2017 Was a Bull Market for Crypto, 2018 Has Been a Bear Market

Understanding the Cryptocurrency Bear Market of 2018: Most of 2018 So Far has Been Bearish For Bitcoin (and Mostly for other Cryptos); Don’t Get Thrown off Your Game By That, but Do Be Aware

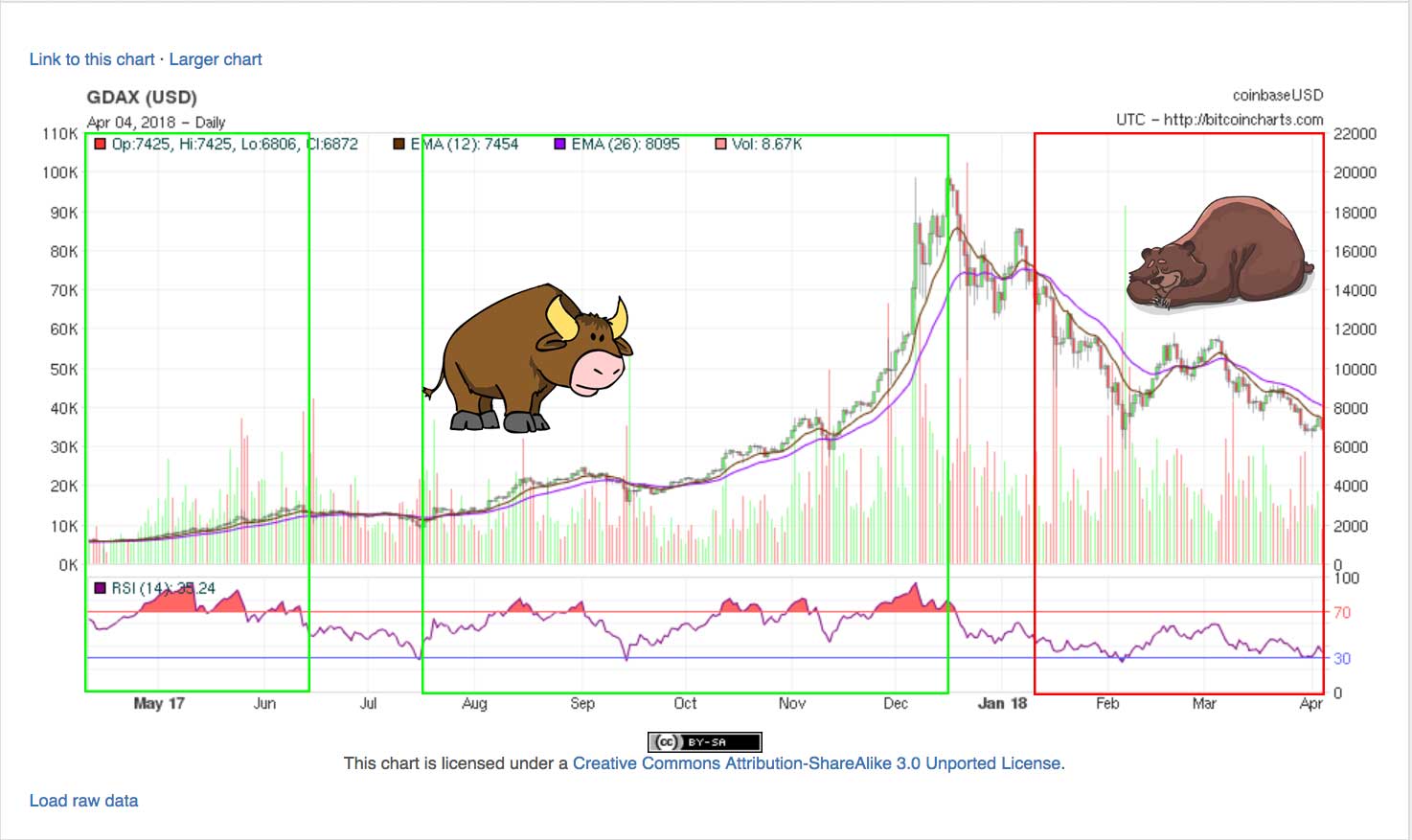

Cryptocurrency believers are arguably right to believe in the future of cryptocurrency. But in terms of price, 2017 was a bull market and 2018 thus far been a bear market. Or at least, this is true for Bitcoin and true for alts since the end of the alt boom right at the start of January.

