What if Institutional Investors are in Stealth Mode?

Everyone is waiting for institutional investors to get into the crypto space, but what if they are already here and accumulating in “stealth mode?”

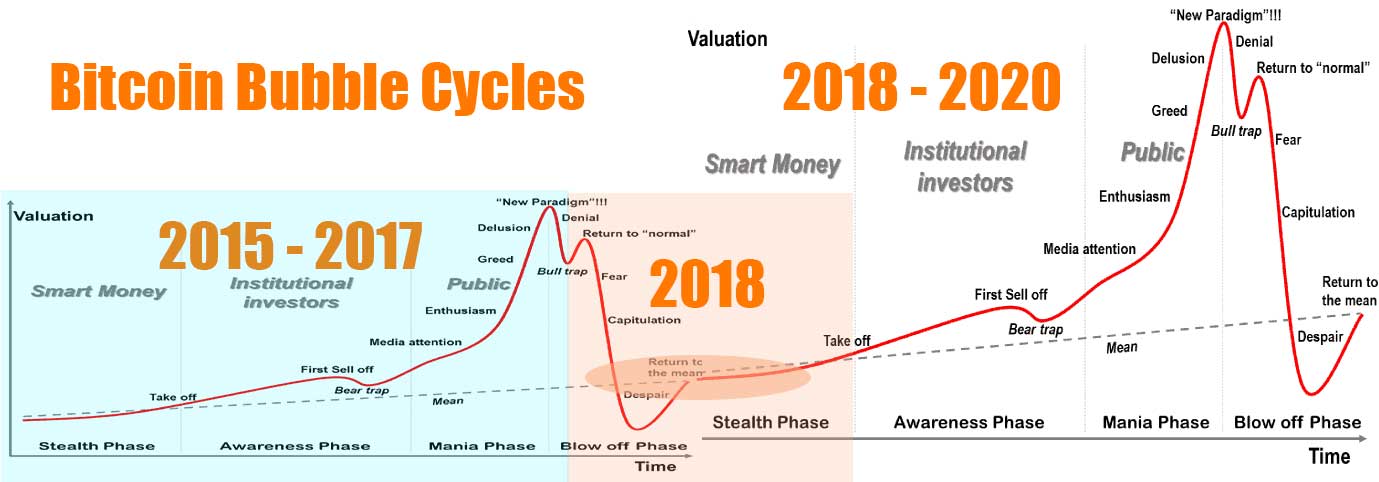

Look at the chart at the top of the page which uses the stages of a bubble image from TransportGeography.org (a good breakdown of a bubble).

I am saying in respect to that chart, “what if using short contracts from futures, hedge funds, over the counter buying, and exchange trading institutions have been accumulating without showing their hand thus far in 2018. Thus 2018’s decline has been a transition between capitulation, despair, and takeoff (to use the terms in the chart)?”

You have institutions using the predictable collapse of the bubble to build a position for the next phase (perhaps even using the of the last bubble for the same purposes).

As a counterpoint, we can point to the fact that regulations are murky and custody solutions are sparse (meaning it really could be the case that this isn’t happening, at least in the US and with the bigger players).

However, as a counterpoint to that, we can point to Grayscale’s reports, Coinbase Custody, and having the guts to build a position in an asset / asset class before things are crystal clear (and anyway… they are pretty clear right now, this isn’t 2014).

Maybe we aren’t at the stealth phase yet, but one thing is likely certain. That is, those who would buy in the stealth phase aren’t going to show their hand until after they have built their positions and are ready to start marking up prices. The awareness phase is simply the phase where big players start showing their hand and marking up prices. As the chart eludes, the “smart money” (including institutional money) will have spent a solid chunk of time accumulating before that phase!

So, if the phases play out like clockwork, and in many ways even if they don’t, waiting until institutions flick on the green light and give the thumbs up may not be the best move for anyone who wants to be in the space.

That said, before you start buying like a maniac. You should remind yourself that there is always the potential to go lower. There is really no low off the table, and for those who would be accumulating here, they have tactics that allow them to accumulate whether the price goes up or down.

The reality is we won’t know if the bottom is in until long after it is in. Likewise, aside from a few early reports like Grayscale’s, we won’t know who has been accumulating until they already have a large chunk of their positions built. Thus, the best we can do is analyze and theorize and guess.

Still, historically Bitcoin has formed the pattern in the image above (see the image below), and thus betting that it will do it again is simply betting history will repeat. Then, on top of that, if it does repeat, it would make sense that we were butting up against the stealth phase at this juncture since this is clearly somewhere on the popped side of the bubble (likely someways into capitulation if not a return to the mean, but if not, at least on the popped side of the bubble).

TIP: The chart below shows the most notable Bitcoin bubbles thus far. They all essentially fit the mold of the classic bubble and all bleed into each other, with each resolving into higher and higher prices over time.

Bitcoin Bubbles since 2010. So it has always been like this? Interesting.