Is U.S. Tax Season a Threat to Crypto Prices?

U.S. Tax Season and the Way it Could Impact the Future of Crypto

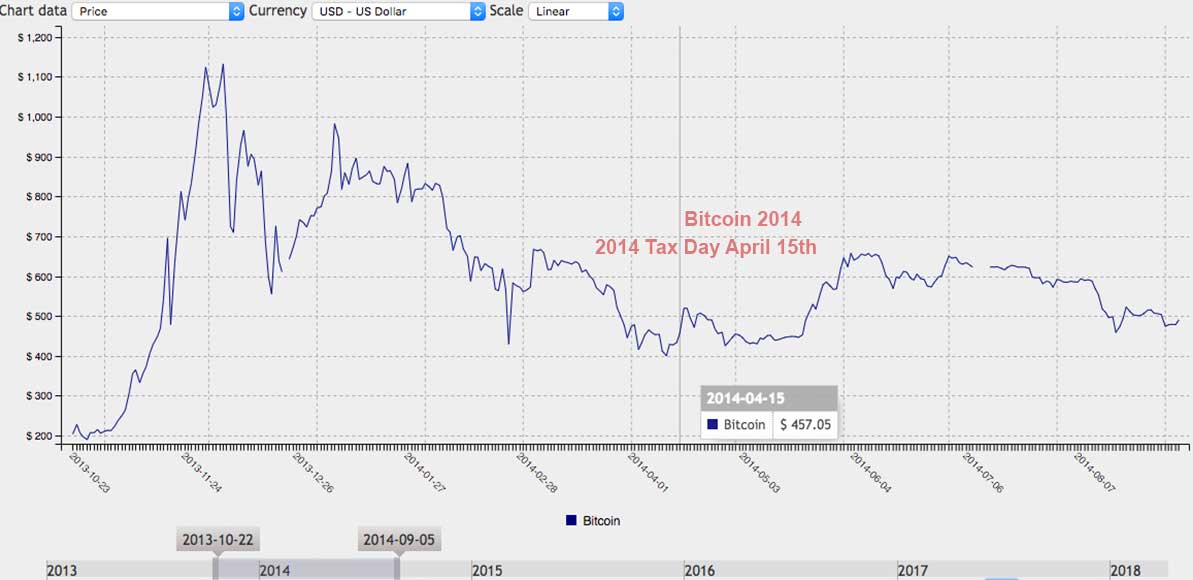

U.S. taxes are due April 17th. Some speculate that money will rush out of crypto before and in after. Both of those things are logically possible. In fact, this is what happened in 2014 (not that history has to repeat; but since it has thus far, let’s consider it).

To address the above theory, first let me make a few points:

- The part about money going out isn’t meant as FUD and the part about money moving in after isn’t the antithesis of that. I join with others to convey what some have said (like Fundstrat Tommy Lee) and acknowledge that this is a reasonable theory (for reasons explained below).

- You should know this is a real issue first hand if you have filed your crypto taxes and live in the U.S.

- Events like this sometimes produce more hype and fear than is justified. It is possible that after tax day we see no rally or that we will see no further sell-off.

If you understand the above, then you may also understand the following line of logic.

The Logic of Why the U.S. Tax Day is a Legitimate Concern and Why Tax Season Ending Could Result in at Least a Temporary Rally

Many countries have crypto tax laws that result in lots of complex paperwork and fees, and this is also true in the U.S.

However, this year U.S. tax season has way more weight than most tax seasons in most years due to when it occurs and how 2017 played out (the other notable one like this was 2014).

The overarching problem for investors, traders, new adopters, and crypto as we speak is this: the U.S. tax season is positioned in such a way that a large amount of Americans got somewhat REKT (AKA wrecked) between 2017 and 2018 (in short, they made big profits in 2017 on paper, but lost them in 2018, thus owe taxes on gains they already lost; “REKT”).

That is done. It already happened. Nothing can change it. We now have to deal with the effects of that.

U.S. taxpayers sitting in crypto collectively owe the IRS billions, and if they don’t have the cash to pay up, they are going to need to sell their crypto to do so by April 17th.

Many likely already sold, and this could have contributed to the recent correction, however many are likely holding out to the last minute (hoping Bitcoin and other cryptos will go up; they did very slightly in 2014).

Meanwhile, once this group is out of the exchanges and into fiat, and once that fiat is in the hands of the IRS, it is hard to see how that cash comes back into crypto right away. Does anyone think that the IRS is going to get FOMO and go long on XRP when the clock strikes midnight on April 17th?

Further, one can speculate that there is a chance that a portion that this whole thing will leave a bad taste in the mouth of new U.S. adopters. They will lock in losses, and thus potentially become turned off by crypto (either forever or for a while).

That potentially leaves many who were once evangelizing crypto now being bitter, and it makes it less likely they will contribute to any upward movement in the near future.

This situation isn’t dire, there are ways around it, and nothing is written in stone, but all paths forward that involve crypto going to the moon are complex.

Any quick rise now is likely to be met with selling (as many will pay the IRS in cash and then need to make up for those losses and traders are now used to having to take gains quickly; it looks like this happened in 2014 from the chart).

Of course, we are talking about retail investors, exchanges, and other entities who might need to cash out for U.S. tax purposes. We aren’t talking about big money and institutional investors who are looking at 2018 with fresh eyes.

There is always a chance that non-retail U.S. investors capitalize on the sell-offs and offset any negative impact that U.S. sellers would have (although this assumes the big money and institutions are all bulls; which is very unlikely).