The meaning of Bull vs. Bear: In simple terms, bull means an upward trajectory and bear means a downward trajectory.

On the chart: You can see an online version of the chart above at BitcoinCharts.com. The meaning of the lines on the chart are discussed below. Know that the crypto market generally follows Bitcoin, so by analyzing the Bitcoin chart we are analyzing the entire market to some extent.

UPDATE Nov 28 2018: Clearly every rally attempt in 2018 failed. The weight of the bear market was too much. There is a lot to learn from this. The big takeaway though is “the trend is your friend.” Once we detected the bear market, it was helpful to have a bearish bias, despite all the rally attempts which offered great opportunities to go long for a short period of time. The next key will be detecting a bottoming pattern and then detecting the next bull run.

UPDATE JUNE 27th 2018: Ignore the overly bullish update below (half joking). There was yet another failed rally in April – May. I warn of this in the following update and on this page, but it’s so easy to think “well maybe this time the rally will stick.” It did not stick, it was just a complex (but predictable) wave of distribution. You see though, it is this sort of series of failed rallies that produces the disbelief rally (the one that sticks). Since any rally could quantum leap us back to the moon, we have to treat every potential bottom and every potential rally like it is serious (just like how I suggest one treat every fork like it is real). If we are treating something probable like it is real, we should do so with caution, and remember any event can go either way.

UPDATE APRIL 19th 2018: This article was published April 4, 2018. A short term bullish trend began taking place between April 11th – 12th, especially in the alt market, and it has held for about a week at this point. The result is that while Bitcoin hasn’t fully broken out of its bearish trend, alts are starting to. The thing to note here is that it is still unclear how this will play out. The bear market thus far has contained a few notable rallies, with one or two being of this magnitude or greater. For a proper bull market to start and/or bear market to end, the current rally needs to jump start a new trend. If it does not do this, then one can say that it becomes a failed rally and does little more than affect how the downtrend line is drawn later (essentially if the rally fails, we are still in a bear market, if it doesn’t, and a new upward trend begins, then we can start discussing the idea that we are in a new bull market). We will update this page as things become more clear. For now, keep in mind the insight below about “recoveries in bear markets being FOMO inducing,” that doesn’t mean they aren’t worth playing to say the least, it just means one should be cautious about overextending themselves based on emotions given the conditions over the last 3 months. Lastly, keep in mind that longer term generally take shape over the course of days, weeks, and months when certain conditions are met. So make sure you take a position that has you feeling comfortable as time progresses and the future unfolds. If every knew what was going to happen next based on historic and current data alone, we’d all be rich!

For a proper bull market to start and/or bear market to end, the current rally needs to jump start a new trend. If it does not do this, then one can say that it becomes a failed rally and does little more than affect how the downtrend line is drawn later… If every knew what was going to happen next based on historic and current data alone, we’d all be rich!

– Me in the paragraph above.

Some Tips and Tricks for Surviving the Bear Market and Being in For the Next Bull Market

Below are some tips and tricks for spotting a bear market and bull market and adjusting your trading and investing strategy accordingly.

- The current market could be characterized as volatile and in a downtrend since January although that is subject to change at any moment (especially given the volatile nature of cryptocurrency). This is different from the long-term bull market from about 2015 – 2017. That market was volatile, but the trend was upward. NOTE: One could argue that the entire trajectory from 2010 – 2018 is bullish, so please keep that in mind for very long-term positions (see a logarithmic chart of Bitcoin from 2012 to 2018).

- No one knows what is going to happen next. This price right now could be the lowest price we’ll ever see. We don’t know, nothing about the past or present can tell us about the future for sure.

- In general, investing in bull markets is easier and more rewarding for more people.

