Dear Tom Lee, Your Consensus Rally Prediction has Not Failed Yet

Based on Historic Data, We Need to Give it about a Month Before We Can Say the Post-Consensus Rally Didn’t Happen

For some reason the media narrative is that the post-Consensus crypto rally did not occur, Tom Lee even agreed. I disagree that we can make that claim yet.[1][2]

CRYPTO: #Consensus2018 rally did not happen, very disappointing. What we needed was a trifecta of progress: (i) institutional custody/tools; (ii) buy-in by banks/investment managers; (iii) regulatory clarity (3 of 3 needed), but we got progress on (i) and (ii). Full text below pic.twitter.com/XcqNhgYgK7

— Thomas Lee (@fundstrat) May 18, 2018

NOTE: What Tom Lee says is smart, but I think he is mistaking a pullback before the next rally as him being wrong. I don’t think we can say he is wrong yet; we need to be patient.

UPDATE MAY 30th 2018: Although we have seen further correction since this post, I would we STILL need to wait. Again, if you look at past years you can see that the rally was up to two months out from the end of Consensus. We are currently less than a month out. If we don’t see any sort of significant rally in the next month, then I’d concede that there was no post-consensus rally.

Looking [Very Generally] At Historic Data on Post-Consensus Rallies

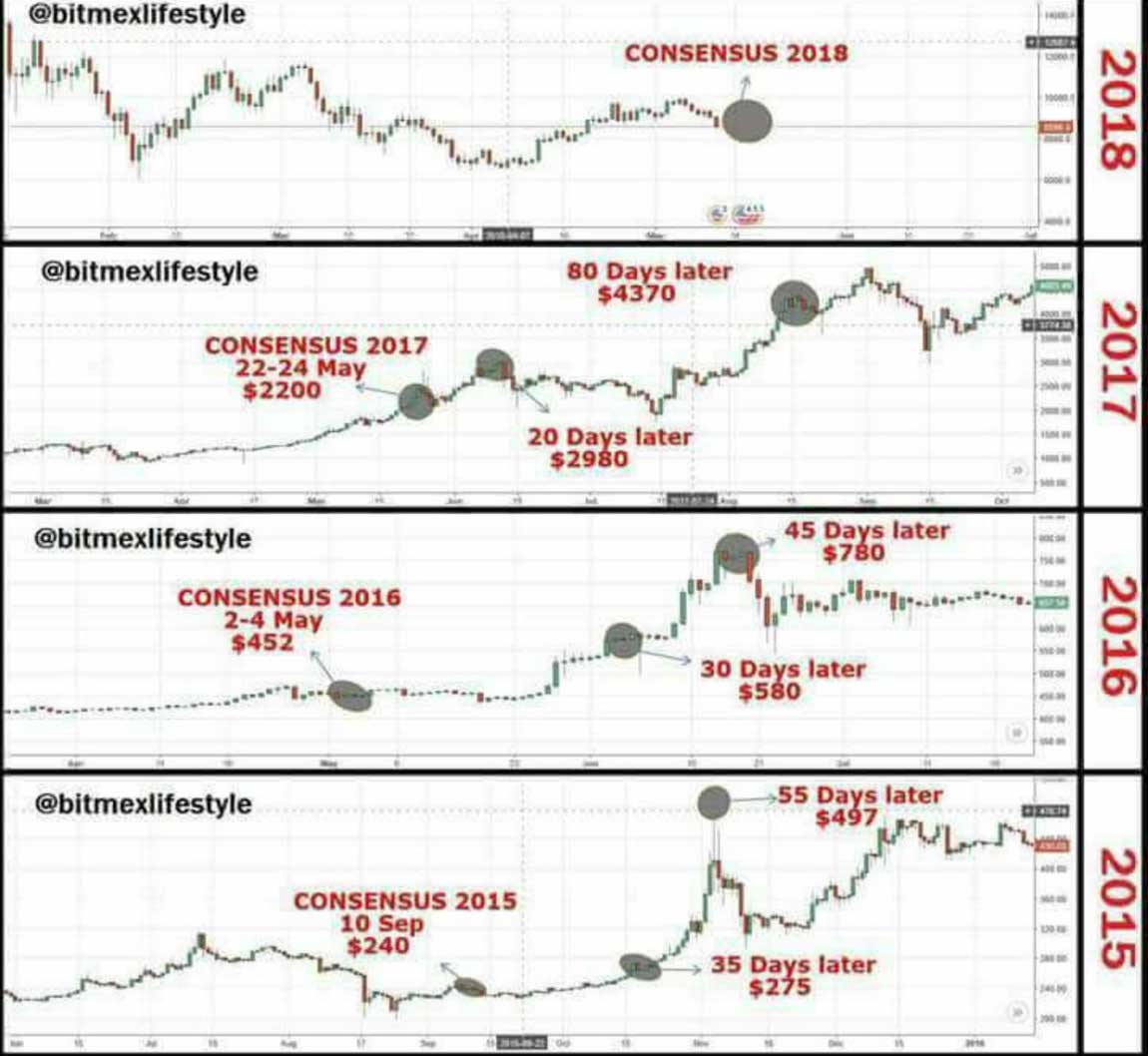

If you look at past years (in the chart above) you can see that the post-consensus rally has taken as a month or more to materialize in every year except for 2017.

Meanwhile, 2017 is the last year I would be looking at to compare to 2018.

Nearly all of 2017 was a rally that we have paid for over and over in 2018. Meanwhile, most of 2018 has been bearish. Thus, 2017 isn’t the best source of data for 2018 predictions (even though attendance of Consensus 2018 was 3x what it was in 2017).

If instead of 2017, we look at 2015 and 2016, we can see that it took a month or more to see a post-consensus rally (almost 3 months to see the peak in one instance).

We only have a few years of data to look at, so I can see why people would have different opinions, but that limited set of data has never in my eyes suggested the consensus rally would necessarily be immediate (only that it could be).

Further, with the market expecting an immediate rally, I think the bears pushed for the opposite a bit (if everyone expects something like $10k or a rally, that psychology is easy to play with and people can be pressured into buying or selling rather easily).

If I had to go into theory mode, I would say what is happening is not too hard to figure out and the post-Consensus rally still has potential to occur.

TIP: I didn’t make the chart above. I found it on Tom Lee’s Twitter from another user. Clearly, it should be attributed to the person or group who wrote their name all over it. However, I did eyeball it to make sure it wasn’t deceptive. From what I can tell, what it is illustrating is correct.

What We are Seeing and What Could Happen

Here is my theory on why we are seeing what we are seeing and what could happen:

