BitMEX

BitMEX is a cryptocurrency derivatives exchange that uses high leverage and margin trading and is open to many non-U.S. citizens. They have were the highest volume exchange in the 2018 bear market, although up-and-coming exchanges like FTX and Binance Futures have given BitMEX a run for their money in recent years.

Save on BitMEX Fees with our code: Get a 10% discount on trading fees for your first six months of trading when you use the following BitMEX referral link https://www.bitmex.com/register/7rnV63.

BitMEX lets you (assuming you are from the U.K., Japan, etc… or use a VPN) long or short some of the top cryptos using 1x – 100x leverage (the option differs by crypto).

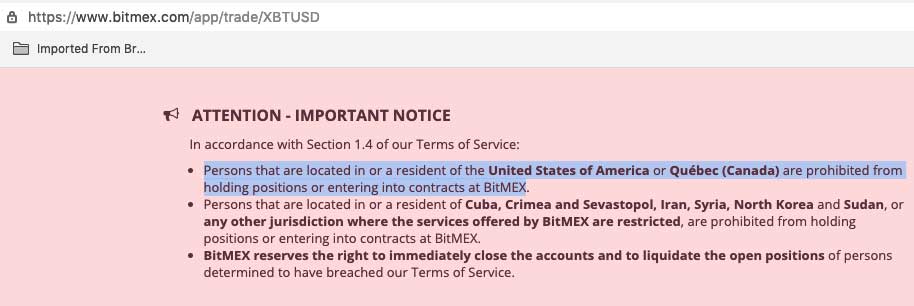

You can’t use Bitmex in the US, they can close your account if you do… but like, people do anyways using a VPN.

In other words, you can use BitMEX to hedge, you can use BitMEX as a high octane casino, and/or anything in between… but you need to double-check the rules in your country before you use it (for example, if you live in the US, you aren’t supposed to use it).

With Bitcoin on BitMEX specifically, you buy contracts and each contract is worth the equivalent of roughly $1 USD or 1 coin (see contract value per coin on the site; it differs by coin).

Contracts are bought using Bitcoin, and you are paid out in Bitcoin, meaning you need to leverage your bids against Bitcoin. This means you use Bitcoin to short ADA, to long XRP, to long ETH, to short ETH, etc (you use Bitcoin for everything on BitMEX).

In simple terms it works like this, 1. you bet x Bitcoin to buy y contracts betting that a given coin will go up or down, 2. you fund your position and choose your leverage to determine your liquidation price, 3. you choose a stop price (to avoid liquidation if the trade goes against you), and 4. you pray.

If you are profitable you can close the position at any point and then get the money equivalent to the contracts owned, minus fees, back in Bitcoin.

Likewise, you can close the position manually at a loss or let your stop hit at a loss if the trade goes against you.

So, to hedge at BitMEX, you might do something like this:

- Buy $1,000 worth of Bitcoin on Coinbase.

- Put $100 worth of Bitcoin short on BitMEX at 1x – 3x.

- Sell your long position and close your short if it goes down to cover costs.

- Close your short position and sell your long position if it goes up to take profit on your long.

That being one of many examples of how to use leverage “the right way.”

To gamble like a drunken sailor on BitMEX, you might do something like this:

- Try to time the bottom to recoup losses from 2018 bear market.

- Stake way too much Bitcoin at 100x long with no stop price and a liquidation price dangerously close to local support.

- Get liquidated and have no money for the next cycle.

- Make the list at BitMEX Rekt (feel free to screenshot that).

- Double down on that sort of thing until you literally have no money left.

- Post about it on Reddit.

- Explain to the federal government how you don’t have the money to pay your taxes because you lost it all using a VPN to margin trade on a site banned in the U.S..

Really, your options are endless if you live in a country that allows BitMEX trading. Some choices are better life choices than others, but like, BitMEX is a platform, not your Gamblers Anonymous sponsor.

For those not wanting to enter such an extreme environment as BitMEX, keep in mind that Kraken, Bitfinex, and a few other exchanges also allow you to short using leverage (although no other exchange offers the fabled 100x) and CBOE and CME futures also perform most of the same functions when it comes to BTC.

Bottomline: BitMEX is great for those with skill and self-control, especially those who live in countries where accessing BitMEX isn’t questionable. However, BitMEX is notoriously dangerous, so proceed with caution.

TIP: On BitMEX you owe fees on the total amount after leverage. If you 10x and double your money, you owe about 10% of that in fees for example. So make sure to take fees into account. Also, see the related: BitMEX Co-Founder Becomes Britain’s First Bitcoin Billionaire.

WARNING: It can be confusing with BitMEX being popular and Author Hayes being on TV all the time, but you still have to be careful about using BitMEX and promoting it as a US citizen. One could argue that it isn’t legal for US citizens to give out BitMEX referral codes. So, do consider the implications of BitMEX and paid BitMEX promotion (you’ll note you won’t find a referral link or ad for BitMEX on our site). It is a grey area, I haven’t heard of anyone getting in trouble for using or promoting BitMEX, but like, that doesn’t mean it isn’t on the table for the future.

“Disgorgement” is a legal remedy where someone has to pay back money they made illegally: they’re “disgorged” of their ill-gotten gains.

For example, if a US citizen takes referral fees for sending investors to an unsanctioned futures broker, they may have to pay “disgorgement.”

— Jake Chervinsky (@jchervinsky) November 13, 2018

NOTE: see A Quick Starter Guide to Leveraged Trading at BitMEX for some tips and tricks on using BitMEX. For a video, see this BitMEX Leverage Trading Introduction for Beginners.

"BitMEX" contains information about the following Cryptocurrencies:

Bitcoin (BTC), Bitcoin Cash (BCH) + Bitcoin SV (BSV), Cardano (ADA), Litecoin (LTC), Ripple (XRP), Tron (TRX)