If we look only at 2014, we can assume that there will be a short-lived rally after tax day (and in 2014 starting right before it), but that it won’t be enough to take us back to all-time highs. If there isn’t a prospect of all-time highs, then selling is likely to resume with each attempted rally. 2014 was like this.

That doesn’t paint a very attractive short-term picture, but there is none-the-less a number of ways out of falling into a trap like crypto did after U.S. tax day 2014.

The way out that I think is the most likely is that we will see slow and steady gains for months with very little pumping. These days each pump is met with an equal and opposite dump, which is shaking many people’s confidence, although it is a fun part of the crypto coaster for some).

NOTE: Oddly enough, or not, with only a few business days to go before tax season… Bitcoin surged in price on April 12th. This isn’t so far off from what happened in 2014. It will be interesting to see if this rally sticks, or if we see a sort of repeat of 2014 in this respect too!

Why compare 2014 and 2017? I’m comparing this year to 2014 because 2014 and 2017 are the two years in which mass adoption of Bitcoin and price spike happened in one year and then a correction happened in the next year leading up until the time taxes were owed. I’m not comparing it to other years where we saw a sustained rally after tax time (in those years the general trend was up, and thus the factors leading up to the tax season were not the same).

Another Way to Look at the Above

I made the basic case for what I wanted to say above, but for those interested, let me illustrate what I mean more clearly using a bullet list:

- People who got into crypto last year had a lot of opportunities to make money in 2017. In fact, if they traded or HODL’d it was hard to avoid making money.

- People who traded or HODL’d in 2018 had a lot of opportunities to lose money. In fact, if they traded or HODL’d it was hard to avoid losing money.

- Anyone who traded in 2017, and this includes the simple act of buying alts with BTC or ETH, likely realized capital gains. Thus logically, many made money in 2017 on paper and lost it in 2018 on paper.

- U.S. tax season is based on the calendar year, losses from one year can’t, for the most part, be written off against gains from another year. So 2017 gains can’t be weighed against 2018 losses. This means many are people have significant losses.

- The crypto correction worked against U.S. investors and traders specifically and in some cases brutally due to its timing. This happened in 2014 as well (another year in which the big uptrend came late in one year and then the correction in the next all the way until tax season).

- Anyone who owes the IRS money probably needs to sell some crypto now or in the near future.

- Not only do those in difficult positions need money; funds and exchanges which potentially owe U.S. taxes need to cash out too.

- All the above puts sell pressure on the crypto market. That pressure isn’t impossible to get around, but it is there.

- Now consider, the rise of Bitcoin in 2017 relied on crypto evangelists who made money, new adopters, and FOMO.

- Many of the new adopters are now REKT (or wrecked) and will have big tax bills.

- Those who got in early are now getting close to seeing losses (they could capitulate if we see further selling).

- There is a risk that the “new adopters” will now not get back in. There is a risk that they won’t suggest others get in either.

- If earlier adopters end up needing to pull out, they could decide not to get back in, and they too could stop evangelizing.

- In 2017 winners and bag holders evangelized crypto. In 2018 many who got burnt will become the opposite of the crypto evangelist and become crypto haters and doubters.

- We might lose our new adopters, lose some early adopters, and see our evangelists become haters. Going to the moon has gotten more complex. The next wave largely relies on a new wave of adoption, more users, more traders, more money, more volume, more press, etc.

- Further, now bigger investors are entering the space. If they decide to war against the whales, the whales could lose.

- If the whales capitulate, then we will see crypto dominated by large investors.

- If new adopters, early adopters, and whales all capitulate and get out, it takes crypt’s price and adoption back considerably.

This could create a downward spiral that would prolong the current correction, offset any rally attempt, and set crypto’s growth back.

This is easy to imagine because, as noted a few times above, it looks like the sort of thing that happened in 2014.

In 2014, tax day was on the 15th (not the 17th as it is this year). There was a little before tax day, then a rally right before tax day which took off on tax day and ended shortly after. That 2013 – 2014 chart looks very similar to the 2017 – 2018, and so far many of the same types of occurrences have played out, and this is why I’m entertaining it.

In 2014 the tax day rally wasn’t enough, however there was indeed future rallies. There was for example one notable rally attempt in the summer (this one sustained longer), it was pretty much all downhill from there until 2015.

Then from 2015 to 2017, the price did what it arguably should have just done back in 2014, that is, it built back up slowly, regaining confidence with the world each step of the way.

And then, well 2017 happened, and you know the story from there.

I’m not saying history will repeat, but I am saying there is a very real historical precedent for trips to the moon being postponed starting on tax day after an epic pump which leaves enough U.S. taxpayers down to put a temporary damper on new adoption.

Bottom line: In retrospect, I wonder to myself how much of the 2014 correction is explained by the epic pump of late 2013 and correction of 2014 extending to U.S. tax day? There could be no real correlation, but since so much of 2013 – 2014 to 2017 – 2018 has correlated, and since the troubles for U.S. tax payers are repeating again like they did in that time (just now on a larger scale), it does seem that it is at least worth examining. I realize the examination isn’t the most cheery thing in the world, but like, neither is paying collective billions in taxes on “profits” that no exist as on-paper “losses.”

NOTE: On tax day 2014 Bitcoin was $450. It got to a high of about $1.15k in 2013 and a low of $150 in 2015. The high for 2013 was $645. If history repeats, it implies we have room to go up again (but the next attempt on tax day won’t be the event that takes us to the moon). If history doesn’t repeat (which is very likely), then your guess is as good as mine. Be careful about getting overly bullish or bearish; these are uncertain times.