The GBTC / ETCG Indicator is Mighty Bullish

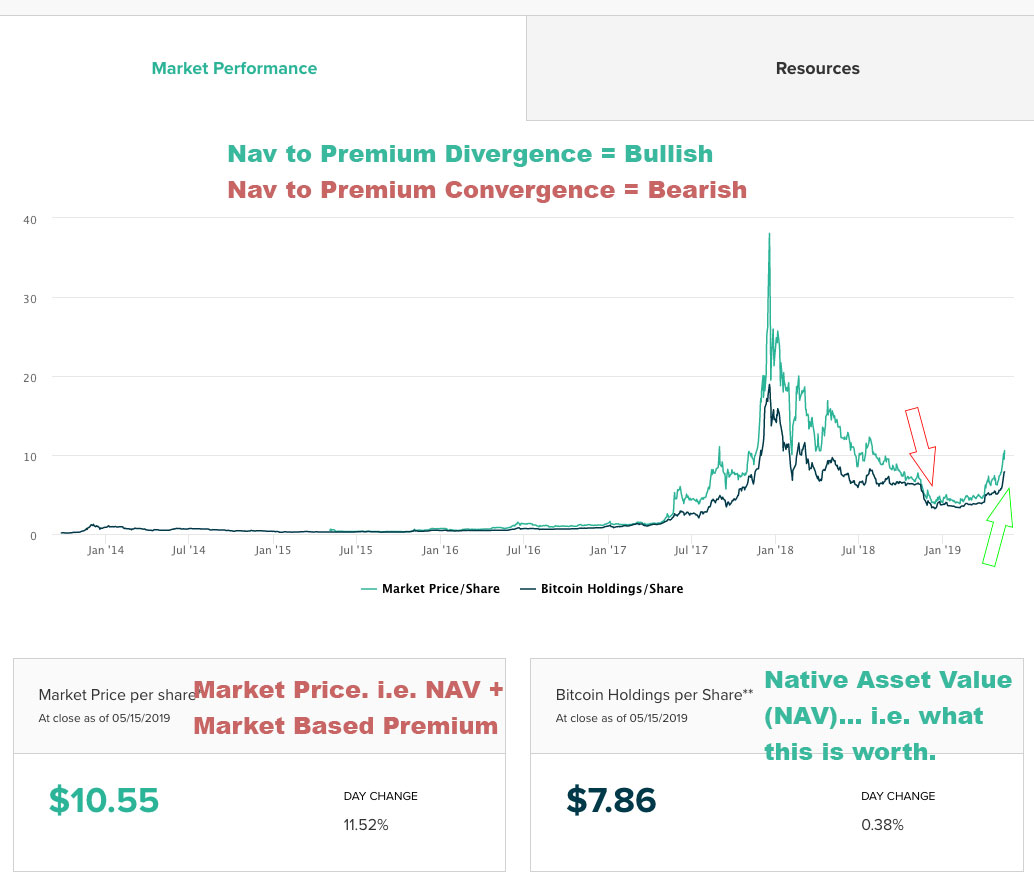

When GBTC and ETCG trade at a premium to the underlying assets, it is generally a sign that crypto is bullish.

On the flip side, when the premium and native asset value (NAV) of the trusts coverages, it is generally a bearish indicator.

That is to say:

