CoinDesk Consensus: Invest is Happening (Watch it Live)

CoinDesk’s Consensus: Invest conference is happening and you can watch it live at CoinDesk.

CoinDesk’s Consensus: Invest conference is happening and you can watch it live at CoinDesk.

VanEck’s ETF might be in limbo with the SEC, but they are moving forward with crypto by partnering with NASDAQ to “bring a regulated crypto 2.0 futures-type contract” to the market.

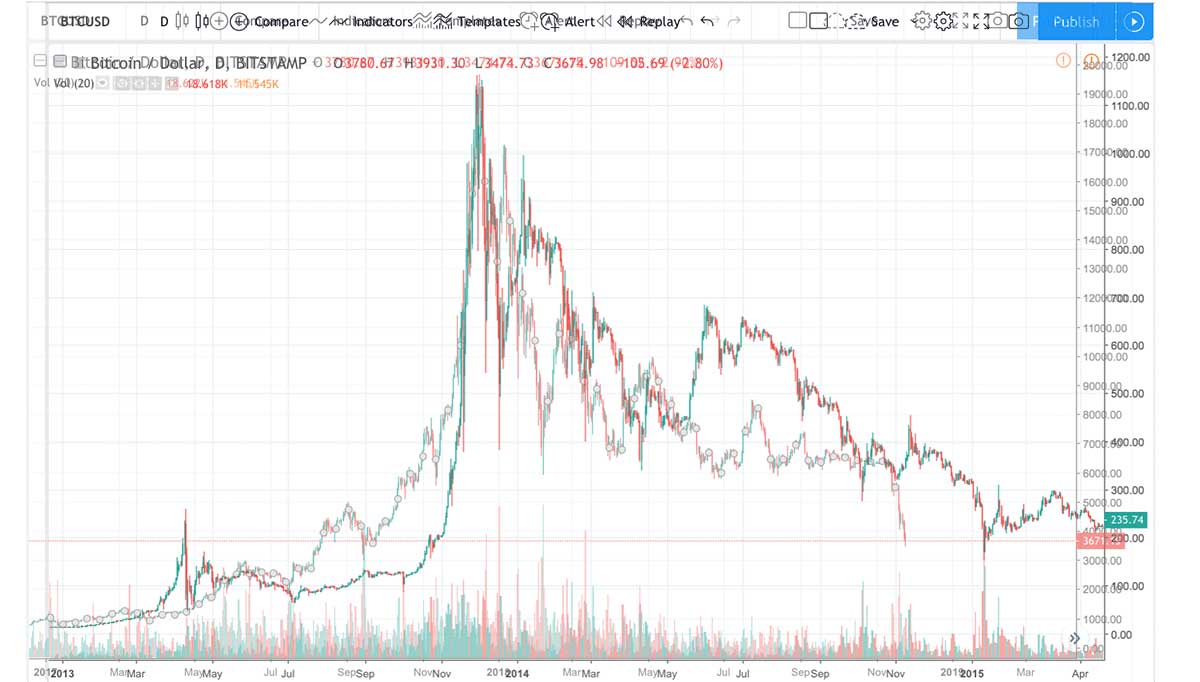

The decline in the total market cap of all crypto in 2018 from peak to low is actually bigger than in 2014. Not just in dollar amount, but in the percentage dropped.

Coinbase Wallet (an Ethereum wallet / DApp browser) now supports Ethereum Classic.

