Inverted Head and Shoulders Plays Out as BTC Sees Price Spike

Inverted Head and Shoulders Plays… but There is A lot More Going on than That

Bitcoin (BTC) saw a nice price spike today (perhaps in part because CBOE futures settle tomorrow). This spike completed an inverted head and shoulders pattern that was forming. It also potentially caused a small short squeeze as shorts had to cover positions (see BTCUSDShorts).

Back to the pattern, an inverted head and shoulders is a bullish reversal pattern. Patterns don’t always play out (to say the least), and when they do their outcome doesn’t always hold, but in this case the pattern has played out so far. When they do play out, it can be helpful to analyze them in retrospect to see what happened and why.

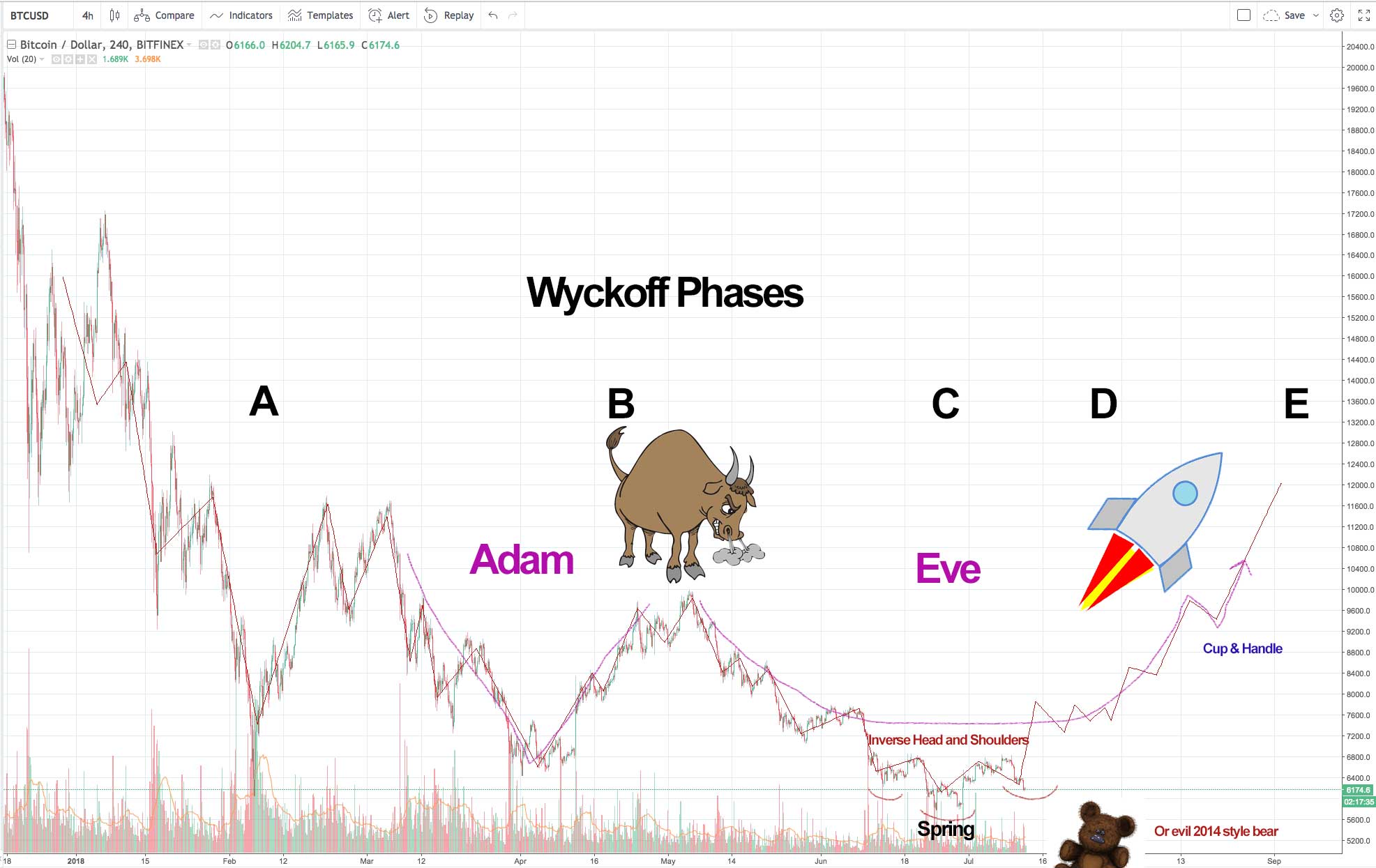

I wrote about this potential forming back on July 12th and showed how if this pattern played out it could jumpstart a bigger move (the image above illustrates in one chart what is explained in those links).

So far so good on the bigger pattern, but there is clearly a long way to go before we can look back and say “that worked, or that didn’t work.” It is really all a matter of probability (never certainty).

To be clear, the idea here isn’t to make predictions or offer investing advice, it is instead to provide some insight into how patterns form and play out in cryptocurrency (pattern recognition is important in crypto trading, perhaps even more than other markets, because price action relies so heavily on speculation).

Right now Bitcoin has made a 10%+ jump from $6.8k to $7.4k while most alts are at around 6%+ (aka 4% losses against BTC). For a short term bull trend to be in play we would really want to see alts heat up and cause excitement across the board.

In April we didn’t just see a big green candle and short squeeze for Bitcoin, we saw alts heat up before that move and then saw most coins run together. This current price action is nice from a bullish perspective, but it doesn’t have the “oomph” April did.

To fully break out of the bear trend of 2018 and to start a new bull trend it will take a lot more than an afternoon of Bitcoin running. Bitcoin will need to hold its ground (roughly hold above $7k) and continue to make headway (ideally past resistance at the $7.8k level).

Of course there are no hard and fast rules here. Bitcoin could run solo (like it did in Sept – Oct), alts could lag behind Bitcoin for a substantial amount of time, or all coins could fall back down only to find another way out of the $6k zone later on… or, you know, not.

For now the moves are fresh and the market needs time to find its footing (which means finding a place to trade sideways most likely).

Meanwhile, the price action in Bitcoin and alts over the next few days will help decide the next phase.

If Bitcoin holds its ground or makes gains, and if alts heat up, there will be many reasons to be excited as an investor. If Bitcoin can’t hold, it is a mixed bag, it could be great for shorts (as a move down from $7.4k to $6.8k is just as nice for shorts as $6.8k to $7.4k for longs), but on the other side it at least gives a hint that Bitcoin once again… isn’t dead.

A dead cat may bounce, but a dead cat does not generally trade in range for 5 weeks, finding support over and over, only to make 10% gains in one day. That is more like what Lions do. Roar. ?