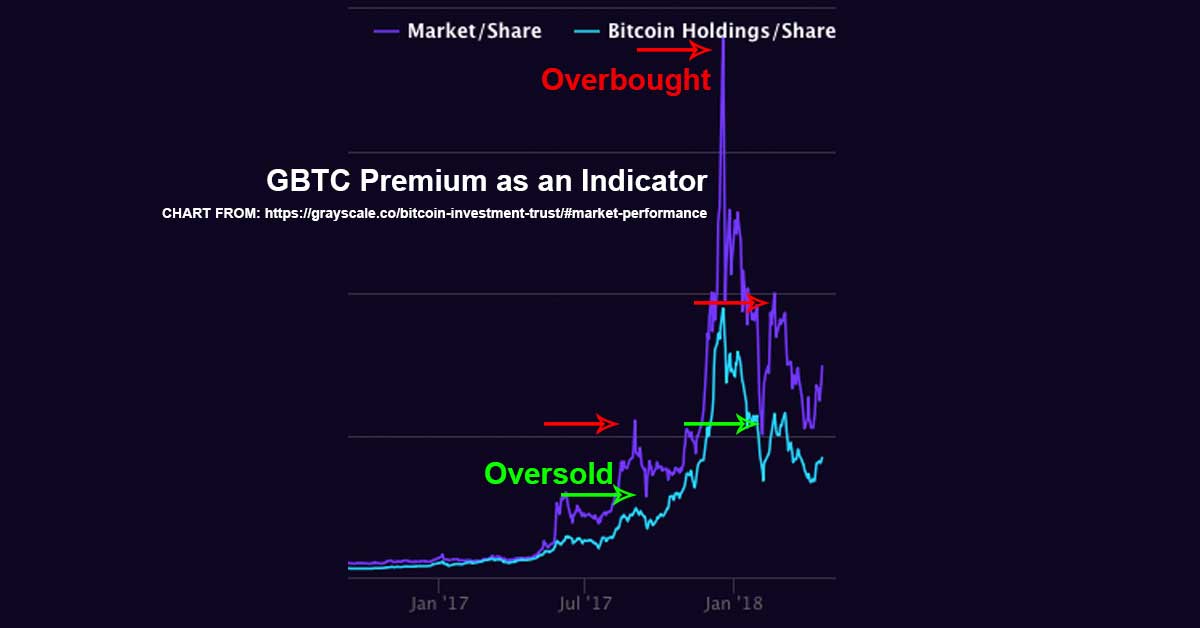

- The Native Asset Value (NAV) to Premium Divergence (premium is increasing) = Bullish / Becoming Overbought

- Nav to Premium Convergence (premium is decreasing) = Bearish / Becoming Oversold

On that note, the premiums are diverging (which is bullish).

This means as a buyer, you could do well here, but you want to be cautious and think about how these premiums might come back to bite you during the next correction (so maybe you pick an exit price, chart this out, plan to average, etc)… and that means as a seller, you could do well, but you want to think about the pitfalls of mistiming a market like this (selling early means that you don’t just miss the price increase, you stand to risk the premium increase as well… if ETC goes flying up, ETCG is likely to follow and hold its ground regardless of the premium).

Also note, there is no rule that says these must ever not trade at a premium. The reality is the forces that be have allowed near zero crypto products on the market aside from ETCG and GBTC.

If you want altcoin exposure in your 401k, you get ETCG or nothing. If you want Bitcoin, you get GBTC or nothing. That is for every single American, full stop.

That means ETCG and GBTC are super crowded trades (meaning if crypto keeps running that premium may stay high).

Not only that, but many brokers won’t let you touch these. So if that changes demand could increase even more.

So things to note here:

- These trusts are super high risk / high reward due to the premium.

- Risk / Reward aside, the fact that we are seeing this divergence is super bullish for crypto (in the moment).

- When we see convergence we might want to heed its warning, it is a bearish indicator to see convergence.

NOTE: Basic logic says buy when the premiums are low and sell when the premiums are high as a longer term investor. However, as a trader, you might be waiting for the divergence to trade them. Meanwhile, others may just use this indicator to signal to them that true crypto markets are bullish. Lots of ways to use this, just as a rule of thumb don’t be silly and go all-in on these when the premium is through the roof. If you really want to go all-in on Bitcoin and Ethereum Classic, think about buying the underlying asset at no premium!

TIP: There is another side to this coin, that is, we can see this as an overbought / oversold indicator too. If you are a buyer, you likely want to think of this as overbought / oversold. If you are a short term trader or just looking for confirmation of the current trend, you likely want to think of divergence as bullish and convergence as bearish.