Ethereum Rallies Toward All-Time High

Ethereum (ETH) has rallied toward its all-time high, and some signs point to a break of the all-time high.

This section covers cryptocurrency ETFs, ETNs, trusts, funds, and other such products. For example, this section includes GBTC.

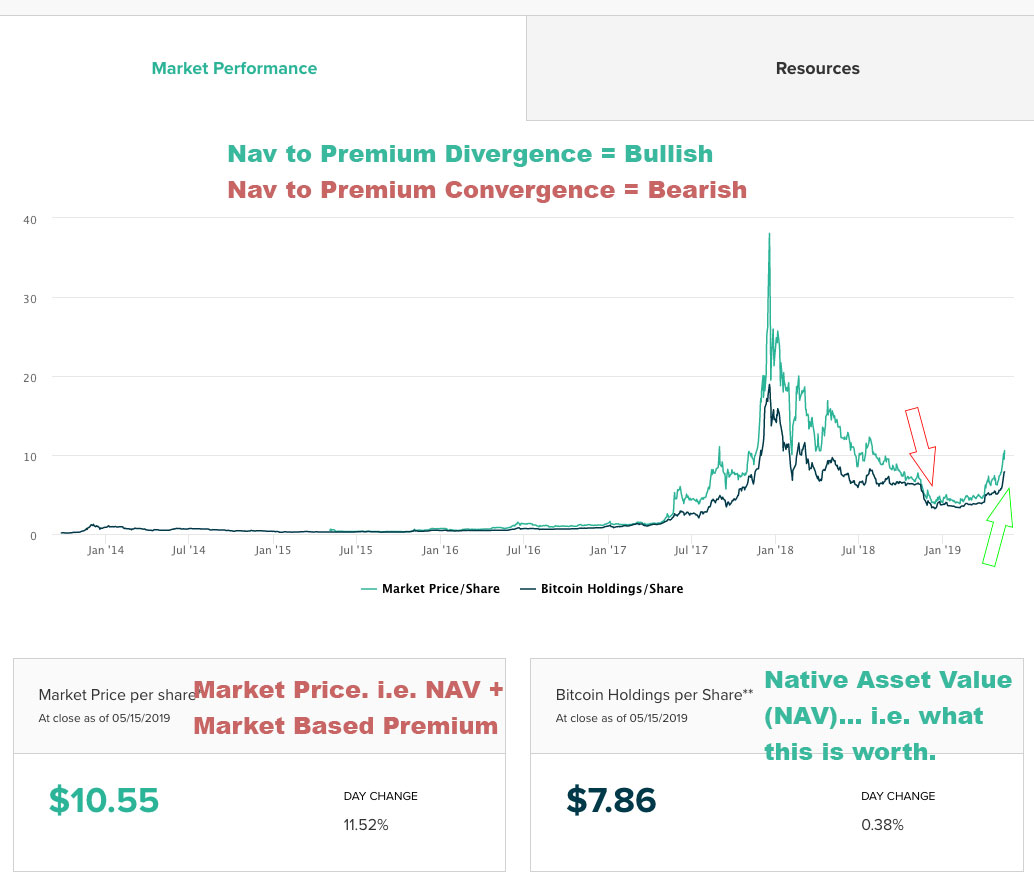

NOTE: The Bitcoin Investment Trust (GBTC) is a trust that holds Bitcoin. Shares of the trust can be purchased on the stock market. The trust holds about 170,000 bitcoins. Each share represents about .092 bitcoins (so if you own 10 shares, you own contracts that represent just under 1 bitcoin). In other words, GBTC isn’t a cryptocurrency. Instead, it represents ownership of a cryptocurrency held in a trust by the Greyscale investments.

Ethereum (ETH) has rallied toward its all-time high, and some signs point to a break of the all-time high.

