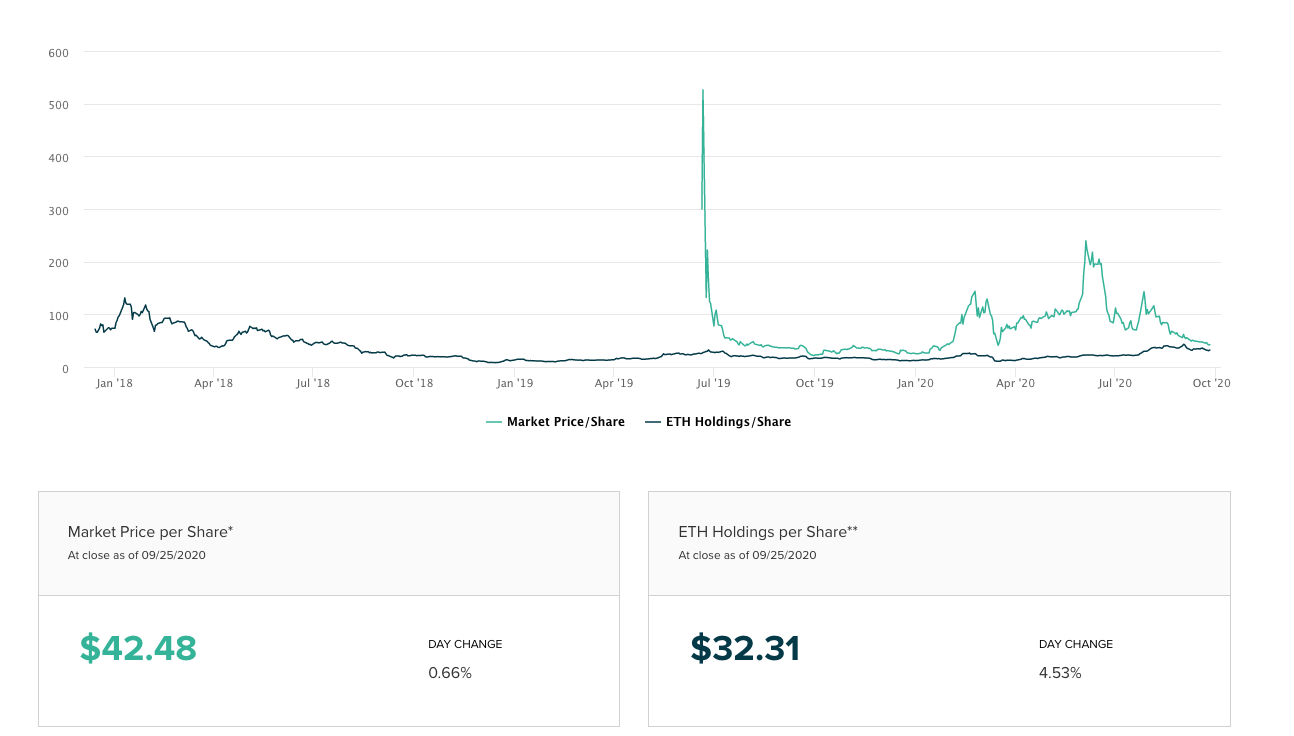

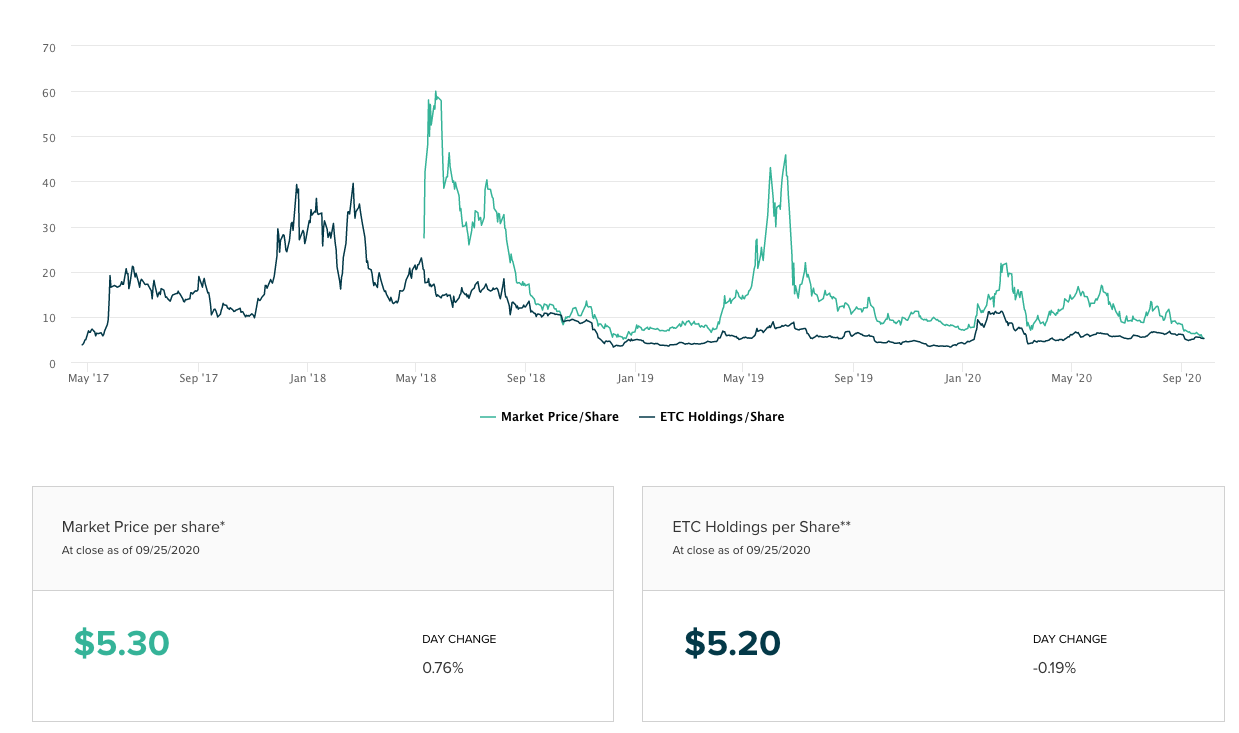

ETHE and ETCG Shed Most of Their Premiums (Oversold?)

ETHE and ETCG have historically traded at large premiums to NAV. However, both assets are trading at low premiums right now.

This is attractive as a buyer, as the upside for these now goes beyond just the gain you can make on the underlying asset and includes the gain made by potential future premiums.

Despite this there is reason to be cautious, as low premiums are typically found in crypto bear markets, and if the underlying assets drop there is of course always more room for downside. Plus, with ETCG there is the concern of ETC to consider (ETC was 51% attacked more than once this year).

That said, look at the premiums to NAV below of both assets. The trend of both trusts have diverged from the underlying assets and now ETCG is trading basically at NAV while ETHE is trading only a little over (especially compared to its historic premium). That is ultimately in my book a buy signal and not a sell signal, or at least historically this has been when you want to build and not sell positions.

For more on how to understand the premium/NAV divergence and convergence, see this article.

NOTE: The photo above shows ETHE approaching some major support levels.