What happened is this: After a run from the mid-$6ks to $10k crypto was overbought (see the daily RSIs of top cryptos and Bitcoin specifically) across the board. Bitcoin (and thus the entire crypto market) pulled back after Bitcoin failed to breach the psychological $10k level. This is a normal, predictable 2018 market cycle that is forming a predictable 2018 pattern. See the image below; this pattern has been all 2018 has produced, and it isn’t unlike past patterns. Tom Lee was right with his tax prediction because we were at the end of a correction phase and ready for a run. RSI was low at the time, and his prediction was made in the accumulation phase near the $6k double bottom. This time Tom Lee is also potentially right, but he is counting himself out too early based on the fact that he didn’t have his timing right. I think he was basing it too much on 2017 when he made the call.

What could happen next is this: Anything could happen. However, if crypto follows its 2018 pattern I believe one of two things will occur, based purely on a rough analysis of historical crypto patterns, which is what Tom Lee was basing his predictions on. Either 1. we see the post-consensus rally in the next few weeks after some consolidation around this price level (give or take $1k BTC); we could already be in recovery mode for all we know. We saw a little consolidation. 2. Ether (the second most important coin after BTC) broke from its current formation (which, unlike most cryptos, is still somewhere between bullish and indecisive) taking the rest of crypto with it. As a result, we breach or test $6k BTC support we have been bouncing off all 2018 long. If we consolidate there, then we are essentially primed to retest $10k (yet again). If we breach it the gates of hell might open up a little.

Best Cases Vs. Worst Cases (Which Depends on Your Position and Intentions)

The best cases give us another shot at $10k, the worst case risks breaching $6k and turning 2018 into another 2014 (this is the sort of thing that happened in 2014 – 2015, what looked like recovery was more like an extended dump phase).

The problem here is while the best case is the best case for holders, bulls (after they accumulate), and bears (because they will have more room to short on the next wave down; the closer we get to zero in a straight line, the fewer chances they have to short). The worst case is the best case for institutional players coming into the game late who need to accumulate coins. They can accumulate at any level using futures as a hedge, but it’s simpler and cheaper for them to buy low. If I wanted to control all crypto, I’d want the price to go as low as possible to buy as much as possible, but even here there is wisdom in letting it wave down.

This is Not Investment Advice; More Than Just a Standard Disclaimer, it is Also the Case

I don’t call odds on this site or make predictions with price targets, but I do like to pick apart historical patterns in an educational way to help people see the forest for the trees a bit (so they can go forth and make their own choices and analyses).

In other words, I wouldn’t suggest buying or selling. I’d suggest sticking to your strategy.

