Providing Liquidity on Uniswap

How to Provide Liquidity on Uniswap and Other Such Exchanges

To provide liquidity on Uniswap:

- Go to app.uniswap.org.

- Connect your web3 wallet, for example, Metamask (make sure you have ETH and the tokens you want to pool; you can use Uniswap to get the tokens to pool if needed).

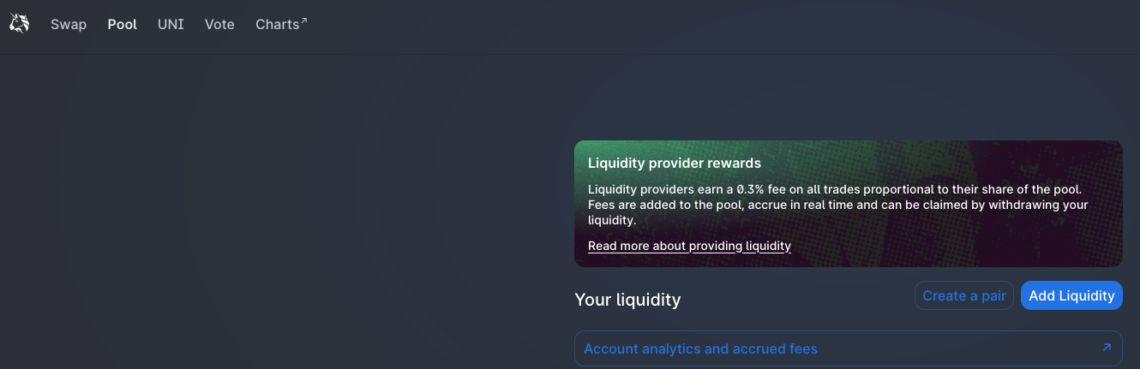

- Click ‘Pool’ at the top of the screen, click ‘Add Liquidity’ to put up the two assets at a 1:1 ratio, and then click ‘Supply.’

After the transaction goes through you will get LP (liquidity pool) tokens of the corresponding pool type in exchange for your underlying tokens.

So for example, if you put up ETH and DAI, you get ETH-DAI LP tokens.

This is the gist for Uniswap, Suhiswap, and all other similar exchanges (although some decentralized exchanges of this type have slight differences, for example, Balancer doesn’t require a 1:1 ratio).

TIP: Sometimes transactions fail. Typically increasing slippage tolerance will prevent this. Learn more about failed transactions.

What are LP Tokens?

LP tokens represent a share of a liquidity pool and can be exchanged for that percentage of underlying tokens. You can turn your LP tokens back into the underlying tokens at any time by hitting the ‘Remove’ button (you can also add more underlying assets at any time by hitting the ‘Add’ button).

TIP: Uniswap is an “automated market-making” (AMM) protocol. Market making is done automatically via smart contracts, but requires people around the world to provide the assets for the algorithm to make markets with. When you pool assets to add liquidity, you are contributing your assets to this process. The ratio of assets always rebalances to be 1:1 in terms of the value they can be swapped for (it is equal-weighted) and until something changes Liqiduty providers always get 0.30% of fees.

How Price Changes Impact the Value of LP Tokens on Uniswap and Other Such Exchanges

It is important to note that the dollar value of the LP tokens isn’t likely to stay stable, and neither is the exact amount of each underlying asset you can take by back out.

Depending on the trading pair and the direction to the price of each asset, you will gain or lose one of the two tokens and gain or lose dollar value. This is because the pool gets rebalanced as the price moves, people trade, and arbitrage traders help rebalance the pool.

Without getting into details, the price mechanics end up working like this:

- The price of both tokens goes down: You lose dollar value (all pooled assets are worth less).

- The price of the tokens diverge: You lose dollar value (your pool gets stuck with more of the low-value token and less of the high-value token).

- The price of both tokens goes up: You gain dollar value.

When LP tokens lose value due to divergence it is called impermanent loss (IL). Basically, this is a loss on paper, but not a loss until you sell (as the balance could shift in your favor again over time).

To get a sense of what could happen, check out this impermanent loss calculator.

Rug Pulls: One more risk of Uniswap aside from the above is called a “rug pull.” Simply put, that is when liquidity is pulled from a market. While this is more of a problem for traders than liquidity providers, if you get stuck as the only liquidity provider you will still end up in a pickle and the price of an asset could collapse against you (which would of course leave you with heavy impermanent losses).

How Trading Fees Can Offset Impermanent Loss

So the first thing that should come to mind when you read the above is that between gas fees and impermanent loss, providing liquidity is bad deal versus just holding the tokens.

This would be true if it wasn’t for fees.

The loss of dollar value can be made up for by trading fees. Uniswap charges 0.3% per trade and that fee goes directly to liquidity providers.

The fact that fees accrue over time helps balance out the fact that the majority of potential price moves are disadvantaged for liquidity providers versus token holders.

How Yield Farming Can Offset Impermanat Loss

Providing liquidity is the basis of “yield farming.” The term yield farm is simply a way of saying “provide liquidity strategically and take advantage of the best current deals (which often means staking liquidity tokens for new risky DeFi projects to collect their governance tokens).”

If you are tactically providing liquidity, and then staking LP tokens, you will not only be getting fees, you’ll also be getting rewards based on your staked tokens. Finding the best farming opportunities without getting rug pulled is the key to offsetting IL. Of course, this is a more risk/more reward situation and while not as complicated as it sounds, far more complex than just holding tokens. So do take things slowly and keep risks and complexities in mind before jumping in headfirst.

TIP: Gas fees make doing any of the above with small amounts a losing bet. Keep in mind each transaction done from trading tokens, to providing liquidity, to staking will cost gas. That means people who commit more tokens will make up for gas fees quicker, and if you don’t commit enough gas fees can make liquidity providing and yield farming not profitable.