What Trump Means for Bitcoin

Introduction: Trump’s Victory and Bitcoin’s Surge

The 2024 presidential election marked a pivotal moment in both American politics and global financial markets. Following Donald Trump’s victory, Bitcoin surged to record highs, with prices reaching $74,211.88 and peaking at $76,300 on November 6, 2024 as of writing this article. This rise in Bitcoin value reflects a larger narrative of economic optimism and investor confidence that emerged after Trump’s election win.

Image source: Source

In the wake of the election, financial markets experienced a significant surge, demonstrating enthusiastic investor sentiment towards Trump’s anticipated economic policies. The U.S. dollar appreciated notably, signaling strong confidence in his fiscal strategies. This optimism extended to the cryptocurrency market, where investors anticipated potential favorable regulatory changes under his administration. According to BBC News, both U.S. shares and Bitcoin hit record highs, indicating a broad market rally fueled by the election outcome.

Image source: Source

The correlation between Trump’s victory and the surge in Bitcoin prices highlights the intriguing connection between political developments and financial markets. Investors speculated on the possibility of weaker regulations, a factor that historically has driven interest and investment in cryptocurrencies. As reported by PBS NewsHour, the anticipation of a more lenient regulatory environment buoyed market sentiment, pushing Bitcoin and related crypto-assets to new heights.

This trend underscores how political changes can significantly impact market dynamics, with cryptocurrencies often at the forefront of such shifts. The surge in Bitcoin following Trump’s election reaffirms its role as a barometer for investor confidence in economic policies. As TIME suggests, Trump’s win could mark a new era for crypto markets, potentially shaping the trajectory of digital assets in the future.

Election Impact on the Crypto Market

Donald Trump’s 2024 electoral victory has had a significant impact on financial markets, with Bitcoin reaching a record high of $74,211.88. This surge reflects optimism about Trump’s anticipated economic policies. Not only did Bitcoin benefit, but crypto-related stocks like Robinhood Markets and MicroStrategy also experienced notable gains. The correlation between Trump’s win and Bitcoin’s surge suggests a strategic influence exerted by the crypto industry during the elections.

The crypto industry reportedly invested over $100 million in the U.S. elections to influence voter issues and support pro-crypto candidates. This substantial involvement underscores the industry’s growing political influence and desire to foster a more favorable regulatory environment. With expectations of less stringent regulations under Trump’s administration, market participants have reacted positively, further boosting the crypto market.

Beyond Bitcoin, the broader market has also reflected this optimism. The potential for policy shifts towards a more lenient regulatory framework has buoyed investor confidence, resulting in rising prices for stocks tied to the crypto ecosystem. This optimism is further fueled by the possibility of policies that could enhance the integration of cryptocurrencies into mainstream financial systems.

The strategic influence of the crypto industry during the elections, combined with market optimism following Trump’s victory, highlights a pivotal moment for cryptocurrencies. As the market anticipates potential regulatory shifts, the expectation of a more crypto-friendly environment under Trump’s administration continues to drive positive sentiment, potentially accelerating the integration of cryptocurrencies into the financial mainstream.

Trump’s Stance and Regulatory Changes

Donald Trump’s renewed tenure as President has highlighted his unambiguous support for Bitcoin, generating both excitement and speculation within the cryptocurrency community. Notably, Trump has proposed establishing a federal Bitcoin reserve. If realized, this proposal would signify a major shift in how the U.S. government views and interacts with digital currencies, positioning Bitcoin as a critical component of national monetary policy.

Trump’s advocacy for increased Bitcoin mining activities underscores his commitment to integrating digital assets into the U.S. economy. By encouraging domestic mining, Trump aims to bolster the national economy and reduce reliance on foreign cryptocurrency production, aligning with his broader strategy to invigorate American industry.

Simultaneously, the potential overhaul of the Securities and Exchange Commission (SEC) leadership could mark a new era of cryptocurrency regulation. Trump has suggested replacing SEC Chair Gary Gensler, which could lead to a more permissive regulatory framework. Under Gensler, the SEC has enforced stringent regulations on digital assets, emphasizing investor protection. A leadership change might foster innovation and growth in the U.S. crypto market.