I do however think that we should all be sharing our analyses and helping each other, as the only force on earth who can stand up to the big players is a collective of small players. If we flail around buying high and selling low, we lose and wealth consolidates in fewer and fewer hands. That has the potential turn the democratic crypto space into an oligarchy; plus, deep ideological ethos aside, I prefer my readers to find success.

Pronouncing ETH Phonetically, And Also Being a Little Worried About It

With the above in mind, in terms of historical patterns, we’ve seen this setup before. Ether is at .085 BTC right now (its price in satoshis). Last time Ether rallied harder than BTC and formed a sort of head and shoulders pattern where it tested its 12 and 26-day emas on the dailies. It’s currently stuck between them in indecision mode, in some form of either bearish or bullish consolidation; see below. It was right before the major correction from $11.6k to $6k BTC.

Ether breaking down is one of the only things I could see that could bring us low enough to trigger an event similar to those seen in 2014 – 2015. Imagine, $700 ETH back all the way to $360 going tit for tat with BTC playing who can make HOLDers the saddest. That would be soul crushing for HODLers; everyone else can find a benefit in it.

ETH is still rather bullish but it is also trapped between its 12 and 26-day emas on the dailies. When BTC broke down from that, it dropped from about $9.2k to $7.9k. We don’t want Ether to drop and take crypto with it in a cycle of irony as holders. Yet, this essentially happened last time ETH was at a high after BTC pulled back earlier in 2018.

So what could take ETH down? I think you know the answer if you have been paying attention.

If not, it is this: It is the fact that the SEC could come out at any moment and suggest to Congress that it be classified as a security. Ether rallied right after news of ICOs potentially being a security went viral for a minute (this had been known for some time before this). Yet, the reality is big players like Circle are embracing Ether (with Circle even creating an ERC-20 stable coin).

TIP: Some people pronounce ETH (the ticker for Ether) phonetically like EEEETTTTHHH don’t fail me now.

So, Some Reasons to Entertain the Bearish Case, but I Would Argue We Cannot Rule Out a Bullish Post-Consensus Case Yet

We have some reasons to be concerned short term, but if you squint a bit you can see a million reasons to be bullish once all this pay-for-that-last-pump drama is done.

Right now people are assuming we will see at least the mid-$7ks if not the $6ks again. Even my own volcano analysis shows there is potential (see below). However, this is crypto. There are always a lot of surprises. Even if we go down a bit more, we can still see what I would consider a post-consensus rally in the coming month.

Imagine, RSI is low, BTC forms a higher low in the $7ks, and it rallies back past $10k (with the biggest gains being made so quickly it’s hard to get in before if you aren’t accumulating already). It’s not an impossible case, and as someone who has been with crypto for long enough to have enjoyed the 2017 rally and shed some tears in the 2018 dump, I won’t be betting against it with my full stack. In my opinion, the time to bet against crypto was 3 weeks ago. We are likely halfway or more through this bearish phase; at least the chart below hints at that to me.

Mt. KillYourPortfolio erupting.

TIP: What is a post-consensus rally but either a double top $10k or another Mt. KillYourPortfolio forming? Heck, we might even pull what the S&P just did a break up toward the ATH (thus breaking the pattern that has been forming all 2018 long). You need to squint a little to see the bullish case here. Plus, RSI is starting to get low given the last few weeks of bearishness (an indicator that doesn’t say much on its own, but pairs with MACD and overarching patterns very well). Plus, we have many buyers waiting for the lower levels, which means the whales are likely to front run them and force them to enter positions higher, thus pushing the market up.

Bottomline

I’ll be less than shocked to see crypto rally in the next few weeks, but no way I’m ruling out more downside or even a long winter like 2014 – 2015 yet.

I have positioned myself in a way that I’m ready for whatever comes next. However, I can’t help but shake this feeling that this is all leading up to a bigger badder fractal as we start to realize that everything thus far has really been leading up to a wave of institutional adoption which will be followed by another wave of retail adoption (I’m very certain of this, but not certain that we won’t see the winter first).

Further, I think it is clear that institutions are already stealthily in the market despite the narrative that they aren’t (for one, it would be silly for them to give away their position if they are in “stealth phase”).

For all the reasons noted above, I think it is too early to say “the post-Consensus rally didn’t happen.”

That said, trying to predict the future of crypto is a bit of a gamble. Since there is no such thing as responsible gambling, I think we have to recommend positioning yourself in a way that won’t result in ruin if things go south. As you can see from the chart above, things have been going south often recently. That is the most important reality to be aware of despite the bullish mood.