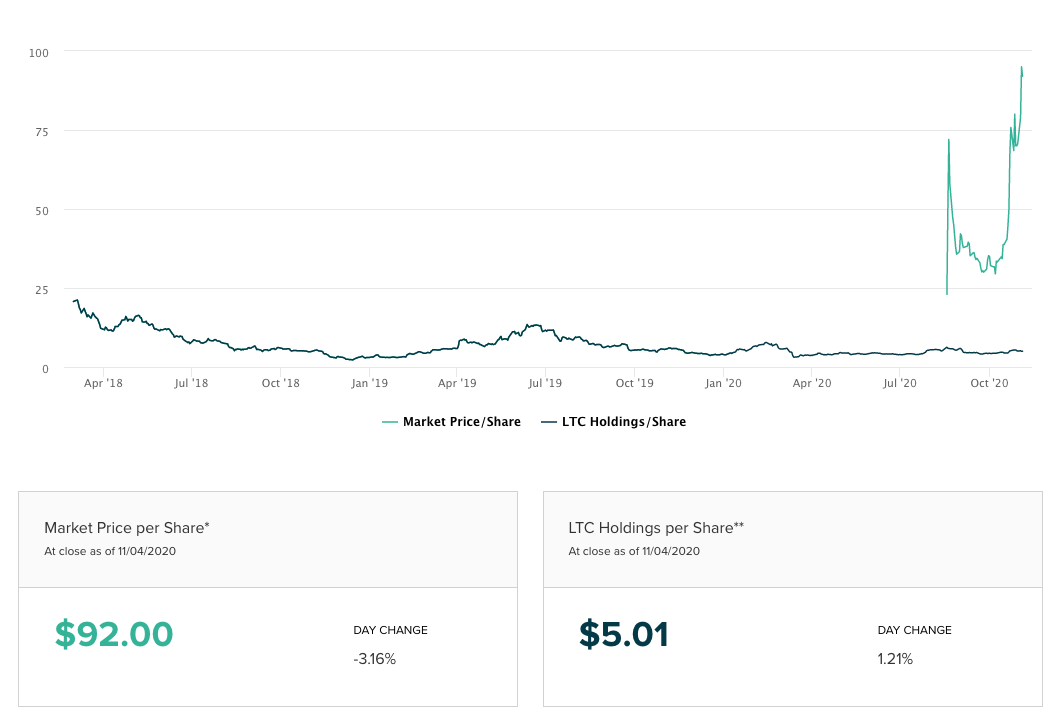

LTCN is trading like Litecoin is worth 20 times what it is worth. LTC is currently worth $60, while LTCN is trading like Litecoin is worth about $1,380.

Litecoin and Bitcoin Cash trusts, LTCN and BCHG respectively, are both trading at about 10x premiums. Meaning they are trading for about 10x what they are worth.

Both LTCN (Litecoin trust) and BCHG (Bitcoin Cash trust) launched with absurd premiums.