The backdrop to these changes is the Executive Order on Ensuring Responsible Development of Digital Assets, issued in 2022. This order established a comprehensive approach to digital assets, emphasizing innovation, consumer protection, and financial stability. As Trump’s administration considers revising this framework, the cryptocurrency industry is closely watching for regulatory adjustments that could redefine digital currency operations in the U.S.

Trump’s Impact on Bitcoin’s Future

The election of Donald Trump as President in 2024 has stirred significant speculation regarding Bitcoin’s future. Many investors are anticipating a potential “bull run” that could drive Bitcoin valuations into six-figure territory. This optimism stems from Bitcoin’s historical price movements, which often align with political and economic shifts. Under Trump’s administration, there is growing confidence that economic growth policies and potentially relaxed regulatory frameworks could further boost Bitcoin’s rise.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BTBU57NXVVCBDDVWCDUT63LHGY.jpeg)

Image source: Source

Prediction markets, which have gained credibility in forecasting electoral outcomes, anticipated Trump’s victory. This accuracy highlights their potential as a tool for understanding how political events might influence Bitcoin’s trajectory. The correlation between political forecasts and Bitcoin’s market behavior could become essential for investors looking to capitalize on future trends.

An important source of insights into the economic trends affecting digital assets is the ACCC Report. It sheds light on broader economic dynamics, offering a glimpse into how policy changes might impact digital asset markets. With Trump’s proposed economic strategies, including discussions about a federal Bitcoin reserve and increased mining activities, the stage appears set for a potential reimagining of Bitcoin’s role within the U.S. economy.

While there is palpable optimism regarding Bitcoin under Trump’s presidency, it is crucial to approach these speculations with caution. Cryptocurrency markets are inherently volatile, and external factors—such as global economic shifts or unforeseen regulatory clampdowns—could still influence Bitcoin’s trajectory. As investors navigate this landscape, a blend of past trends, political developments, and economic forecasts will be critical in shaping expectations for Bitcoin’s future.

Impact of a Pro-Crypto Senate on Legislation

The 2024 U.S. election has not only marked Donald Trump’s return to the presidency but also highlighted a shift towards pro-crypto politics within the Senate. This change is exemplified by Bernie Moreno’s victory in Ohio, signaling a potential pivot towards a legislative environment more favorable to digital currencies. This trend reflects an increased support for policies that align with the burgeoning cryptocurrency industry.

With a Senate more aligned with crypto interests, the legislative landscape for digital assets could see substantial transformation. This shift is expected to create an inviting atmosphere for innovation and growth within the cryptocurrency sector. The new alignment suggests a possible reduction in regulatory barriers that have historically hindered the sector’s expansion.

A tech-driven approach to economic policy, as outlined in a Pew Research study, is anticipated to play a crucial role in shaping the crypto market’s future. This approach aligns with the Senate’s current trajectory, potentially leading to policies that endorse digital currency adoption and integration into the broader financial system.

A crypto-friendly Senate could significantly impact market dynamics, encouraging institutional investment and solidifying Bitcoin’s status as a credible asset class. As policymakers draft legislation that supports the growth of digital currencies, market participants may experience increased stability and confidence, potentially driving further investment and innovation.

The election of pro-crypto senators marks a critical juncture for the cryptocurrency industry. As the Senate leans towards more accommodating regulatory frameworks, the potential for digital currencies to flourish under these conditions appears promising. This evolving political landscape, combined with anticipated regulatory shifts, underscores the transformative potential of this electoral outcome for the crypto market.

Navigating Market Volatility Post-Election

The 2024 presidential election has ushered in a new era of uncertainty and opportunity for Bitcoin investors. With Donald Trump’s victory propelling Bitcoin to unprecedented heights, the market now faces the challenge of navigating potential volatility amidst anticipated regulatory changes and evolving economic policies. Investors must approach this period with a strategic mindset, balancing optimism with caution.