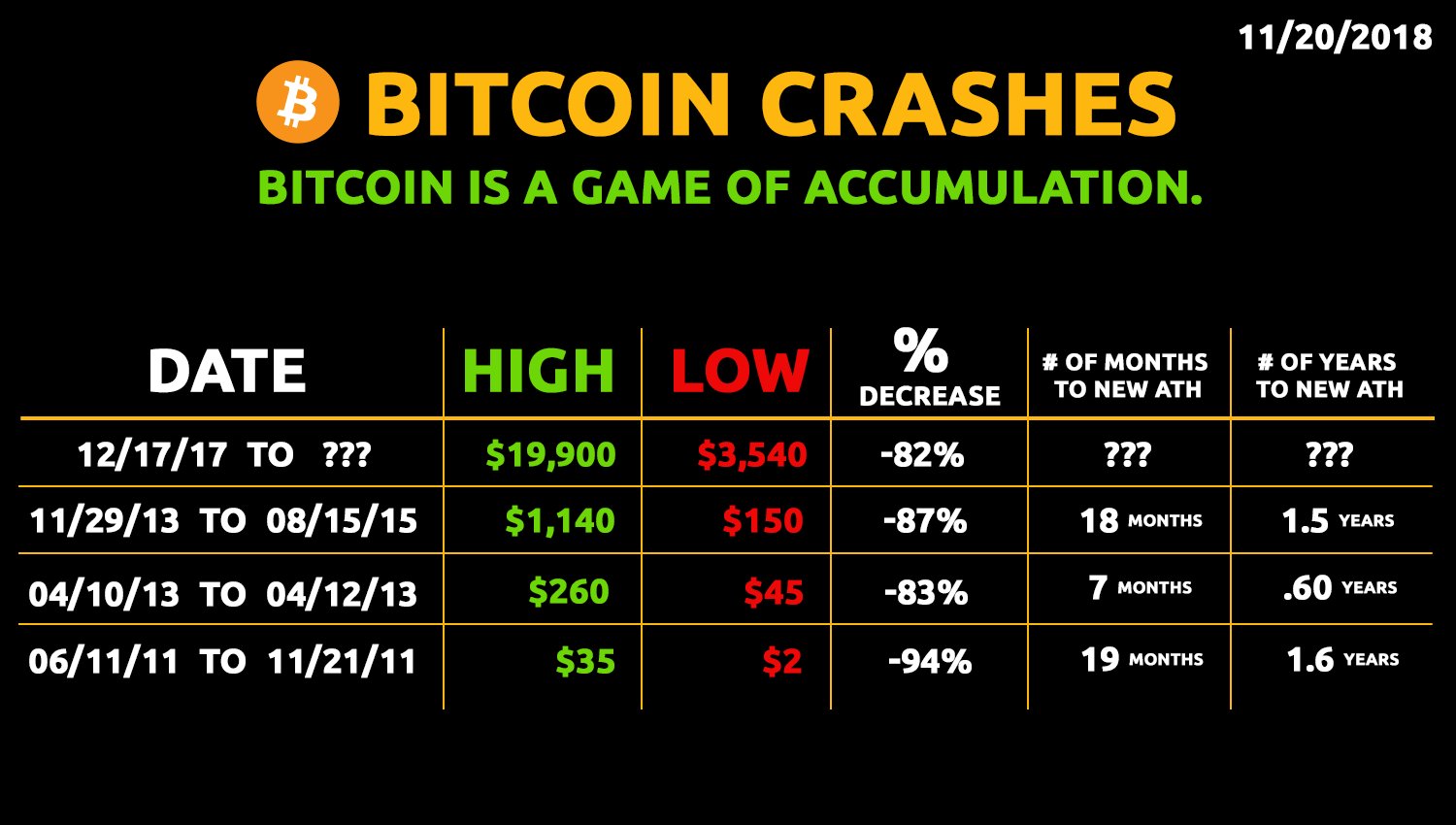

This isn’t the first major crypto bubble that started with a media blitz and ended with heavy losses for bag holders.

If you bought the top of the 2017 – 2018 crypto market, you could be down 80% – 99.9% depending on what you bought. That is rough, but you have options.

The SEC’s Hester Peirce did an interview with Peter McCormack of “What Bitcoin Did” where she discusses crypto regulations.

Bitcoin SV (a Bitcoin Cash fork) is regaining ground against Bitcoin Cash. This is a set up for a great outcome where SV shows strength, but not at the expense of Bitcoin Cash.

Here is Bitcoin’s 2018 bubble overlaid on top of the 2014 bubble. Below you’ll find a chart that looks at the crypto market caps from this time period as well.

Calvin Ayre and CoinGeek are proposing a clean split between Bitcoin Cash ABC and Bitcoin SV to end the hash war.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.