Different Styles of Cryptocurrency Trading

There isn’t one style of trading cryptocurrency, there are a few. Some styles are more likely to fit a person’s tastes, tolerances, and goals than others.

A section on cryptocurrency investing and trading tips and tricks designed for novices, but with insights anyone can enjoy.

For informational and educational purposes only.

There isn’t one style of trading cryptocurrency, there are a few. Some styles are more likely to fit a person’s tastes, tolerances, and goals than others.

When trading cryptocurrency, it is helpful to look forward to figure out the next best move. Meanwhile, it isn’t very helpful to look back unless your goal is to learn a lesson or analyze data.

Risk management and position sizing are important aspects of cryptocurrency trading and investing. It can be tempting to go all in or out. However, this can be a recipe for disaster given the volatile crypto markets.

One of the simplest ways to gauge the medium term price trends of the crypto market are the 12 and 26 EMAs on Bitcoin on daily candles (the only indicators on GDAX).

We discuss the difference between investing and trading in cryptocurrency. Investing and trading cryptocurrency are two very different things. Each requires a different mindset and set of tactics.

If you are trading cryptocurrency or investing in it, it can be helpful to have a basic grasp of chart analysis and a few standard chart patterns and technical indicators. We present a simple to understand guide for beginners.

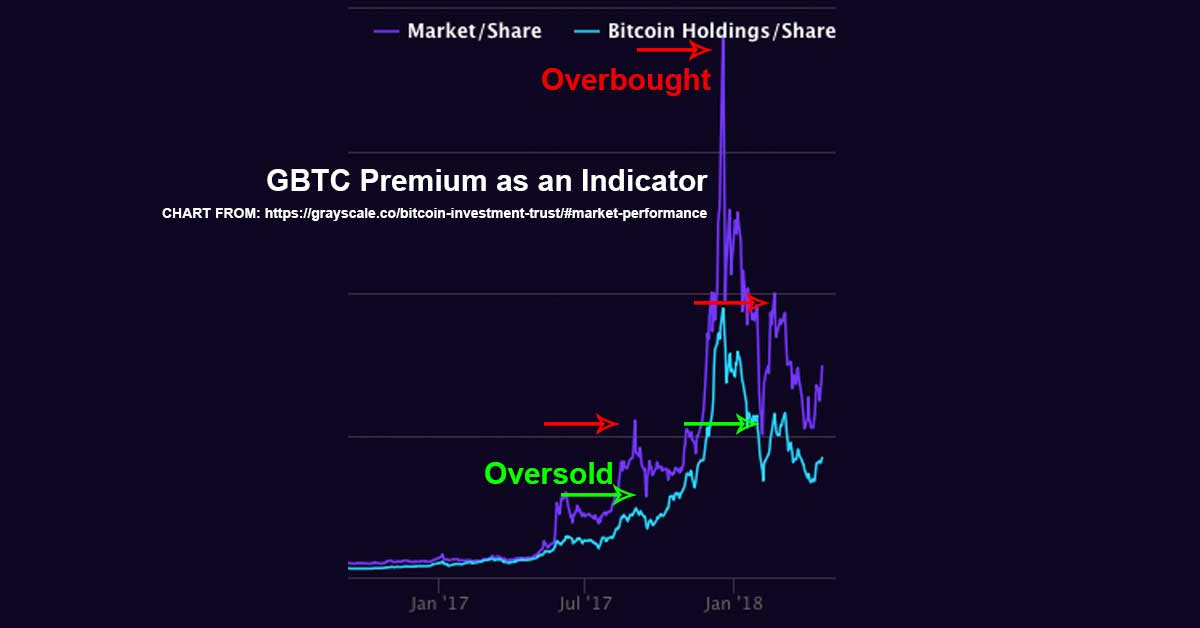

In some markets, people will pay a premium for Bitcoin products when crypto is doing well. Specifically, this can be seen in South Korean markets and in GBTC.

Here is a list of everything you need to get started trading and investing in cryptocurrency along with specific suggestions on products for beginners. In other words, here is a cryptocurrency investing starter kit.

Here are some tips for bot trading crypto for beginners. That is, some tips for automating your cryptocurrency trading using software.

When a bottom has been hit, or when a asset is soaring toward a high, it can be tempting to buy or sell on impulse due to the fear of missing out. Watch out for that.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.