- Bear markets present opportunities for really big gains, but they are difficult. To get those gains, you have to time your buys and sells correctly which takes skill, a risk tolerance, and a willingness to do things like strategically sell for a loss and then buy back higher based on trends.

- Those who treat bear markets like bull markets are likely to end up holding bags or taking losses. Being a bull in a bear market is like being a bull in a China shop; likely rather expensive and rather messy.

- Recoveries in bear markets are FOMO inducing, which means they can draw you in, and then crash on you, accentuating your losses over time.

- Corrections and crashes in any market can spur on panic selling and present an opportunity to buy the dip, but dealing with that reality in a bear market is more difficult and requires more skill. In general, avoiding panic selling is good (you are better off selling the bounce or top of the recovery generally speaking) and buying the dip is smart (to either HODL or sell). However, in a bull market both of these have a higher success rate, and in a bear market they have a lower success rate and require more skill to pull off correctly.

- Some basic useful indicators like MACD and RSI can help. Both these indicators (featured on the chart above), especially on longer time frames (in the chart above, 1-day candles), can give us a sense of how trends are or aren’t changing. A low RSI signals that an asset is oversold and that an attempt at recovery is likely to come soon, a high RSI hints at an unsustainable path because the asset is overbought. For MACD, when the short-term average (on the chart it is the 12-day dark purple line, but it doesn’t have to be this) is below the long-term (on the chart it is the 26-day light purple line), it hints at bearishness. When the short is above the long, it hints at bullishness. Meanwhile, when the lines converge, the trend is decreasing, when the lines further diverge, it hints that it is increasing. Lastly, when the price of an asset is trapped under the moving averages, as it has been since January mostly, this is a bearish sign, and when it is sitting pretty on top of those lines, it is generally bullish. As you can see, 2017 was mostly bullish, but 2018 has been mostly bearish with some earnest attempts at recovery and nice bounces in between.

- To time the bottom of this longer-term bear market (to buy at the lowest price in these coming days, weeks, months, years or whatever it is) one will have to take risks. If you wait for a bull market, you will necessarily miss the lowest prices. However, if we see stagnation in between, then everyone will likely have a chance to build positions at decent prices.

- A conservative investor who doesn’t want to gamble will likely want to play this differently than a risk taker. A risk taker might aggressively try to find the bottom and may even be willing to trade in any market. However, someone more conservative who wants exposure to cryptocurrency needs a more conservative set of tactics. They can, for example, average into the dips (trying to build an average position when they think they are at or near a bottom) or they can simply wait for a proper bull market to resume (passing up the best prices, but taking what is likely a lower risk bet).

- No matter what you do, waiting for a signal that trends are reversing is a good move. A conservative investor will look at longer time frames 2hour, 4hr, 6hr, 1day candles. A risk taker might look at 5minute and 15min candles. Or, either might look only at a price and average their buying and selling based on that. There is no wrong move, assuming you have taken a sober look at the market and worked out some strategy.

- Anyone looking to be a long-term investor should mostly ignore shorter-term trends, anyone trying to play the market should focus on both long and short-term trends. Bitcoin can look like its going up or down for a week or two straight only to reverse course and continue the overall trend. In a bull market, that means HODL is often a good move. In a bear market, that means don’t get tripped up into FOMO buying just because we see a solid 24 – 48 hours or panic selling just because we see a few days of down-trend.

TIP: Take a look at that logarithmic chart again. If this is like 2012 – 2013, then the next run could be around the corner (with progress coming in the next weeks and months; just like it was in 2013 where there were two major rallies). If it is like 2014 – 2017, then the wait for all time highs could take years. Of course, this could be a different case altogether (the highs could never come back, or they could come back sooner, no way to know). Since we don’t and can’t know, we simply want to be aware of our current state, history, and some possible worlds and prepare for them.

How Should One Apply the Basic Tips Above?

The idea of this page is not to tell you when to buy or what to buy (it is for informational and entertainment purposes, not investing advice as the disclaimer on the site says).

The point here is simply to open your eyes up to the fact that we have been in a downtrend in cryptocurrency in 2018, an overarching bear market and that this is different than the stagnation of 2015 or the bull market of 2016 – 2017 (especially 2017).

