How to Get the Best APY in Crypto

Best Ways to Earn Interest on Crypto

Farming, staking, lending, and interest accounts are some of the best ways to earn interest on crypto. Interest rates of 5% – 10% are common. And that is just for single assets including BTC, ETH, and stables.

Meanwhile, you can earn 20% or more on asset pairs, and if you really want to go risk on, you can find farms offering hundreds or even thousands of percentage points a year.

Some of the best choices of platforms for crypto Annual Percentage Yield (APY) include BlockFi (interest account), Crypto.com (staking), Balancer (providing liquidity), Yearn (farming), and FTX (lending). Many of these platforms offer more than one method of bearing interest. With that said, these are far from the only choices. Below we will list out some of the best choices for earning interest on your crypto.

IMPORTANT NOTES AND RISKS: Each platform will have a range of coins you can earn a yield on, we use BTC, USDC, USDT, and/or ETH examples. Many platforms pay the yield in the coin you stake. Some platforms require you to hold their token to get the max yield. Some platforms offer lower yields on larger amounts. Some platforms have lockup periods. In general, yields are subject to change (the example yields below are as of Aug 3 2021). Using DEXs can mean needing to wrap coins. Farming and liquidity providing generally require you to deal with more than one coin and thus this method is subject to impermeant loss. DeFi generally means paying high gas fees (Ethereum) or taking on more contract risk (other platforms). Keep in mind gas fees are generally high when price is volatile, and trying to move quickly can eat into gains from yields. All Decentralized Platforms are subject to contract risk, while Centralized Exchange (CEX) platforms are subject to platform risk. Lastly, interest and liquidity providing have tax implications, as this money is income.

Yield Bearing Crypto Interest Accounts

Yield-bearing interest accounts like NEXO and BlockFi are centralized platforms that lend your crypto and offer you interest in return. The benefit of these platforms is that they pay high yields for single assets and don’t require you to use a decentralized service. The drawback of these services is that they aren’t full exchanges and may have limitations for withdrawing and higher spreads or fees for swapping than traditional exchanges. This can in theory make it hard to quickly buy or sell with the crypto you are staking. Here are two examples of top yield-bearing platforms.

BlockFi Yield: BTC (Tier 1) 0 – 0.25 BTC 4% BTC | (Tier 2) 0.25 – 5 BTC 1.5% BTC | (Tier 3) > 5 BTC 0.25% NOTE: The more you deposit, the less your BTC earns.

NEXO Yield: BTC 6% without NEXO | 8% With NEXO token

Staking Crypto For Yields

You can stake on DeFi, on centralized platforms, or directly through some crypto projects. There are many options for single asset staking on DeFi (see a list of all staking coins) and most exchanges have staking options. We’ll list a few examples below.

ZRX Yield: ETH 4%

Coinbase Yield: ETH 5%, USDC 6% (not live yet)

Binance Yield: BTC 7%, ETH 4.9% – 21.6%

Crypto.com: BTC 8.5%, ETH 8.5%, USDC 14%

Yearn Yeild: USDC 4%

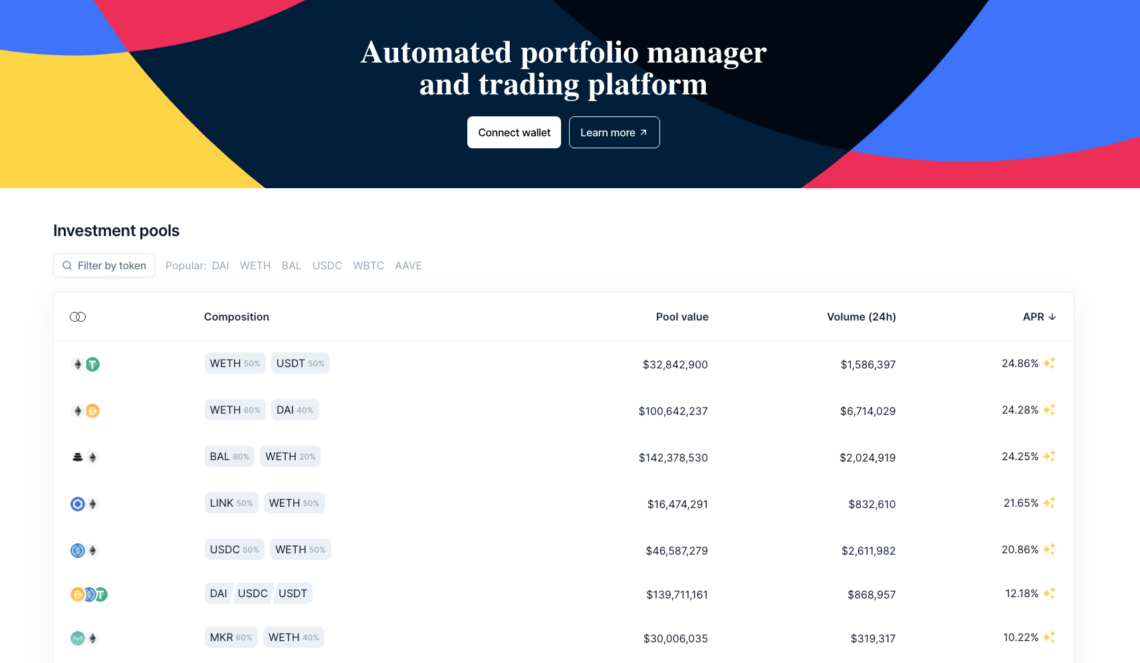

Providing Liquidity for Crypto

On Ethereum markets are generally made by Automated Market Making protocols, for example, UniSwap, SushiSwap, and Balancer. On these platforms, you put up both sides of a trading pair along with others in a pool, and then those assets are used to provide liquidity for traders using the Decentralized Exchange. In return for this, you get a trading fee that is shared by the pool. The risk here is a deviation in price that causes impermanent loss that exceeds the gains from trading fees. Make sure to find the best pools now, the best pools change!

SushiSwap Yield: WBTC/WETH 2.5%

Balancer Yield: WBTC/WETH 9%

Farming Crypto

Farming is a general term that sometimes describes staking and providing liquidity, but more specifically means getting additional rewards for staked and LP tokens. A farmer will generally chase the best yields or will use strategies that chase yields for them. This can earn not only what one gets from staking and LPing, but also from the extra fees and governance tokens they get for putting their staked and LP tokens on a specific platform. Farming opportunities and strategies change, but platforms like Yearn and Harvest can help you capture opportunities. These options are especially good for Curve stable pools (Curve strategies).

Harvest Yield: CRV:TriCrypto 20%

Yearn Yield: yveCRV 17.43%

TIP: You can also look into crazy yields like the ones on PandaSwap, which currently offers over 2,000% APY as of Aug 2021. High-risk yields on Polygon and Binance Chain tend to be very high risk, but those big yields are out there.

Lending Crypto

When you put your money in BlockFi they gain a yield by margin lending. You can actually margin lend yourself. To lend you must enable margin on your account on centralized platforms. On decentralized platforms, you simply need to connect your wallet. Please be aware you have to adjust your lending rates on some platforms. If your rate isn’t competitive enough, your crypto may not be lent (this is the benefit to using services like BlockFi who will do it for you).

FTX Yield: BTC 10%

AAVE Yield: DAI 2.7%

Compound Yield: USDC 1.28%