BTC Hitting Oct 2017 Support, GBTC Hitting Sept Support

BTC is hitting Oct 2017 support. That support has been holding well since Feb 2018. GBTC is hitting Sept 2017 support. That support hasn’t been tested since Sept 2017.

This section covers cryptocurrency ETFs, ETNs, trusts, funds, and other such products. For example, this section includes GBTC.

NOTE: The Bitcoin Investment Trust (GBTC) is a trust that holds Bitcoin. Shares of the trust can be purchased on the stock market. The trust holds about 170,000 bitcoins. Each share represents about .092 bitcoins (so if you own 10 shares, you own contracts that represent just under 1 bitcoin). In other words, GBTC isn’t a cryptocurrency. Instead, it represents ownership of a cryptocurrency held in a trust by the Greyscale investments.

BTC is hitting Oct 2017 support. That support has been holding well since Feb 2018. GBTC is hitting Sept 2017 support. That support hasn’t been tested since Sept 2017.

The SEC’s decision on the Bitcoin ETF from Van Eck Securities Corp. and SolidX Management is postponed while the SEC requests another round of comments from the public. The exact decision date isn’t clear, but essentially it is 21 days for comments from Sept 20th (when the order was published in the Federal Register), 35 days for rebuttals from that date, and then with that information another decision has to be made.

Anyone following the hype surrounding Bakkt is probably trying to figure out exactly what, “physically delivered Bitcoin futures contracts” are. The answer: Just what they sounds like.

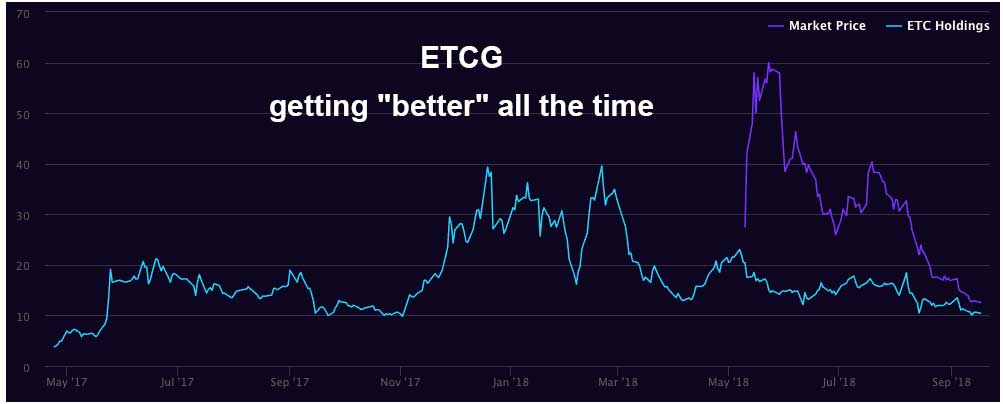

The premiums on GBTC and ETCG just keep getting lower and lower as the crypto bear market drags on. If crypto recovers, finding the bottom of these could be epic.

The SEC has halted traded on Bitcoin Tracker One (“CXBTF”) and Ether Tracker One (“CETHF”) until September 20th.

Bear market aside, Bakkt, Coinbase Custody, and Coinbase Wallet are a few examples of products helping to bring cryptocurrency mainstream. In simple terms, these three products are kind of a big deal and could have a major positive effect on the cryptocurrency space in the coming months.

The Ethereum Classic Investment Trust (ETCG) is an investment product by Grayscale which gives investors and traders exposure to Ethereum Classic (ETC).

After rallying over Bitcoin ETF hopes in July, and then crashing over ETF fears in August, the market didn’t even flinch as the SEC rejected 9 Bitcoin ETFs at once on August 22nd.

The SEC must approve or deny two Proshares Bitcoin ETFs this week. The deadline is Thursday the 23rd, they cannot extend the decision. This isn’t great timing considering the price of Bitcoin, recent ETF drama, and the SEC’s history of denials…. or is it?!

A Swedish Bitcoin Exchange Traded Note (ETN) called Bitcoin Tracker One (CXBTF) can now be invested in via some US markets. Check with your broker/exchange to see if the product is offered.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.