The GBTC Premium Explained

Understanding the Premium on Grayscale Products like GBTC, ETHE, ETCG, LTCN, BCHG, etc

You might hear that GBTC or another Grayscale product has a “premium.” This is a reference to the difference between the value of the holdings of the trust vs. the market price of the holdings.

The current value of the holdings, that is the underlying value, is also called Native Asset Value (NAV).

The current market price of the holdings is what the trust costs on the stock market.

When the market price is higher than the NAV, the difference is called a “premium.” Thus, NAV + premium = market price.

No one dictates this premium. Supply and demand on the stock market creates the premium! In other words, traders create this premium as a result of trading (there is no entity or formula that comes up with the premium).

You can check a snapshot of the premium as of the last trading day at any time on Grayscale.co. This can give you a good idea of what the current premium is.

As a rule of thumb, if you don’t understand the premium, you shouldn’t be buying shares of GBTC or another trust. This is especially true with new trusts as they can tend to trade at a very large premium when they launch and sometimes even higher sometime later (see LTCN as an example). It can be months to years into a trust being launched before they even out to a reasonable premium, so you’ll really want to keep an eye on this.

With that said, if you understand the premium, and you understand the crypto markets, you may find these trusts to be not only useful and potentially profitable to trade. In fact, you may even find you can take advantage of the premium!

With that covered, in 2021 some Grayscale products started trading at a discount! That means they are trading under their NAV. This is also something to keep in mind when trading these products.

Here are two rules to consider with the above in mind:

- The premium makes GBTC or another trust bought at a high premium a risky bet (even riskier than BTC or the other crypto themselves). This is because if crypto goes down hard, which it often does, the premium can shrink and magnify your losses!

- The premium makes GBTC or another trust bought at a low premium a potentially profitable bet (even better than BTC or the other coin themselves). This is because if crypto goes up hard, which it sometimes does, the premium can expand and magnify your gains!

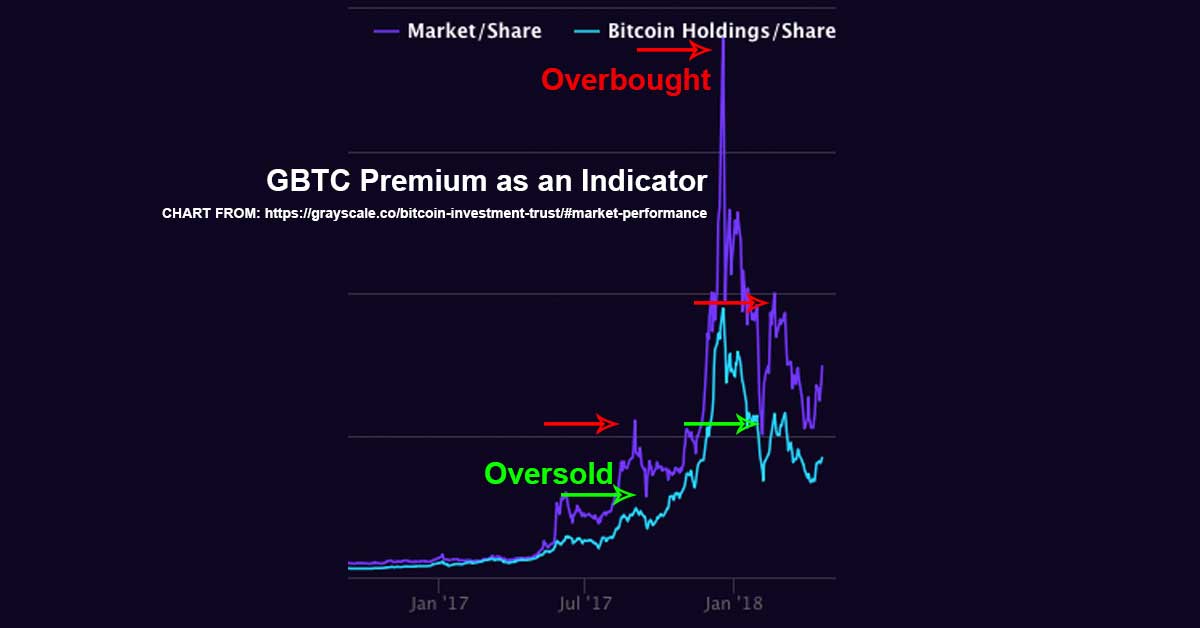

Further, one can think of the premiums as indicators of crypto sentiment and even the direction of the market, where the basic rule is this:

- The Native Asset Value (NAV) to Premium Divergence (premium is increasing) = Bullish / Becoming Overbought. If you know what RSI is, you can think of this as being similar to RSI. A high RSI is a sign of bullishness, but also a hint that a correction to the downside is coming.

- Nav to Premium Convergence (premium is decreasing) = Bearish / Becoming Oversold. Again, like RSI, a low RSI is a sign of bearishness, but also a hint that a correction to the upside is coming.

Lastly, because premiums are unpredictable, be aware that small moves in the underlying asset can cause big moves in the trust, and big moves in the asset may lead to next to no movement in the trust if the premium is high (or may even lead to the opposite move). There is a layer of unpredictability here!

See the pictures below for a better idea of what I mean by the above.