Bitcoin Makes Gains in July Breaking $8k

Bitcoin made some serious gains in July after hitting its 2018 bottom in late June and then completing an inverted head and shoulders reversal pattern. The reversal was in part sparked on by an upcoming Bitcoin ETF. So far Bitcoin is trading above $8k. Let’s look at how we got here and what might happen next.

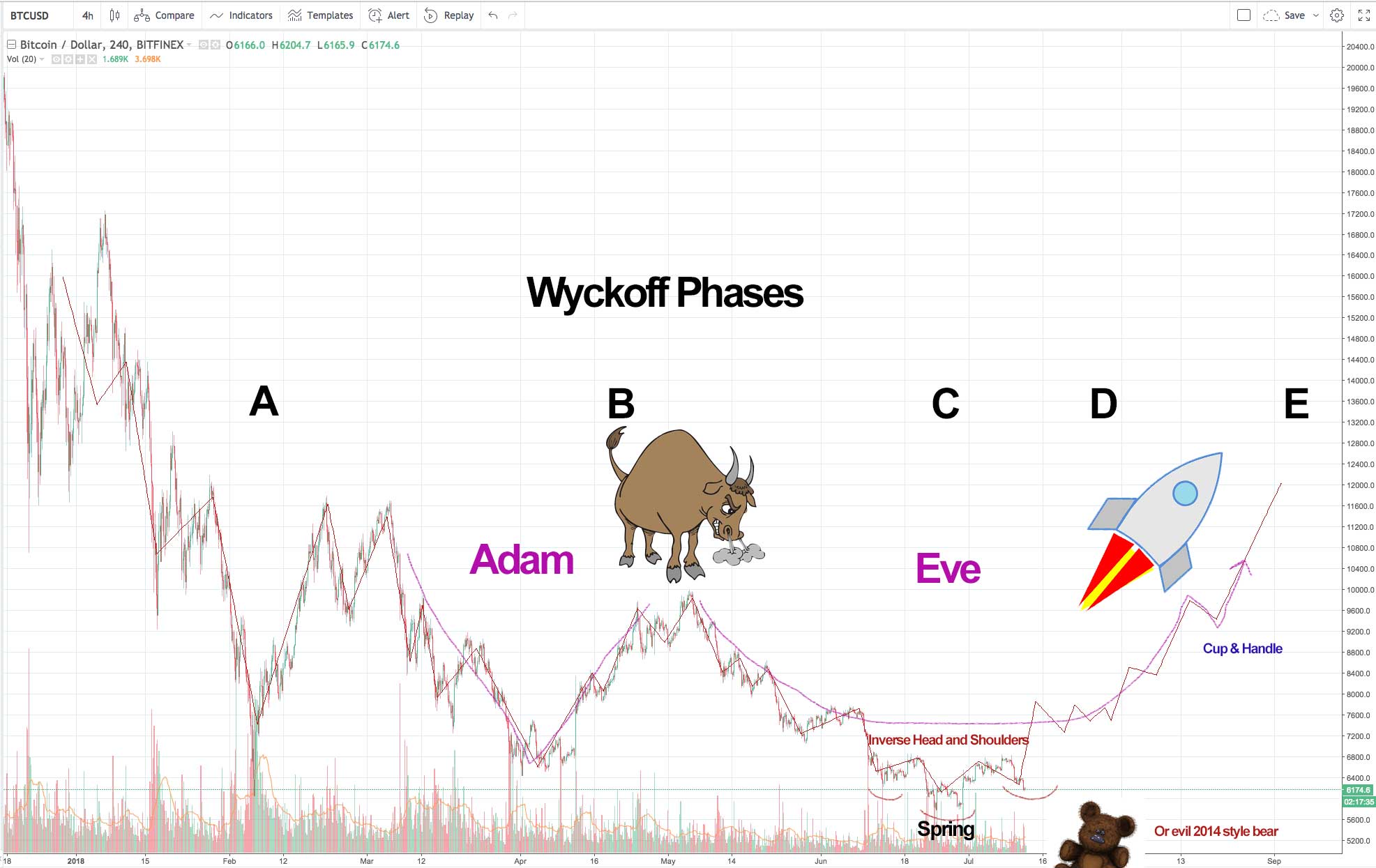

First off, look at the image above. Me (the author of this page), and others, noticed a potential reversal pattern forming in July as illustrated in the chart above (it was published July 12th).

The first part of the reversal, an inverted head and shoulders, played out when Bitcoin hit $7,250 or so. However, on top of that I also notice some other bullish reversal patterns forming over June and July and illustrated most of what I noticed in a single chart (the one above; see this page for other aspects of the reversal).

The ETF news and other technical factors were enough to spark a rally that thus far has this grand reversal pattern playing out.

This isn’t an example of me making a prediction, instead it is an example of how one can look at a chart (even one that looks bearish) and consider the possible pathways for the price to travel. Sometimes a bearish chart offers a setup for a bullish reversal, sometimes a bullish chart offers a setup for a bearish trend to form. Sometimes all it takes is a bit of good or bad “news” to set one of those paths in motion. Then, once on the path, the gravity of that trend takes hold of the market.

Right now Bitcoin is on yet another bull run attempt in an otherwise bearish 2018. You can look at the chart and see the last two major rallies failed, but that doesn’t mean this one will.

