Major Crypto Correction

For reasons that aren’t fully clear, but likely relate back to the recent alt boom and South Korea news, cryptocurrency entered a correction period.[1]

This correction, which had been building slowly for over a week, ramped up Monday night (Jan 15) as the market cap of crypto dropped by $100 billion and BTC and most coins hit recent lows. The correction then continued over the course of days with alts dropping relative to BTC, and BTC itself dropping all the way down past $10k!

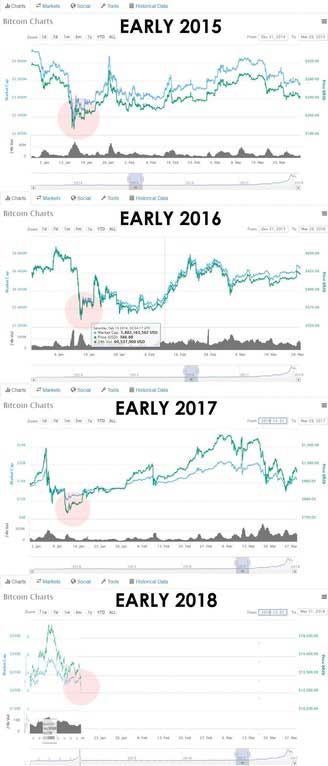

This was panic inducing, especially for new investors who had just recently “bought the top,” however it was almost standard fare for cryptocurrency in general, and somewhat expected for this time of the year (I mean, just look at the comparison of Bitcoin charts from January of each year below; clearly there is a pattern here).

Cryptocurrency loves patterns. One pattern to note is the January correction. This set of charts has been shared across the internet, it tells an important story. Moral of that story: Don’t panic!

If history is an indicator the pain won’t last long, that is if it is like any period other than late 2013 – 2016 this could be seen as a chance at buying low. However, if we get another long bear market like we saw after the Silk Road… then it is a different story.

Still, when we look at the facts behind the panic, its hard to think that “the bubble has popped” and “we are entering a bear market” and easier to think “this is just a healthy correction, intensified by a string of bad news and some panicked new investors.”

It is likely that we will see a recovery, and that this is just being spurred on by profit taking after the last alt boom and recent negative news about South Korea regulations (and other such bad news and talk of regulations encircling the internet).

With the above said, here are some factors that intensified the expected correction:

- South Korean exchanges being taken off Coinmarket cap (it made it look like prices dropped).

- Word of South Korea banning exchanges (they are a major player in the global crypto market).

- Word of China cracking down on crypto (in terms of cracking down on miners and more).

- Bitconnect shutting down its exchange (they were accused of being a Ponzi, and everyone’s worst fears came true when they shut down their exchange and the price of Bitconnect tokens dropped by 90%).

- New investors who jumped into BTC and alts for a quick buck were perhaps over eager to “stop their losses” and ill prepared to hold through the deep corrections that are common to crypto.

- Bitconnect and alts had just made such epic gains that a correction was expected.

- Bitcoin futures trading potentially had some adverse effects over the past month (or at least helped cause downward pressure on btc).

- Crypto tends to correct every January around this time (see graphic above).

- Some big names like Warren Buffet and from Wells Fargo CEO Dick Kovacevich came out against cryptocurrency.

- Legend has it that the Chinese sell off all their crypto assets each year in January in anticipation of “Chinese Spring Festival.” The idea being that they aren’t supposed to trade or gamble, but are supposed to buys gifts for friends and family (but wait; wouldn’t they buy their friend crypto with crypto?!… anyways). Supposedly this is part of the reason crypto seems to dip every January. They even notably close the stock markets during Spring Festvial. With all that said, while this theory made sense last year, when the Festival started January 28, it makes less sense this year as it starts February 16 (note that the eve of the first day is celebrated). Perhaps though this will or did contribute to the current mods of the market.

- The media was eager to play into fears to drum up headlines, and everyone on social media kept pointing to $6k and $8k support levels for Bitcoin.

NOTE: Since then. A major Japanese exchange was hacked and over $500 million worth of NEM was stolen. There was Tether FUD. Everyone thought India made crypto illegal (but actually they said nothing has changed and clarified that crypto wasn’t legal tender; AKA you can’t pay your taxes with it). Facebook banned crypto ads. Umm, just lots and lots of bad news piled up and people stopped reacting to good news (there has been a nice chunk of that too). The end result is Bitcoin kept on correcting into the $8ks, around where it was before the last run, as predicted by many…. and it took most other cryptos with it.

All of this in tandem really took crypto for a ride, and we saw one of those fabled 50%+ corrections (I’ve lived through many of these, they are real, they happen, and you must hold through them or buy quickly after to be a crypto investor… no way around it!).

Keeping in mind that we don’t know how long the correction will last, and we don’t know if we will see a few small recoveries in between (as I update this article on Jan 19th I can see we are either seeing a temporary recovery or the start of a full recovery), here are a few words of general wisdom (but not a directive on how or when to buy or sell):

Historically it has been effective to buy the dip (small average buys with your extra funds to buy down to low supports like $10k and $8k btc), don’t panic sell (hold), but most of all don’t spend more than you can afford to sit on for years / lose. If you don’t overextend, then you don’t have to panic, if you buy the dip, you enjoy the recovery, if you hold, you get to ride the next wave whenever it may come.

If you do the above, then you can choose to recoup some profits on the bounce, or you can hold and wait out the correction. As long as you don’t panic sell, you should be fine.

Historically crypto has been on a gradual upward trend despite some really difficult times. Thus, we have to hope history keeps its course. It is likely this is like September where (following a quick rise to new highs) the China FUD caused a correction (and Jamie Dimon didn’t help) and temporary bear market, but that of course is speculation.

Still, South Korea FUD plus Dick Kovacevich, and following a quick rise to new highs for crypto, just seems to familiar to panic over.

There is no way to know what comes next, but one has to assume regulation talks in South Korea won’t be enough to end the global crypto market for good. Thus one might want to think twice before giving up. Instead, this could be an excellent time to slowly and gradually build positions for the next wave. Mistiming the bottom a little might be stressful, but I promise you it will be more rewarding than FOMO buying the top filled with regret months down the road 😉

This is to say, as the sagely McAfee once tweeted, “don’t panic; buy the …. dip.”

- Why we won’t have a long term bear market, and how to systematically pick your future investments in crypto. Reddit.com. <—- excellent Reddit article that I essentially agree with on most points if not every point.