The Ethereum Trust (ETHE) Explained

The Ethereum Investment Trust (ETHE) is an investment product by Grayscale which gives investors and traders exposure to Ethereum (ETH).

ETH is the only way to get exposure to cryptocurrency on the traditional markets aside from trading Bitcoin futures or buying Grayscale’s other products GBTC and ETCG.

As of July 2019, every share of ETHE represents a little under 0.1 ETH. Specifically the trust has 1,027,200 shares of 0.09620794 ETH (so a little under 100,000 of the current circulating supply of 106,000,000 ETH, i.e. about 0.1% of all circulating ETH, is held in the ETHE trust).

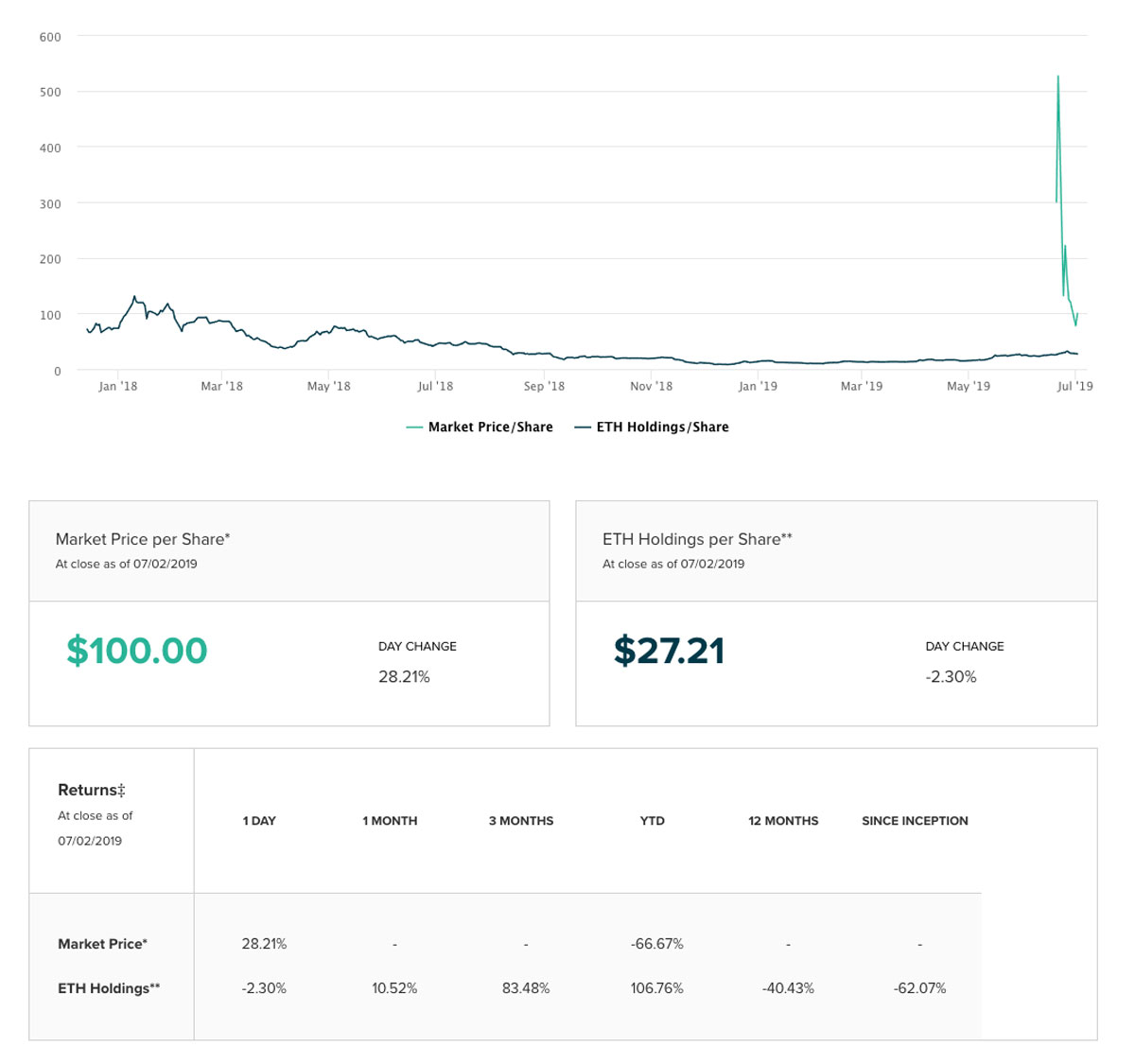

With that noted, ETHE often trades at a substantial premium to ETH. For example, on 07/02/2019 ETHE traded at $100 and ETH traded at $295. In other words, the holdings per share of ETHE had a value of $27.21 (a little under $29.50), but traded at $100 (i.e. at over 3x that cost).

This difference between the market price and “NAV (native asset value)” or the value of holdings per share is called a “premium.” The trust doesn’t dictate the premium, buyers and sellers on the market do.

Like GBTC (the Bitcoin Trust) and ETCG (the Ethereum Classic Trust), ETHE has historically traded at a rather high premium since its inception. See the current premium here by clicking “market performance.”

If you catch these trusts at the wrong time, you can end up with a really high price compared to the value of the underlying asset (TIP: if the market price is higher than the value of the asset has ever been, take it as a red flag; see some tips on GBTC as an indicator to understand what I mean).

One last thing to consider is that there is an annual fee of 2.5% for the fund.

Put that all together and you are buying 1 ETH for more than it is worth most of the time and the value of your investment is generally decreasing by 2.5% a year (not to mention that crypto is risky in general).

So, you are taking on risk with crypto AND taking on extra risk with ETHE. That is the bad news.

Here is the good news though, GBTC and ETCG have traded at a premiums for a long time now. When the market is bearish that premium tends to deflate, and when the market is bullish that premium tends to inflate.

That means if you catch these trusts low and have a little luck, you can actually outpace the gains made by crypto holders in crypto markets!

So there are pros and cons. The benefits are exposure to crypto via the traditional stock market (so you can use your 401k to buy this asset for example) and the potential for massive gains, while the drawbacks are the risks that come along with crypto, fees, and premiums.

In short, if you know what you are getting into, ETHE could be the score of a lifetime, however there are serious risks to consider here.

What is a trust? A trust (an investment trust) is a company that owns a fixed amount of a given asset (like gold, bitcoin, or Ethereum). Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. In a gold trust, 1 share might be worth 1/10th an ounce of gold. With the Ethereum trust, 1 share is worth about 0.1 ETH. The trust is managed by a company who charges a fee, in the case of GBTC that company is Grayscale.