Bitcoin Dominance Hits 2018 High as Alts Lag; Here is Why

Bitcoin Dominance and How to Know When to Trade Alts to BTC and BTC to Alts

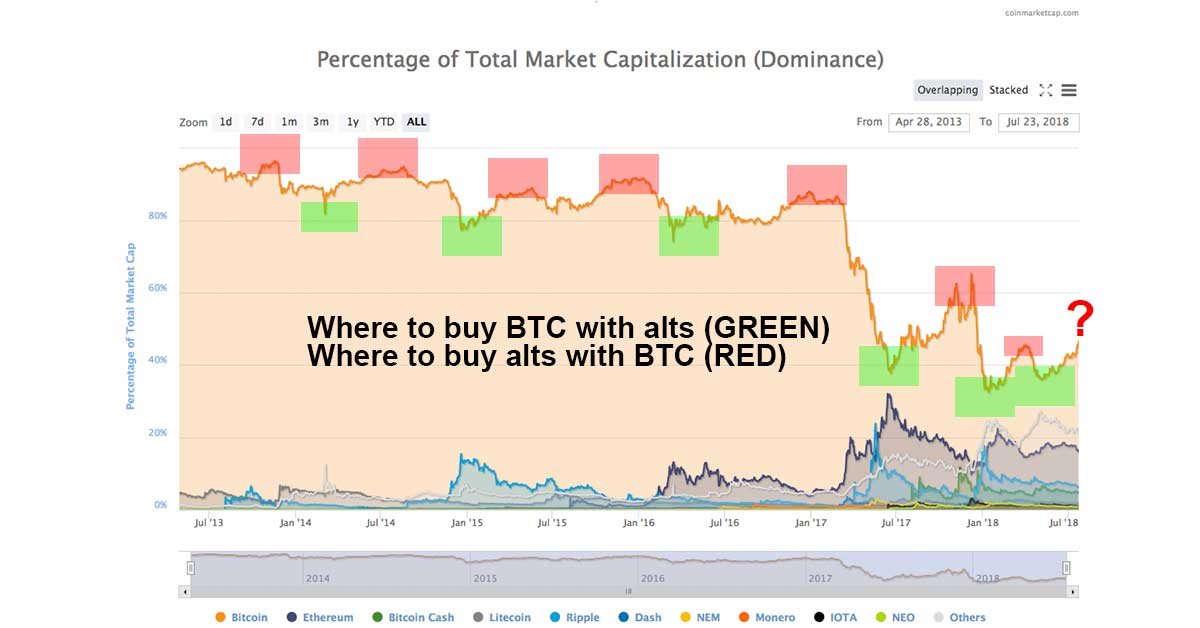

Bitcoin Dominance in the crypto market hit a 2018 high with 45%+ of the crypto market cap being Bitcoin. This occurred due to Bitcoin gaining value in anticipation of a Bitcoin ETF while alts lagged. Let’s discuss Bitcoin Dominance.

NOTE: In the chart above it shows where it would make sense to trade alts to BTC and vice versa based only on the crypto dominance chart. About half of those end up being bad or lukewarm plays at the time. I’m not trying to illustrate the best places to buy if you have a time machine, I’m trying to illustrate how patterns in Bitcoin dominance can inform your timing of swapping BTC and alts around. 😉

Here is everything you need to know:

- Dominance refers to how much of the total market cap of crypto belongs to a given coin.

- What coins do well goes in cycles and Bitcoin and alts have historic relationships that seem to play out again and again. In this cycle here in July 2018 Bitcoin is outpacing alts (leading to declines in BTC values for altcoins). NOTE: This stings a bit for alt investors because alts just tracked BTC during the last correction, but haven’t tracked BTC during this recovery (meaning many alts are in rough shape by 2018 standards)…. that said, we saw this in February as well to some extent.

- Bitcoin Dominance and alt dominance tend to go in cycles, Bitcoin dominance will rise for a few months at a time, then alt dominance will rise for a month or two (sometimes it is a longer or shorter period, sometimes there is chop in between). The trend is actually toward alts gaining an increasing amount of dominance over time (this has been true since 2013 at least, but the trend ramped up in 2017), however Bitcoin will likely be “king” for the foreseeable future. NOTE: The more popular alts there are, the more Bitcoin will logically share its dominance.

