The Altcoin Boom is Back on and Bitcoin on the Rise… for Now at Least

Altcoins are Back and I Hope They Won’t Be Trouble (But, It’s Crypto)

If you pay attention to crypto you know alts have had a really solid week or two and Bitcoin hasn’t been to shabby either. Are we breaking out of the bear market?

Below we take a very general look at some historic trends and compare them to the current crypto rally to try to get a sense of what is going on in crypto land (for entertainment and informational purposes)

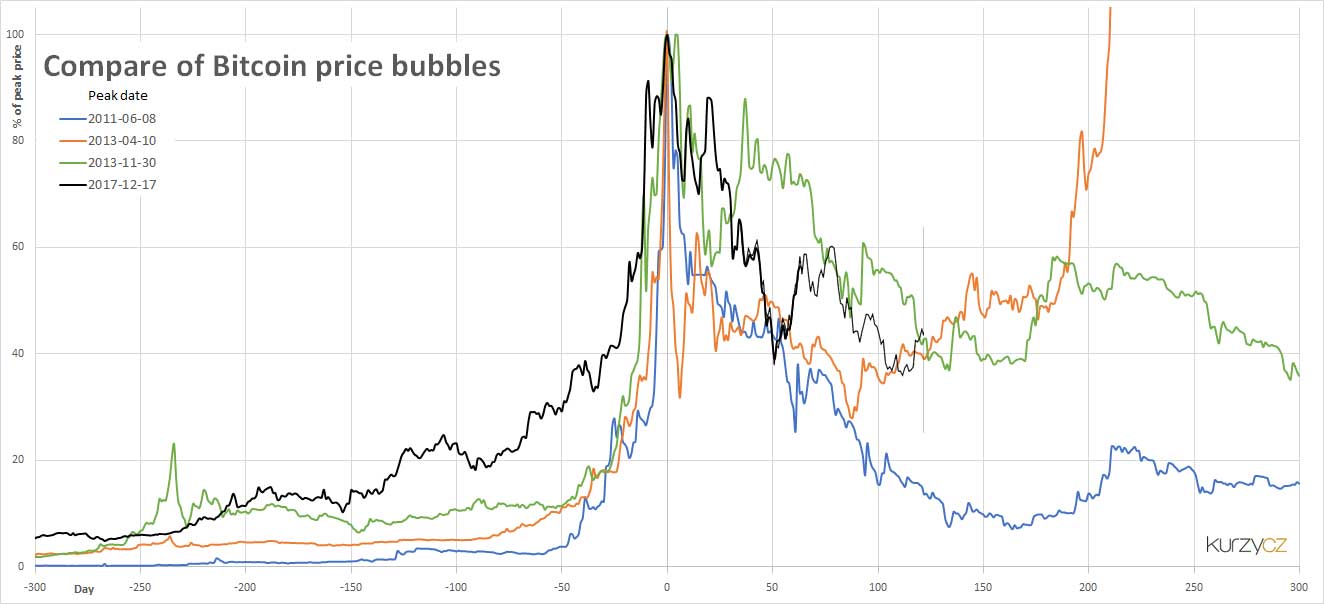

The short answer (for entertainment purposes) is “maybe.” That is a “maybe” based on what is happening now to some degree, but otherwise I’m simply basing that answer on historic crypto trends (for example the ones shown in the chart above; a Wikipedia chart from the page on economic bubbles featuring Bitcoin bubbles I updated for April 2018).

The first thing to note in terms of the chart is that Bitcoin has had so many bubbles it is, out of all assets of all time, it used as an educational tool when talking about economic bubbles (note that alts tend to be even more bubbly).

The second thing to note is that bubbles pop and at some point a new phase begins (that new phase generally being either stagnation or the formation of another bubble).

The third thing to note is that every Bitcoin bubble except the first 2013 bubble spent more time popping than the current 2017 – 2018 bubble has. To me the current bubble looks like it could go the direction of either of the 2013 bubbles (the smaller one that turned into the larger second one, or the second larger one that formed at the end of 2013 and popped slowly over 2014 – 2015 and resulted in an 80% drop, years of stagnation, and $150 Bitcoins).

Given that, some questions one might have include: “Is the 2017 – 2018 bubble done popping?” “are we going to immediately see a bull run like in 2013 if so?” “is this like the 2013 bubbles at all?” and “if coins run, are both alts and BTC going to run, or will it be like those times when only one of the two runs?”

Below I try to offer some thoughts on all of this.

The reality of the world we live in is this:

- Crypto is a bubble and bust economy. That means big and quick gains, and then long and painful busts. Each time it happens the stages of the classic bubble seem to play out. I assume this is due to the speculative nature of crypto and the fact crypto is a global 24/7 market. This tells me the human condition is the main catalyst behind economic bubbles, and that crypto just allows that condition to express itself more freely due to its speculative nature and lack of clear regulations (and I think research on bubbles backs that up).

- This bubble seems to be moving more quickly than the late 2013 – 2014 bubble and many notable historic bubbles (like the dot-com).

