didn’t create it.

Can anything kill a network? The only way to destroy Bitcoin is for people to stop mining it, or for a malicious small group to take control of 51%+ of mining power for long enough to completely change the blockchain (one reason consolidation of mining power is theoretically a problem). That said, while a 51% on Bitcoin is possible in theory, there is very little economic incentive in a 51% attack, as a group with that much mining power would almost certainly make more money keeping the system running with integrity (so, not impossible or unheard of in smaller coins, especially if the attackers are renting mining power rather than buying rigs, but not profitable in theory for a major coin like Bitcoin due to the damage it could cause and the amount of money it would take to rent/own the hardware needed to accomplish it). Also, the chances of no one in the world mining Bitcoin is near zero (unless another coin takes its place and we stretch out the arc of time long enough). Consider, even in 2010 when Bitcoin first came out there were more than enough miners. The thing to note here however is that neither a 51% attack or a drop in mining power would necessarily kill Bitcoin, it would more just cause some temporary headaches while the issue was dealt with.

Will big miners shutting down cause the price of Bitcoin to drop? A big miner may liquidate existing Bitcoin, or they may stop playing market maker (setting buy and sell orders). And, that may impact prices in the short term. However, a block is mined roughly every 10 minutes and X new coins are minted at that time no matter what, so a constant stream of new Bitcoin is always coming out as mining rewards regardless of who is mining and how much hash power is dedicated to mining. Thus, it doesn’t really affect the price if a big miner starts mining or shuts its doors. As long as miners sell every Bitcoin they mine, there will always be a steady stream of Bitcoin coming onto the market until all blocks are mined (although block rewards do get halved every few years; so less and less new Bitcoin will come to market over time). TIP: Temporary fluctuations due to hash rate aside, the only thing that affects how much Bitcoin is minted roughly every 10 minutes is halving which occurs every 4 years.

The negatives of lower prices: The main negative of lower prices isn’t for the network or its users, it is for HODLers and the mining industry. HODLers lose value on paper, the mining industry loses money in practice (less rigs to sell, less profit from mining, etc). In words, Bitcoin going to a penny would totally change the landscape of crypto, but it wouldn’t break crypto.

Is there a maximum price ceiling? There is no maximum price at which a crypto breaks either. Difficulty adjusts as more players try to mine the more valuable coins, this only adds more computing power to the network.

Can mining costs be used to predict fair value? Despite the above mining costs do work as a decent indicator of what the fair value of a crypto should be in my opinion. At any point in history there is going to be average mining costs, and those mining costs can work as a good indicator of the overbought and oversold conditions of a crypto… but there is no hard rule that says they have to stay at any price. This is more an issue of economic theory than a practical matter.

- The “mining cost price floor”: Myth or reality? BitcoinTalk.org.

- re: mining death spiral. Matt Odell Twitter. <—- got the idea to write this from him.