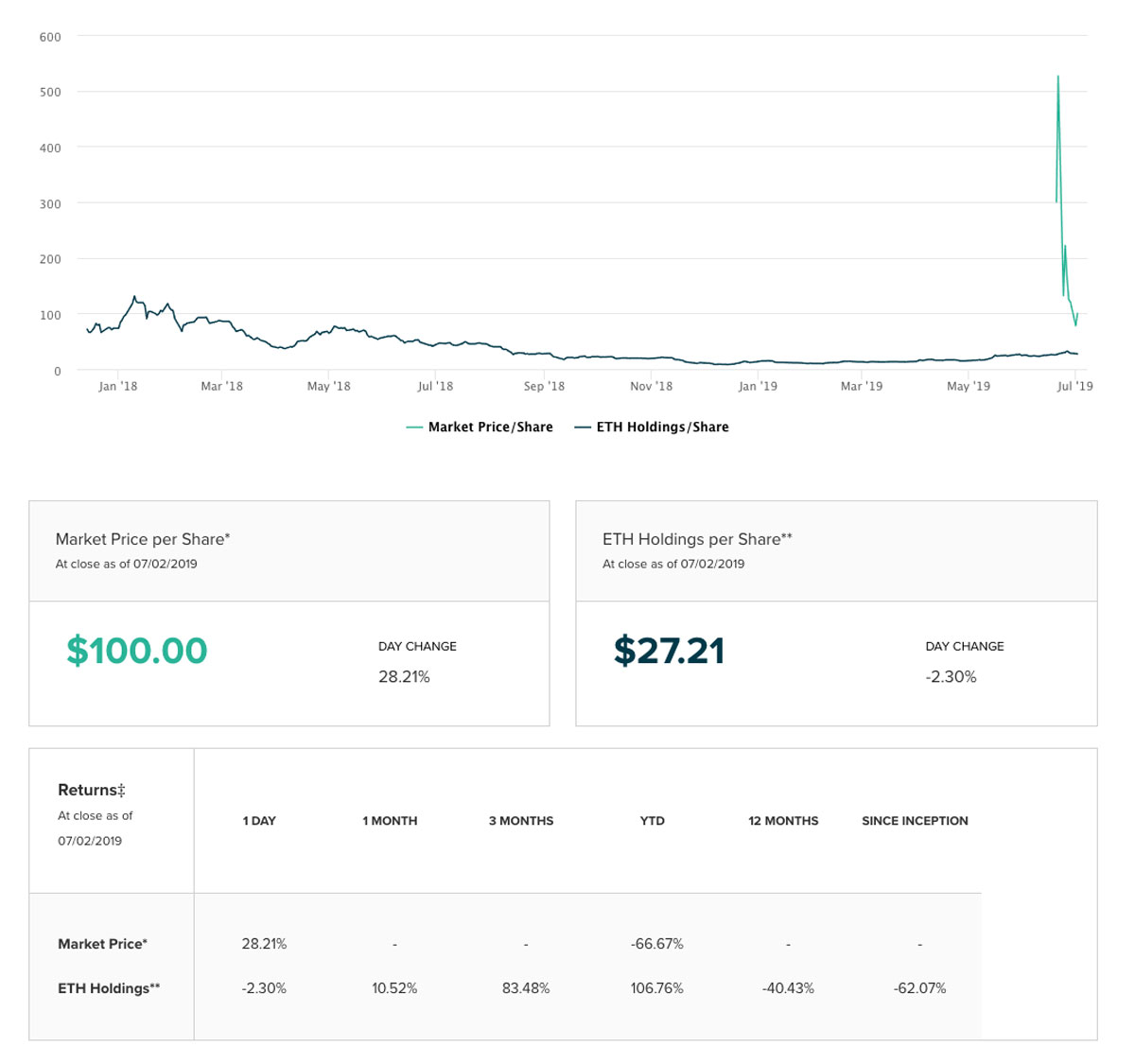

The Ethereum Investment Trust (ETHE) is an investment product by Grayscale which gives investors and traders exposure to Ethereum (ETH).

The Block has revealed all of the partners of “Project Libera” (the code name of Facebook’s crypto).

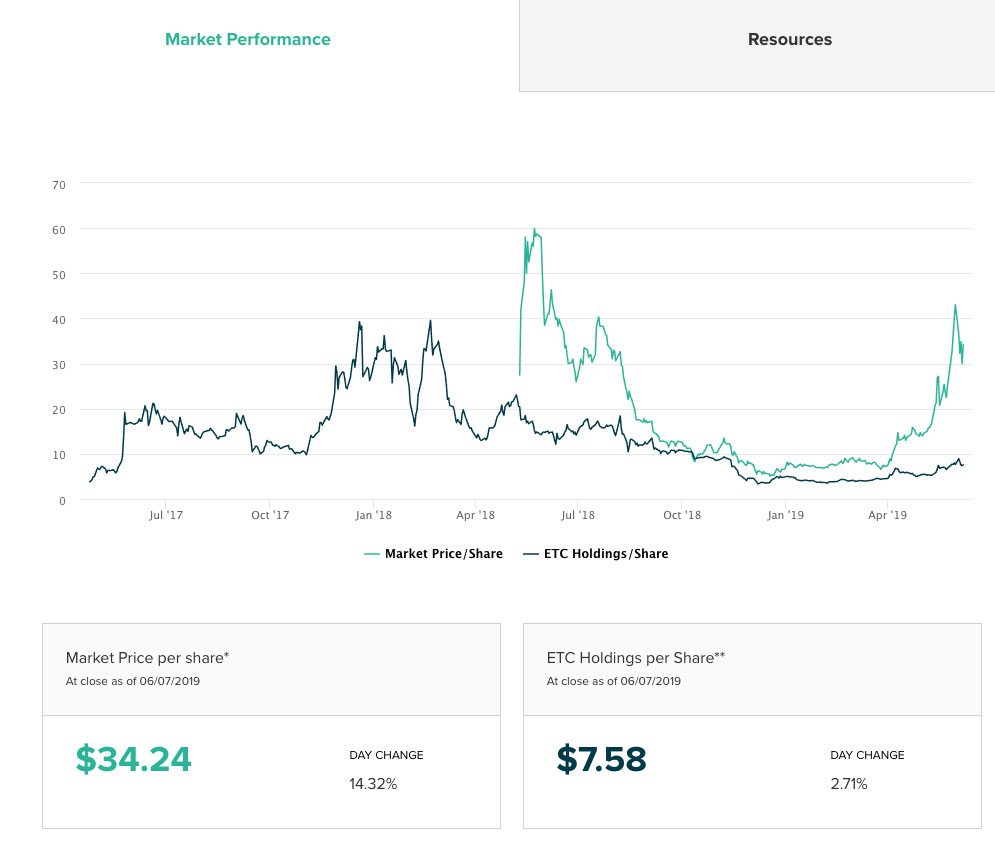

ETCG currently has a rather large premium. Right now ETCG is trading at $34.25 while ETC is valued at $7.50. In short, the trust is trading at over 4x its Native Asset Value.

You might hear that GBTC or another Grayscale product has a “premium.” This is a reference to the difference between the value of the holdings of the trust vs. the market price of the holdings.

When GBTC and ETCG trade at a premium to the underlying assets, it is generally a sign that crypto is bullish.

Cboe resubmitted its joint proposal with VanEck and SolidX for a Bitcoin ETF after withdrawing it during the government shutdown.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.