The ETCG Premium Hits Low While GBTC Nears 2018 Lows

The ETCG and GBTC Premiums are Low… But What that Means Isn’t Always Clear

The ETCG premium is at its lowest point ever, meanwhile the GBTC premium is near its 2018 low (it was lower in February for a day).

In general when the premiums on these trusts are low, it historically has been a better time to buy them then when they are high (basic logic).

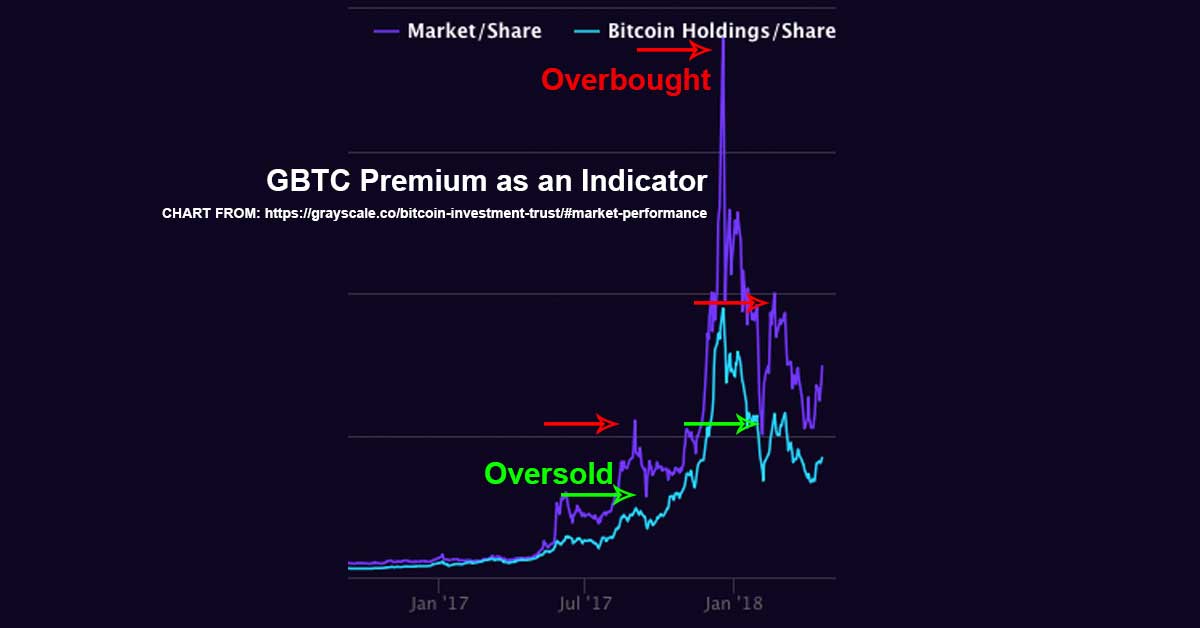

Also in general, these premiums have worked well as an indicator. When they are low the local bottom tends to be near. When they are high the local bottom top tends to be near.

In other words, nothing says BTC and ETC can’t go down more, and nothing says the premiums (the price of the stock compared to the underlying assets) can’t also get closer to the Native Asset Value (the actual value of the assets), it is only that it is notable that the premiums are currently lower than has been the trend in 2018.

I would show you in an image, but Greyscale lags on posting data to its site and thus I don’t have data from today yet (I am going off my own calculations).

Still, you can see the historic chart for yourself here: GBTC premium and ETCG premium.

And you can see an illustration of what I mean from historic data here:

The GBTC premium works as an indicator of crypto sentiment at least, if not price direction.

Bottomline

ETCG should trade for its value at $12.50, but is trading for $15.00

GBTC should trade for $6.90, but is trading for $8.85.

It might not sound attractive to pay an extra $2.50 for indirect ownership of on ETC or nearly $2,000 for indirect ownership of a Bitcoin… but when you consider both trusts have traded at 100% premiums at times, and when you consider ETC has traded above $15 and BTC above $8,850 in recent months, the logic behind taking a chance on them becomes more clear.

Ultimately I would say that crypto is risky and buying crypto indirectly at a premium via these trusts is even more risky, but I also think the data is still useful to be aware of and, as a silver lining, those who do take a risk and time the bottom and then ride the next premium increase stand to outpace crypto holders.

Simply put, its hard to recommend Greyscale’s trusts as an investment alternative to crypto, but there is logic in keeping an eye on these puppies especially when the premium is nearing a recent high or low.