GBTC and ETCG Premiums are Melting Off

The premiums on GBTC and ETCG just keep getting lower and lower as the crypto bear market drags on. If crypto recovers, finding the bottom of these could be epic.

It could be epic because, in the best of all possible worlds, we would see the premium inflate again (thus potentially giving us a bigger return than buying the underlying cryptos).

Meanwhile, that is “IF,” because crypto is in a bear trend and there is no promise that crypto will come back, or if it does that ETC and/or BTC will come back.

However, from a “if… then” standpoint, there is reason to have the ETCG and GBTC premium situation on your radar.

IMPORTANT: If a less than ideal situation occurred, then buying the underlying cryptos would be a better move. These trusts are risky to say the least (anything risker than just investing in crypto is absurdly risky… because just investing in crypto is itself risky). Do your own research, and make your own investment choices, my goal here is to make you aware of a situation… not to give you advice on how to act (AKA this is purely educational and informational content).

Historically GBTC’s premium being low has been a solid indicator that we were approaching the local bottom of at least a minor Bitcoin market cycle.

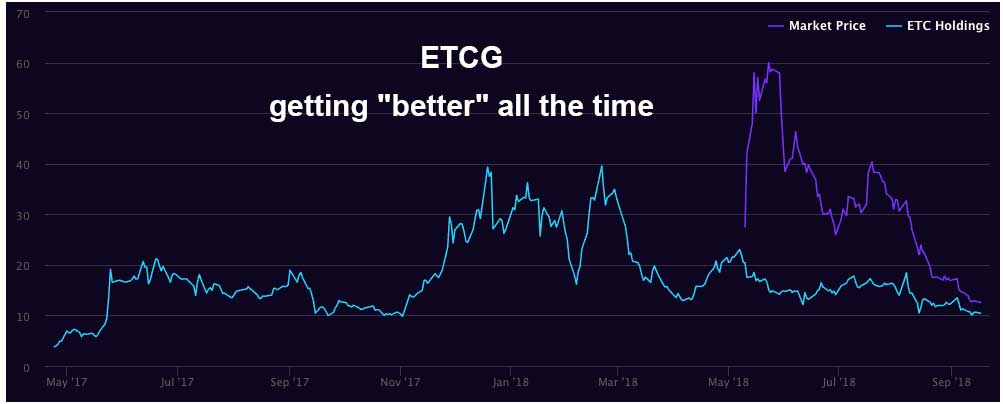

ETCG has no such history, because it has only ever really existed in a bear market and only existed with an absurdly high premium until recently, but for my purposes I’ll assume that ETCG will follow Bitcoin’s trend moving forward.

Given the above, investors might want to keep a close eye on these trusts.

Consider, ETC traded at $10.75 at a point today and ETCG at $12 at a point today. Compare that May when ETC was $14.50 and ETCG was $48 and you can get a sense of what I’m saying.

If we see the market price and the native value of the asset converge (thus eliminating the premium), it’l be the best deal-in-the-moment in terms of market price vs. value of holdings that we have ever seen for ETCG and it’ll be equivalent to something we haven’t seen in GBTC since before the 2017 boom.

Meanwhile, BTC’s spread of BTC $6.35 and GBTC $8.25 is nothing to scoff at either. The more the premium melts away, the more attractive it is in terms of market price vs. value of holdings too!

In short, although timing the crypto market is like trying to catch falling knives with a blindfold, and while timing these trusts is like doing that with your feet, those who get lucky or are great foot jugglers might want to keep an eye out for an epic deal.

Bottomline: If we are anywhere close to the bottom, and you can get GBTC or ETCG anywhere near the lowest premium, there is a chance that you’ll be able to catch not only the increase of the underlying asset but an increase of the premiums on the way up (thus making the trusts a potentially better deal than the underlying assets… but if and only if all the stars align).

UPDATE: A day after I wrote this ETC was $10.50 and ETCG was $11.50. The premium is melting off. Keep an eye out for that convergence point (or, even a chance to buy ETCG at below NAV value). Remember though, you are still taking that underlying risk on ETC. This an article about the icing on the cake, the underlying cake is still in a bear trend. If you are reading this now, please check both ETC and ETCG prices to better understand the current situation. These markets move fast, anything can happen.