I like to treat each attempt as if it could be the one that results in a major bull run, not because I think it will, but because I am betting that one will and since I don’t know which it will be… I have to assume that each one is the one (that means having a game plan for what to do in case it isn’t).

With that in mind, let’s think about things that could turn this minor run into a major one. I would consider the following to be major factors:

- The Solidx shares ETF gets approved in August, then the Direxion ETFs get approved in September (giving us a full two months of reasons for Bitcoin to stay in bull mode). BONUS: It becomes super bullish if at least one non-Bitcoin product can make its way onto the exchanges. Ethereum ETF anyone?

- The rest of the pattern I showed above plays out (taking us past the resistance in the $10ks and even potentially the $11ks). NOTE: There are a few variations of this that can play out now that we have made it this far, some allow for serious downside, some are just all up, up, and away. For example of a super bullish pattern with downside, a giant head and shoulders could form by the price action from March to May repeating in reverse essentially (this could take us back to $20k by the end of the year).

- Volume increases, confirming this run is pulling in more traders (and not just resulting in higher market caps).

- For a major crypto bull run, alts are going to have to heat up at some point (as a Bitcoin solo run is not a crypto bull market, it is a Bitcoin bull run only). So I would be looking for alts heat up in response to the Bitcoin run at some point here (even if they lag for weeks). So far Bitcoin has been on a solo mission, but the holy grail for crypto investors is an alt run like we saw in the summer of 2017 and winter of 2017 – 2018. Those runs were in response to Bitcoin heating up first, so while alts haven’t kept up with BTC so far (they have been “lagging”), the precedent is there.

- On the flip side, if Bitcoin forms a double top here, the ETF isn’t approved, and we end up back down in the $5ks with alts getting dragged down once again… then we essentially have only prolonged the bear market. Doing it this way is still better than straight up capitulation and crashing… and it does offer setups for the future, but it isn’t what I want to see as a crypto investor with crypto.

Now let’s discuss how to play this market.

I can’t tell you how exactly to play the market or what investments to make, but I will offer some basic logic that might help you decide for yourself:

- If you want to follow the trend, the overarching trend of crypto in its lifetime is bullish, the overarching trend of 2018 is bearish, and the short term trend of Bitcoin is bullish. Meanwhile, alts are stagnant in Fiat value and bearish in BTC value (but many are forming potential reversal patterns; see the image below). In general you would want to be in a coin that is doing well (and then get out when that trend breaks); for some that means average in before the trend occurs, sometimes that means following the trend (it depends on what type of investor or trader you are).

- If you want to see gains like people saw in the Summer and Winter of 2017, you’ll need to find the bottom of the alt market. Right now alts are like falling knives. At the same time, reversals tend to happen very quickly in crypto. There are countless ways to mistime alts, but if you get anywhere close to the bottom, and then alts do run behind Bitcoin… you are looking at a serious payday.

- Whether you take a chance on Bitcoin or alts, if the bear trend resumes anything could happen. Some alts could go to zero, Bitcoin could go to $1k, etc. There is no magic point at which things have to recover. So any bet you take either needs to come with an exit plan or a sober assessment of risks. This could be near the bottom of the alt market… especially in BTC prices (where many alts are testing December and April lows and have extremely oversold RSIs)… but it could not. If it is not, and Bitcoin fails here, the downside has no limit.

In short, Bitcoin bullish for now. The setup is there for more bull. The bull run could take alts with it or not (they could be lagging, or they could be waiting in bear mode until Bitcoin stops running). However, the overarching market of 2018 thus far has been bearish and that means there is a long way to go before we can declare crypto to be in a bull market (and that means anyone taking long positions now is taking on risk in hopes of reward). As for short term positions, the trend is your friend, and the trend is with Bitcoin and not alts.

An example of potential reversals for alts: I marked up this GDAX chart a few days ago to show how we could bounce off April lows in BTC prices. We also need to look at December lows. The closer we get to these, the more of a buyer I’ll be (meaning I’ll add to my long positions; I run a crypto site, I’m generally invested in crypto… but never all in, because I also practice risk and money management). Buying alts now, or even at the previous bottom, is gambling and risk taking due to the current trend. I am betting on a bounce or run at those levels based on what BTC is doing (it is bullish, so it makes sense for me that many alts reaching their lows at once with oversold RSI while BTC is running would spark on an alt run). However, if BTC turns bearish, then my plans will change. A more conservative investor would likely wait for a trend to form and not try to catch a falling knife! However, to counter that, a long term investor might simply average in despite exact prices at this point (we are clearly not at the all time highs any more). Look at April 19th of BCH and show me where exactly you had time to follow the trend if you weren’t a day trader? Meanwhile, you can see that any buy from late Jan to April ended up being decent by late April. Here, at this point, I’m willing to bet that these aren’t the highest prices we will ever see in terms of BTC or fiat for alts… however, it’s a gamble because 1. the chances they are not the lowest is perhaps even greater and 2. the trend is with Bitcoin and not alts right now (spotting a potential reversal and taking a bet is betting on what might happen, betting on a current run is betting on what is happening; big difference). Still, I am bullish on the potential of alts, and I’m looking for those December and April lows.

Of course most investors would love to see all coins do well. But in terms of BTC prices, most alts have a little more room to go down to test their April bottoms.