Uniswap

Uniswap is a DEX that has become increasingly popular due to the DeFi boom of 2020 due to its ability to swap a wide array of Ethereum-based tokens.

Choose the tokens you want to swap, click the connect wallet button to connect a web3 wallet like Metamask, input the amount you want to swap, and then hit swap.

The tokens will be swapped based on a liquidity matching algorithm (an automated market maker (AMM) protocol) that native and unique to Uniswap, but the gist is it works like any other exchange for the end-user when doing simple transactions.

If you are trading a market that is quickly moving, try adjusting slippage to avoid failed transactions (those can be costly and annoying).

With that covered, you can also use Uniswap to buy tokens that aren’t listed. You can input any token address, and if it has a liquidity pool, you can swap it.

TIP: You can swap some tokens that don’t have a trading pair using Uniswap. To do this, Uniswap will make multiple trades to get you the trade you want. For example, to buy a coin with Dai that only has an ETH pair, Uniswap might trade into WETH first.

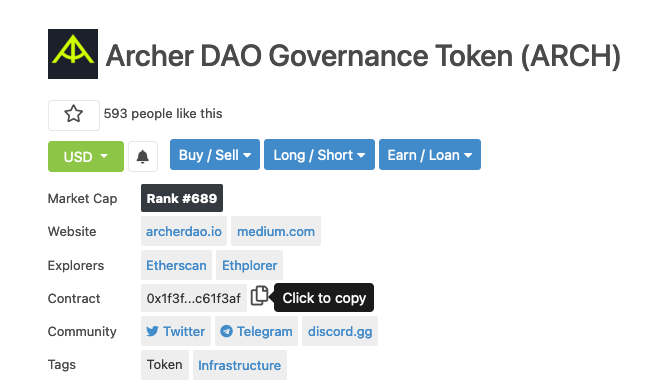

TIP: You can find a token’s contract address on EtherScan, Coingecko, their Github, etc. Coingecko is a good choice since they will typically list legit projects and provide a clickable Uniswap pair on screen (you can for sure end up with a copycat address if you aren’t careful with where you find your contract address; take a moment to make sure you have the right coin).

The biggest use case of Uniswap for the average person is that you can swap a really wide array of ETH-based token on it (in cases long before they would ever be listed), the big drawback is that exchanges like this can charge high fees as they have to execute more than one contract to work (and each contract costs gas to execute).

Providing Liquidity (and Yield Farming): Not only can you buy and sell on Uniswap, you can also get paid to provide liquidity. Providing liquidity means putting up both pairs of a trading pair at a 1:1 ratio and then having rights to an equivalent percentage of the pool that you can redeem at any time. Providing liquidity, along with staking, is the basis of Yield Farming. There are complexities and risks to providing liquidity, but that is the gist. For more on this, check out Binance Academy’s “What is Uniswap and How does it work” article (don’t forget to read about impermanent loss).

The Risks of DeFi and Uniswap: Uniswap has led to many new ico-ish coins coming out which are launching through Uniswap (especially true for DeFi coins). These of course are incredibly risky, but this isn’t an article on risk management, this is an article on how to use Uniswap. If you are new to crypto, consider it a rule-of-thumb that Uniswap is for trading established ETH tokens and moonshots and that buying the latest new Uniswap “gem” is a risky game. 🦄

UniSwap Tutorial 2020: How to Use UniSwap Decentralised Exchange & Liquidity Pools."Uniswap" contains information about the following Cryptocurrencies:

Ethereum (ETH), Uniswap (UNI)