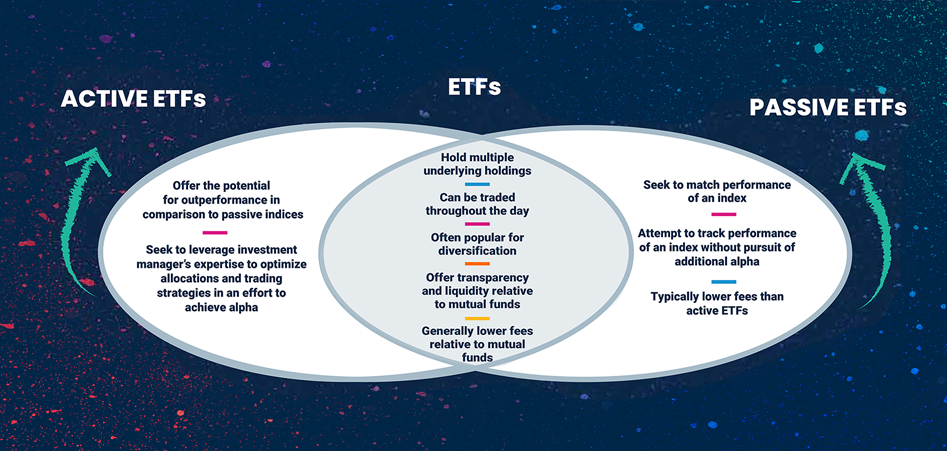

One effective strategy for managing market volatility is the use of active ETFs. These investment vehicles offer flexibility and adaptability in dynamic market conditions. Unlike passive ETFs, active ETFs are managed by professionals who make informed decisions to optimize returns and mitigate risks. This hands-on approach can be particularly advantageous in a market as unpredictable as the current post-election landscape.

Image source: Source

Experts recommend diversifying portfolios to include sector-specific exposure, which can help cushion against potential downturns in any single area. By investing in a broad array of assets, including those outside the cryptocurrency sphere, investors can better position themselves to weather market turbulence. The integration of non-correlated assets into a portfolio serves as a hedge, reducing the overall risk profile.

Renowned financial analysts emphasize the importance of staying informed and agile. As Trump’s administration hints at potential regulatory shifts, including the replacement of SEC Chair Gary Gensler, investors should remain vigilant and ready to adjust their strategies. Financial strategist Emily Tran notes, “In times of transition, the key is adaptability. Keeping a close eye on policy changes and market signals can provide investors with the insights needed to make timely decisions.”

Ultimately, the post-election period is ripe with possibilities for those willing to navigate its complexities. By leveraging tools like active ETFs and maintaining a diversified investment approach, investors can capitalize on opportunities while safeguarding against unforeseen challenges. As the market continues to react to political and economic developments, the ability to adapt will be the cornerstone of successful investment management in this transformative era.

Future Implications of Trump’s Victory on Bitcoin

As the dust settles on Donald Trump’s 2024 electoral victory, the immediate surge in Bitcoin’s value and the broader cryptocurrency market presents both opportunities and challenges. The record high of Bitcoin, reaching $75,410.10, reflects the optimistic sentiment among investors, driven by expectations of favorable policies and a potentially lighter regulatory touch under Trump’s administration. However, this optimism is tempered by the inherent volatility and unpredictability of the crypto market, which will require careful navigation by both institutional and individual investors.

The implications of Trump’s presidency on the trajectory of Bitcoin and the crypto landscape are significant. His proposed initiatives, such as a federal Bitcoin reserve and increased U.S. Bitcoin mining, suggest potential institutional embrace of digital currencies, heralding a new era of legitimacy and mainstream acceptance. However, the path forward is not without hurdles. Possible shifts in regulatory frameworks, with hints of leadership changes in key financial oversight bodies like the SEC, could either pave the way for innovation or introduce new complexities for the market to grapple with.

Politically, the victories of pro-crypto candidates in the Senate signal a legislative environment that may be more conducive to the growth of digital assets. This could lead to a more stable and structured market, fostering confidence among investors and encouraging further capital inflow. Yet, the sustainability of this growth will depend on how adeptly the industry can adapt to market dynamics and regulatory evolutions.

The intersection of political developments and Bitcoin’s trajectory underscores the intricate dance between policy, market sentiment, and technological innovation. As these elements unfold in the aftermath of Trump’s victory, the crypto market is poised at a critical juncture, with the potential to redefine the financial landscape. The ability to seize opportunities while mitigating risks will define the next chapter of Bitcoin’s storied journey.