We are Still in a Bear Market For Bitcoin (Dec 2018)

We have been in a bear market for Bitcoin for nearly all of 2018. For that not to be true it’ll take a serious change in price action.

In other words, although some bulls are full of hope based on long term trends, traders are as always full of big reactions and even bigger opinions based on small moves, and the media and social media full of noise…. the reality of our world is much simpler than one might think.

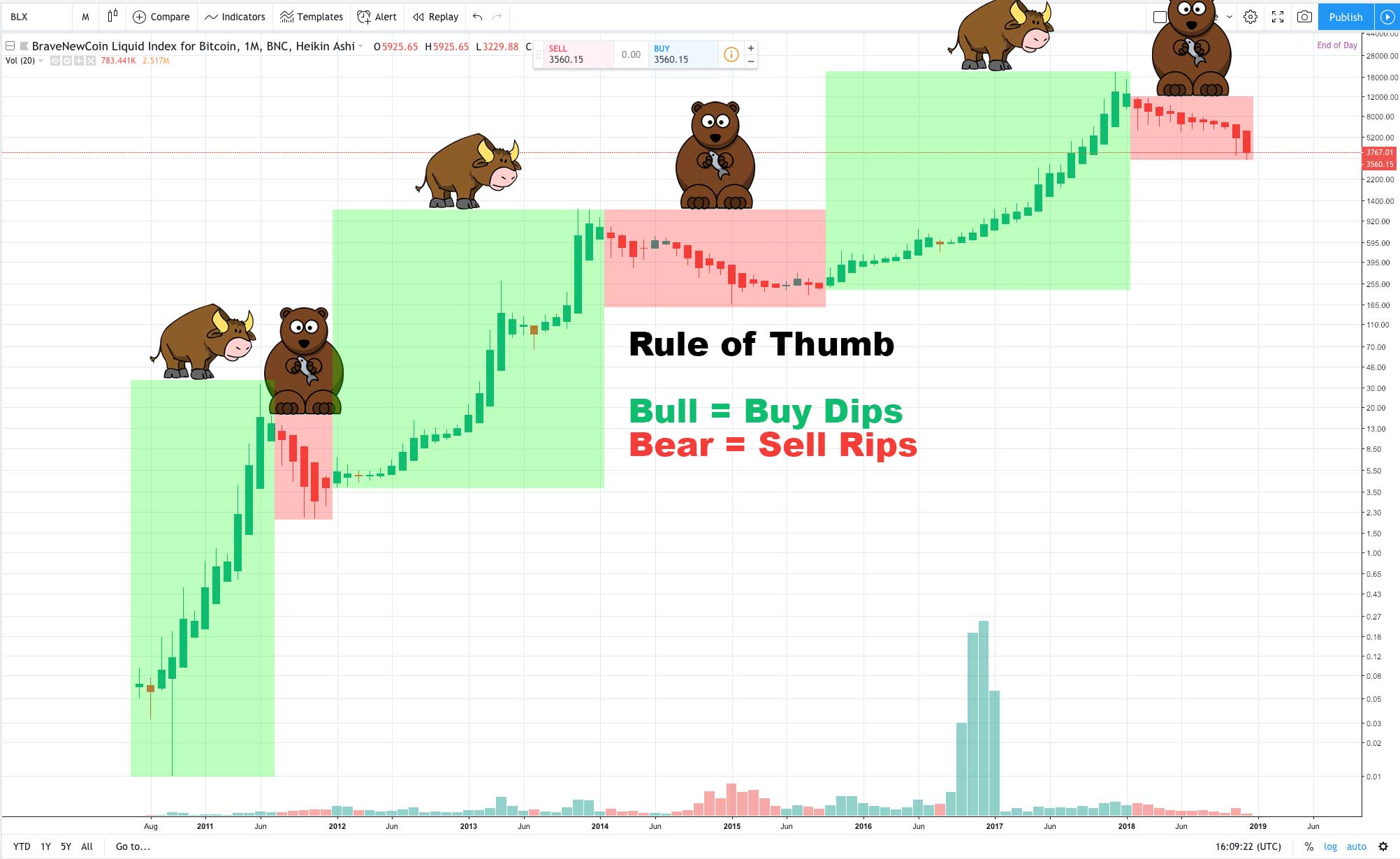

From a simple and zoomed out frame, all of 2018 has been a bear, and it is still a bear (just like all of 2016 – 2017 was a bull), and that really tells us nothing about our future other than “the trend is our friend” and thus we should expect more bear for now.

As a rule of thumb: in a bull market, you can get away with buying the dips and HODLing aggressively. However, in a bear market, you’ll either want to be cautiously accumulating, sitting in cash, or going short. <—- which one you do is a matter of personal tastes, goals, and strategy; I’m just point out basic logic here.

Now really isn’t the time for believing “X price must hold” or “Y price is the lowest we can go”… it is the time for looking at the chart and thinking, “yep, still a bear market, so given that, ‘what is my move?'”

Maybe your move is going all in, maybe it is going 100% to cash and doing something else with your time… maybe it is learning about mining and programing smart contracts and taking a reasonable position in crypto for the future… I don’t know, as long as you know it’s a bear market, that is totally your call as a person what you do with that information.

Really, the point of this article is only to point out that obvious, that is: We are in a downtrend.

There is no magic wand that can turn an ugly downtrend into an uptrend. The best we can hope for is for the sell pressure to stop and give way to stagnation (like in 2015) or for a fundamental change that brings back the bulls and takes out the bears sharply reversing the trend (a bit like the bottom of 2015).

For now, no amount of hopium can save us. It is matter of having time and patience.

Click here to learn more about bull markets vs. bear markets.