Since this is a different market than 2017, some tactics tend to work better than those that had worked in the past.

Buy the dip, and HODL worked wonders in 2015 – 2017, and it could work again in the future (as soon as right now even). Those who bought and HODL’d in late 2017 or early 2018 may very well be able to continue on that path and be rewarded in the coming weeks, months, or years (nothing wrong with sticking to your guns).

However, everyone making any choice should know what they are up against. It could be a market like 2014, where the bearish trend continues, or it could be, like at points in 2017, where a bullish trend quickly resumed.

Although anything could happen next, for the moment we are in an overarching bear market and each little spurt of gains and the good news is simply an attempt at recovery.

If you look at the chart you can see that, had we broken out at $11.6k and $9.1k, and those who bought the previous dips were rewarded in spades if they sold before the next downtrend started, and those who waited for the breakout missed out on epic gains (but still had a chance to lock in some gains). That is the nature of conservative investing vs. risk-taking, you always leave potential money on the table in order to protect your capital with a conservative strategy. Meanwhile, you have a high risk/high reward scenario with risk-taking!

If you can time your buying and selling strategically, there is a lot of opportunity in any market! However, if you can’t, you might want to focus more on the risk factors.

At first, it wasn’t clear that the downtrend was bearish, but the double top at $18k – $19k, the attempt at $16k, the double top at $11.6k, and then at $9.1k has helped to paint a pretty clear picture over time. When we compare that to the crypto market as a whole, we can see the trend is the same there too.

So where is the bottom? No one knows. It could already be in; it could happen the second I hit publish. I could publish this then a bull market could start, and we perhaps might never look back from there.

Thus, this isn’t a scare you article; this is a be reasonable with your investing and know what you are up against so you can enjoy whatever crypto throws at us for years to come article.

If you are a risk taker, sub $7k Bitcoin is historically attractive (speaking to last half of 2017 and the first part of 2018 only). If you aren’t a risk taker but are just interested in crypto, realize that you are not in the previous bull market as of April 4th, 2018. While $20k Bitcoins have been real in the past, Bitcoin has also spent years trading at $300 – $1k (and then at $3k – $7k for a good stretch). There is no rule that says Bitcoin has to go up (or that it has to take a straight line path to get there). Likewise, there is no rule that crypto has to hold current values.

While it is unlikely that cryptos will fall all the way back down to early 2017 levels, no strategy should be so rose-tinted as to rule out worse cases and hedge against those risks.

To get back into proper bull mode will likely take time (as there is no quick and easy way out of a long-term bear or bull market). By the time it happens, the best prices will be gone.

There are many ways to deal with that double-edged sword, and it’s truly a matter of personal taste how you do it. The only thing one likely wants to avoid is flying blind. Instead, prepare for the best and worst mentally, be aware of your environment, and give yourself room to enjoy crypto (and avoid being overly stressed out).

TIP: For most people, the right amount of money to have in the market is the amount that lets you enjoy anything the market throws at you (especially important in a volatile market like crypto regardless of whether we are in bull mode or bear mode). If you enjoy a big upward swing because you have exposure to crypto, but aren’t so overextended that a further decline would be devastating, then you are likely in a good place for you. When you are too weighted toward one side or the other, you risk letting your emotions slip in and throw you off of your game (too much cash, you risk FOMO buying; too much crypto, you risk panic selling). Try to avoid being over-taken by emotion by having a realistic outlook on the market and letting your strategy account for whatever comes next.

Bottomline: Bear market = bigger risks, bigger rewards (favors traders who know how to enter and exit positions), Bull market = fewer risks, still great rewards (favors the inexperienced investor who will buy the dips and HODL). 2015 – 2017 favored the inexperienced, 2018 thus far has favored the experienced and laid many traps for those new to crypto. Despite this, those who will do the best in the next bull market are those who can time the end of this bear market. A strategy like “average in when you think the bottom is near,” although risky, is a reasonable move for those who don’t want to miss the best of what the bear market has to offer, but want to avoid the worst. There is no magic bullet, the best move for you here likely boils down to a matter of tastes and educated guesses.