Bitcoin ETF Decision By January 10th Deadline

Bitcoin has been on a rally in anticipation of the January 10, 2024 deadline for the SEC to approve a number of Bitcoin ETF applications.

Although this won’t be the first Bitcoin ETF, and GBTC has long been a viable option for retail Bitcoin exposure, this decision is still important due to how it could impact Bitcoin access in the stock market, fees, and other approvals. As so far the SEC has denied most Bitcoin ETF applications and there are many in waiting, leading to a lack of choice and competition.

TLDR; A Bitcoin ETF approval brings a lot of big names into the space, exposure for retail and things like pensions, plus strength into the upcoming halving. That said, the SEC has a history of fighting these.

Which Bitcoin ETFs are Up for Approval

- Valkyrie

- WisdomTree

- BlackRock

- VanEck

- Invesco and Galaxy

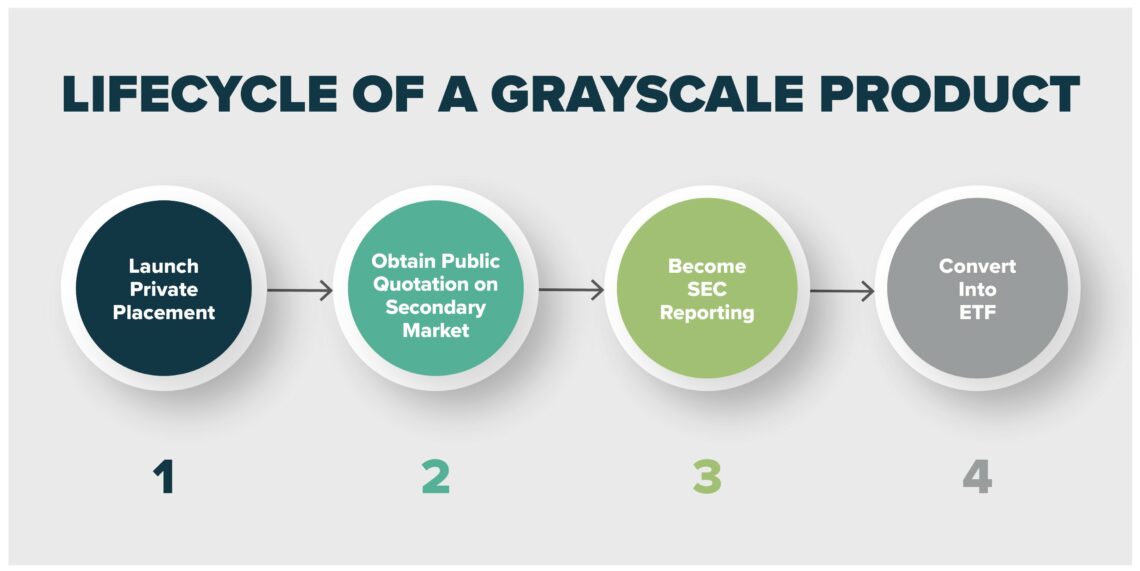

- Grayscale (S-3 filing to convert to an ETF)

- ARK Invest and 21Shares

- Fidelity

- Bitwise and Franklin Templeton

Background of Bitcoin ETFs

Bitcoin ETFs, akin to traditional ETFs, allow investors to invest in Bitcoin indirectly, avoiding the complexities of direct ownership like managing crypto wallets or navigating crypto exchanges. These ETFs track the performance of Bitcoin and are seen as a more straightforward and regulated approach to investing in cryptocurrency.

Also, importantly, they don’t have access issues like Futures or fee issues and other limitations like GBTC (which itself has been trying to get approval to become an ETF).

Impact of Approval

Market analysts and ETF issuers maintain a positive outlook, with the potential approval of Bitcoin ETFs expected to broaden Bitcoin’s investor base, possibly leading to increased adoption and price stability.

Analysts predict that the approval of Bitcoin ETFs will create “trillions in value” over the long term, although they caution against overestimating the initial impact. Some even forecast a “supply shock” due to the institutional demand for Bitcoin. This perspective is supported by the historical performance of similar financial products like the SPDR Gold Shares ETF and the ProShares Bitcoin Strategy ETF, which showed substantial asset growth post-launch.

However, opinions about the market reaction to a potential approval are mixed. Some analysts suggest that the Bitcoin price might experience a sell-the-news-led pullback, as historically observed with other major crypto events. According to CoinDesk, CryptoQuant a crypto analytics firm, even predicted a possible slump in Bitcoin prices.

In terms of historic crypto events, either direction is possible, although one notably similar event of CME futures launching at the peak of 2017 did mark the end of that rally. However, it should be considered that the halving is coming up in April 2024, and there is potential for this rally to simply lead to a potential expected post-halving rally.

Institutional Investors: Why ETFs Matter

A significant aspect of a spot Bitcoin ETF is its appeal to institutional investors like pension funds and insurance funds, offering them a way to add exposure to native Bitcoin. This move is contrasted with synthetic options like futures, which as noted have previously led to price declines. In simple terms, ETFs mean buying, while futures mean the ability to short.

The adoption of a spot Bitcoin ETF is also compared to the gold ETF market in the U.S., suggesting a potential additional demand of nearly $30 billion for a Bitcoin ETF due to Bitcoin’s higher volatility compared to gold.

Bottomline

The January 10, 2024 deadline marks a critical juncture for the cryptocurrency market. With over ten applications submitted, including those from giants like BlackRock, Fidelity, and Invesco, the SEC’s decision will set a precedent for future crypto-related financial products and is seen as a step towards broader adoption of Bitcoin in mainstream financial markets.

If all goes well, this could be a solid catalyst for strength going into the upcoming halving later this year.