- Crypto doesn’t always bubble, it just often bubbles. We started this site in 2015. From 2015 – early 2017 most of what we saw in crypto was stagnation and a steady incline in that time. Yes, there were a few alt bubbles, but mostly it was a stable but slightly bullish set of years. It was actually kind of nice, as people could focus more on use-value and tech and less on lambos. Anyway, if that phase repeats, it is likely to repeat down the road, for now cryptos are on the move.

- Bubbles and wishes for more laid back days aside, right here in the now… Alts and Bitcoin are currently “on the move,” and alts have been leading the pack. This has been true since Bitcoin began to recover from about $6.4k the other week.

- We can essentially confirm that “crypto isn’t dead” and crypto fans aren’t burned out. If either was true, there would be a lack of buyers and excitement around crypto right now.

- Despite the renewed interest, volume is closer to where it was in the summer than where it was at the peak of crypto mania in December 2017 – January 2018.

- Crypto is volatile. It can go up quickly, and down just as quick. This is true even when there is no official bubble happening.

- Crypto is speculative and even when it is not manipulated, it ends up having some of the same features as an asset that is manipulated. For example, almost all substantial price increases happen in very quick “pumps” and are then followed by deceptive and slow “dumps.” Otherwise, we tend to see controlled stagnation at certain prices where big players either buy or sell. I’m not suggesting manipulation, in fact I would suggest it is first and foremost the natural mechanics of a highly speculative market (where big players and enough traders are of the same mind of looking to accumulate low, move up when it is easier than going down, sell when moving down is easier than moving up, and then rinse and repeat… while the average retail investor lags behind selling low and buying high).

- Crypto has fundamental value, but the market price is mainly based on speculation. “What is the fair price of a Ripple token AKA XRP?” That is harder to answer that question than “what is a fair price of the stock of a public company?” Often little bits of news and mood changes can have drastic impacts on the price of cryptos, and there is little more than technical support levels to fall back on or technical resistance levels to pump up against.

- We had been in a bear market since the last alt boom in January 2018 up until the other week. Now things are less clear.

- Bear markets have to end sometime (just like bull markets). In the short term, it looks like the bear market is at least put on pause. Over a longer time frame, it is less clear (unfortunately the way it becomes clear is with continued price increases, so being 100% on the sidelines waiting for clarity won’t suit everyones’ tastes).

- What looks like the end of a bear market can sometimes be just a failed rally attempt (we have seen more than one of these on the way down from $20k; and look at the chart above, this was true in other years too).

- When bear markets end, especially after a bubble pop, there is a phase called “disbelief.” This is when prices start to go up but every thinks we will see yet another failed rally because “that is what happened every other time so far.” This disbelief rally generally happens after capitulation and despair. One could argue we have seen all those phases (with the $6k Bitcoin phase being the despair phase and the journey there being capitulation), but historic bubbles tend to pop harder than the 2017 – 2018 has so far (the 2013 – 2014 bubble did, as did the dot-com for example). Please note that the first 2013 bubble (not the second late 2013 one, the one before that) didn’t spend much time in the popped phase and went into a disbelief rally very quickly. Thus, there is precedent for an epic rally fairly quickly after a popped bubble in crypto (for another example, ETH/BTC price did this in 2017 from May to July and then July to September).

- Crypto tends to trade in cycles, waves, and rotations. Right now alts are in rotation, the wave is up, and we are at least in a mini bull cycle. It may not be enough to get us out of the last bear cycle, but then again, maybe it will be?

- Often after a deep correction all coins rally at first and then, if the rally continues, only specific coins continue to rally with the rest being left behind (this is very common; there are only a handful of exceptions in the entire history of crypto). See alt charts from June 2017 to December 2017 in terms of BTC prices, you can see something a lot like we saw from December 2017 to now. In that time only BTC and a few others really did well. In that time even the few that held their own were eventually outpaced by Bitcoin. The point here being, the rally could continue, but the mechanics of it could change.

- We have essentially seen this same pattern we see today play out before in crypto before, and it has gone both ways.

Putting together we can say, we were in a bear market for most of 2018 up until at least last week. We are either exiting the bear market or simply attempting to rally in what will end up being another failed rally attempt. then, if we start a bull run, it could be market wide or manifest in specific coins only.

There is more than enough precedent in crypto for this all to go either way. We can see that in altcoin charts, and we can see it in the Bitcoin bubble chart above.

If the rally attempt becomes a bull cycle, or if it fails substantially higher, then clearly one wants to be in Bitcoin and alts for that. The same is true from last week to this point, clearly it would have been ideal to catch this early and be in a wide range of cryptos (don’t feel bad if you didn’t get in, it is always very hard to time the bottom without mistiming a bunch of other points that looked like the bottom).

With that said, even though things look very positive right now, it is a little early to celebrate and declare that crypto is back in business.

If we declared victory and went all-in during each rally after an epic pump, we would go broke and be spent by the time the actual rally occurred. Likewise, even if we went all-in at what looked like the bottom each time and held, we would soon enough hold past the high of the rally and then eventually drop past that bottom again.