- If you look at each coin, you can see a clear rotation of dominance between individual coins. This was very pronounced in December 2017 – January 2018, and it can be easily seen with top coins like Ripple and Ether.

- The last period in which Bitcoin dominance was on the rise was Feb – April (three months). The current period of Bitcoin dominance started in May (two and a half months so far). With that said, in 2017 Bitcoin dominated from July 2017 to December 2017 (six months). If we are looking for patterns, we want to be looking for this cycle to end to enter alts (especially top alts; the top 20 or so by market cap so example).

Here are some additional points to augment the above:

- The rotation is mostly a good thing. The push and pull between coins is what helps them all grow in value over time. It generally helps incentivize people to stay in crypto rather than fiat as well (as outside of severe corrections it is almost always better to be in the right crypto than out of the market).

- What coins do well tend to rotate, and this leads to noticeable patterns in dominance. These are wave-like short term trends for the most part (aside from a gradual decline of Bitcoin dominance; which is healthy for crypto and allows BTC value to flow back into the better coins over time). Bitcoin isn’t overtaking Ether, Ether wasn’t overtaking Bitcoin earlier this year, alts aren’t the new Bitcoin, Bitcoin Cash isn’t the new Bitcoin, Litecoin isn’t dead, Ripple isn’t dead, etc. None of that. This is all simply a [mostly] natural pattern of waves spurred on by a range of factors that draw investor and trader attention to certain coins and coin types at certain times.

- The key to crypto is moving out of coins losing dominance and into those gaining. Right now Bitcoin is a solid bet (and heck, it is always a solid bet due to its dominance). However, those looking to make gains in alts want to look to see when trends are likely to reverse (this gives an opportunity to grow alt stacks, grow your btc stack, or to grow your fiat).

- Since seeing the future is impossible, we can instead keep an eye on events, get a sense of trends, build average positions, or attempt to jump on trends early. So, for example, if I think BTC dominance is heading toward an end (for whatever reason, charts, news, local bottoms of alts) I can start building an average position in alts using BTC. Or, for another example, if I see Bitcoin dominance declining quickly, I may shift out of Bitcoin into alts to increase alt positions.

- In serious corrections no coin is really safe. In the above chart I noted good times to get out of Bitcoin or Alts to benefit from the rotation. However, there are points in that chart where being out of all crypto was the best short term move. So there are a few factors to keep in mind here.

Bottomline: Since we have ourselves a natural recurring cycle which creates an ebb and flow between alts and BTC, it is ideal to shift between alts and BTC at the right time (if your goal is to have alts or to profit from trades). Knowing the right time in the moment is not easy… but knowing where to look for the patterns is helpful. Right now in July we have had over two months of increasing Bitcoin dominance, likely in part due to an upcoming Bitcoin ETF. So here we would be looking for the point where alts catch up, but where Bitcoin isn’t dragging the whole market down to make a move into alts. For me I’m looking at August 15th (roughly the deadline of the ETF announcement) and at the April and December 2018 bottoms of alts in BTC prices. If that starts lining up, I’ll be looking very closely at the BTC dominance chart and thinking about increasingly my alt positions. However, in all this I will be weary of the ETF getting rejected and be weary of another leg of correction before we see another market wide rally like April or BTC only alt like late December 2017 – early January 2018. Ultimately I can’t tell you how or when to invest, I can only share the tools and logic I use so it can help you make your own choices on your own journey.

TIP: Right now NEO and Ether are in the backseat, XLM and ADA are strong-ish, and Bitcoin is killing it on a solo mission. Bitcoin didn’t even take its sidekicks Litecoin and Bitcoin Cash along for a ride this time. ROUGH! This may make it seem like NEO, ETH, LTC, BCH or whatever are “dead.” However, that sentiment has always been wrong since I first started following crypto in 2015. We can see Litecoin went from $33 to $1.50. However, we can also see that yesterday’s nightmares are today’s dreams. Who here doesn’t wish they bought LTC at $1.50… or even $33 a this point?! The moral of the story being, if you want to see big gains, you have to be willing to jump into a quality project when it looks like a dumpster fire. I would never trade all my BTC for alts (BTC is and always will be my primary holding), but if one is a fan of crypto and wants to be in other coins at some point in the future, they are either going to have to jump in the dumpster fire or be really quick on the draw when trends reverse. There really is no other way.