This was especially true in 2014 where the bottom wasn’t hit until 2015, meanwhile people fared much better in 2013 during the first bubble. The difference between those two bubbles is like the difference between the summer of 2017 (where there were a few alt and Bitcoin corrections, but buying the dip paid off quick) and so far in 2018 (where at best buying the dips has a best so far only given you an opportunity to sell the subsequent failed rally).

Of course, with that said. No one says you have to go all-in on a dip or recovery attempt. One could for example average into the dips or build a position as recovery ensues (and then for example hold some long and take some incremental profits).

There are lots of clam and logical ways to play any market, including the popped side of Bitcoin bubbles. However, there are also lots of ways to get overtaken by emotion and mess the whole thing up.

The main problem is that it is in our nature as humans to see a few green days in crypto and immediately pop back into bull mode, treating the current market like we are back in 2017 part 2.

With such epic and quick gains, FOMO tends to ramp up quickly in crypto. For weeks it is pure depression, and then the pumps start and everyone dusts off the lambo memes and begins to forget all the bad times in the rearview.

When a true rally comes on, those lambo memes are justified, however not every attempt at a rally is going to turn into a bull market like we saw in 2017, and thus it may make sense to check your FOMO and be a little cautious (especially if you plan to HODL and won’t try to time some trades).

In this sense, it can help to look at not only the price increase this week, but the price and volume data from say the past few weeks, months, and years to get a better sense of where we are in our journey. Where we are in the journey is, as noted, is on the other side of a bubble, in a rally, that will either lead to a new phase of gains, further correction, or stagnation.

This is different than say fall of 2017 where we were clearly not on the other side of a popped bubble and it instead looked like we were forming a bubble, a whole other type of caution and strategy was in order then… and this is different from 2015 – 2017 where we were in a period of stagnation and steady gains and the only reason to be cautious was because we knew about the 2013 – 2014 price action, again another type of caution was arguably called for given the circumstances.

Here today, we have a very recent bubble pop in our review and simply want to know what stage of the bubble so we can make the appropriate moves. We can’t really actually know that, so it can instead make sense to take the appropriate measures that suit our tastes and risk tolerances.

We don’t want to be the person who gets stuck in the disbelief phase and thus misses the start of a bull market, but at the same time we don’t want to be the sucker buying at the top of the suckers’ rally (aka a bull trap) because we confused 50% gains in the course of a few days with the start of a healthy new bull market. That is like confusing a pump and dump with the organic mass adoption of a new coin; dangerous if you aren’t setting stops, taking profits, or slowly building in average position in a way that mistiming a rally won’t result in us being trapped.

Or in simple terms, we don’t want to be coming to the party late only the buy the coins being sold by those more nimble traders who just accumulated before the rally attempt if we are in the middle of a bubble that is still popping… that is just basic logic.

It is a logical fallacy to believe that because a crypto is doing well today that it will continue to do well tomorrow. Instead, cryptos tend to do exceedingly well in short spurts and then enter a longer period of stagnation and/or correction in all times except rare periods where all cryptos are bullish (like 2016 – 2017 for Bitcoin).

To get to the 2017 rally, we had to go through 2014, 2015, 2016, and most of 2017. That gradual onramp is what paved the way to the moon. I’m not saying moon part 2 can’t happen again right now with only a week or two of onramp, Bitcoin essentially did this sort of thing in 2013 as you can see on the chart. I’m just saying, if we go around assuming that the most bullish of patterns will occur every time crypto has an epic week, we will fall into more traps than we will anything else.

Traps are whatever if you have a strategy that accounts for falling in traps, but they aren’t ideal if your strategy is go all-in and HODL.

Point being, be as bullish on crypto as you are comfortable with… but make sure to take a close look at the current market and historic trends before you [speaking metaphorically] go all in on $8k Bitcoins with your credit card. $8k Bitcoins are way better than $19k Bitcoins, but they aren’t as good as the $3k Bitcoins from the summer, or the $1k Bitcoins from before that, or the $150 Bitcoins (or the $1 ETH and $1.50 LTC) before that, etc.

The long term trajectory of crypto is very likely bullish, but in the short term we are at best on the other side of one of the biggest popped bubbles in economic history. Given this, and given the history of crypto, the reality is the exact trajectory of crypto (especially on smaller time frames) is still a little up in the air for the moment.

There is really no investment advice some free site on the internet can give you, but it do think it is appropriate for a facts site on crypto to try to approach things from a centered view. From a centered view, we are on the other side of an epic economic bubble and since we can’t see the future, we don’t know at what stage of the bubble we are at.

TIP: The chart below shows XRP (Ripple’s token) over the years. Notice how some rally attempts manifested as epic price increases, and others came and went rather quickly? All of them were worth being in XRP for, but not all of them justified champagne, lambo memes, and HODLing (especially if you came to the party a little late). Also notice that the points in which buying and HODLing directly after a bubble pop made sense were few and far between, and mostly the best prices were found in long periods of stagnation by the patient? Crypto tends to be like that. However, those few instances where another bubble formed rather quickly were 100% worth being in crypto for. And those two truisms side by side is what makes times like this all the more uncertain. 😀

XRP. An example of bubbles in the altcoin economy.