Will Bitcoin Go Back Up?

No one knows if Bitcoin will go back up or not. However, historically Bitcoin has been subject to a number of booms and busts and recovered to from new highs each time. The same is generally true for most altcoins that stood the test of time, although some never reclaimed their all time highs.

Further, while it may appear that interest is being lost or that Bitcoin was just a fad, interest in Bitcoin (according to Google trends) is trending up in late 2018 and is greater than it was last year in 2017 before the parabolic rise in price and search interest.

Meanwhile, many major ETF issuers like VanEck, futures exchanges like CBOE and CME, institutions like Fidelity, existing companies like Amazon and IBM, and new companies like ICE’s Bakkt have entered or are entering the crypto/blockchain/smart contract space.

Lastly, while the price has been in a downtrend in 2018, the SEC is starting to put forth clear rules for crypto, crypto tech is constantly improving, and fundamentals are improving… all while the space evolves.

The price is down from the 2018 high, but it is up from last year and so is the market cap.

In simple terms, things are gloomy compared to 2018’s high, but pretty hopeful compared to 2016 – early 2017.

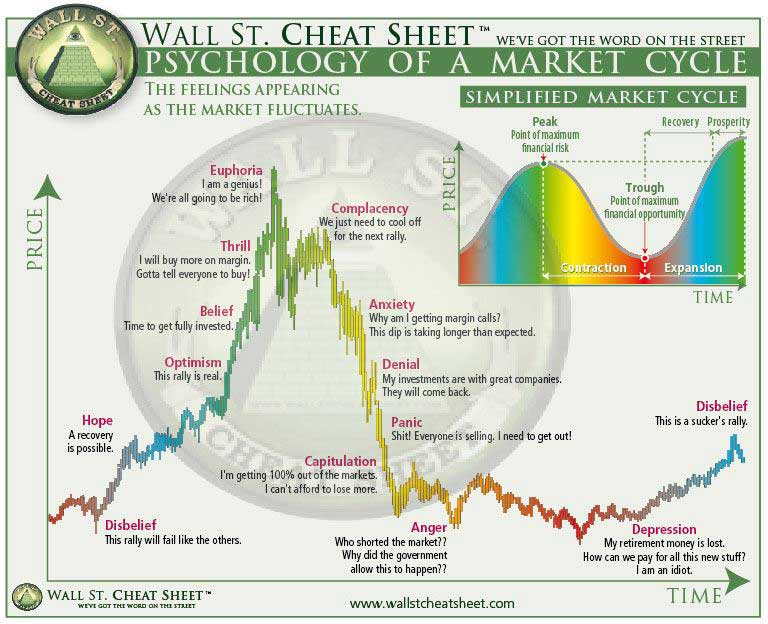

Now all of that aside, just based on technicals (chart analysis), crypto pretty clearly is a speculative asset subject to harsh market cycles.

If the pattern that has formed since 2010 remains true, we should be nearing the end of the current market cycle, and should thus see some sort of bottom form in the coming months (or, in more bearish cases, years).

This bottoming might line up with Bakkt launching, or it might line up with the halving set to occur in 2020 (perhaps preluding the halving). Or, of course it may not.

If the pattern morphs, which it no doubt might, then the bottom could be further out, closer, or never come at all.

I can’t tell you where or when a bottom will form, or if it will form at all, but I can sure show you a few charts to help you understand what I mean by market cycles that help illustrate why those who believe in crypto shouldn’t rush to dismiss it based solely on the current price compared to the peak.

The chart above and charts below are meant as educational, informational, and for the purposes of entertainment. I.e., nothing said or shown here is not meant to be taken as investment advice (see site disclaimers for more information).

What about other cryptos? The expectation is that crypto would generally tag along with Bitcoin; although the more harsh conditions Bitcoin faces, the less bright the future looks for alts. See historic relationships of alts and BTC.

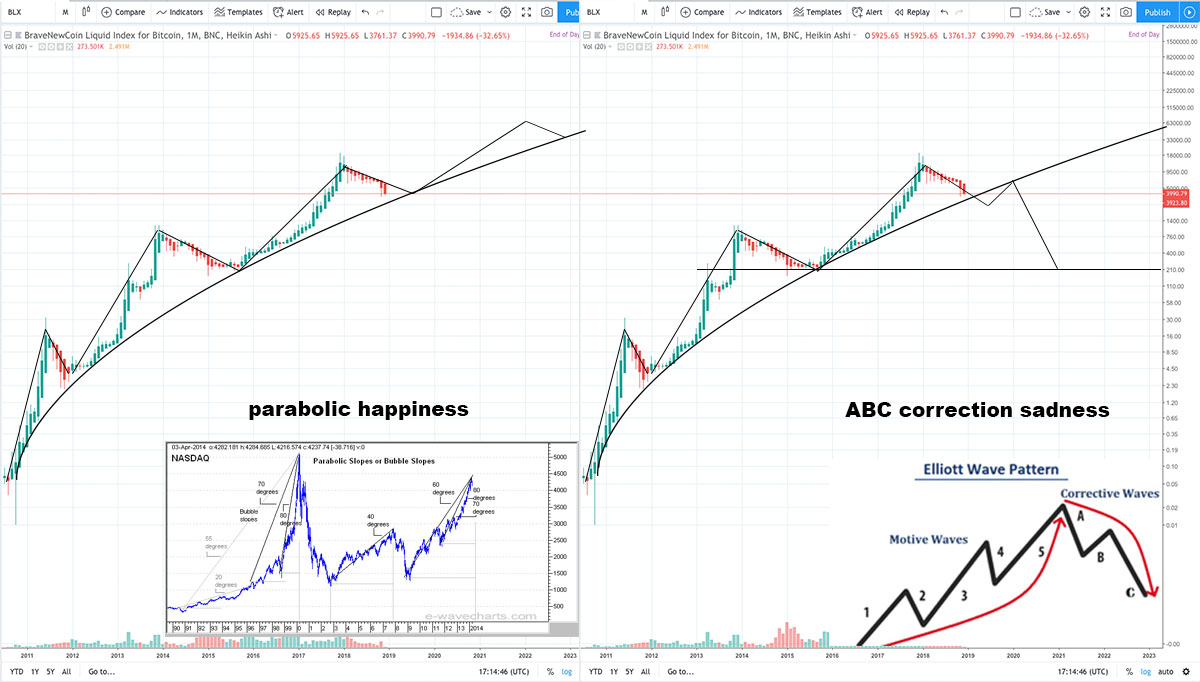

NOTE: The chart above shows 2011 to right now and illustrates two of many paths that Bitcoin could take. The path on the left continues the uptrend, this is a very bullish case. The path on the right morphs and has us experience the first ever true Bitcoin correction. Neither path is likely to end Bitcoin in my opinion, but the one on the right helps to show a possible world in which history stops repeating and a new path is carved out.

NOTE: In all the charts below you need to double check the date. These are charts we have collected over 2018, so some were created or sourced early in the year. The idea is to offer educational resources that illustrate the history of Bitcoin and show how the future might play out if history repeats. This isn’t meant to be used as investment advice. Cryptos are speculative investments and you should prepare yourself to ride them to zero. For more tips on playing it safe, see tax implications and risk management.

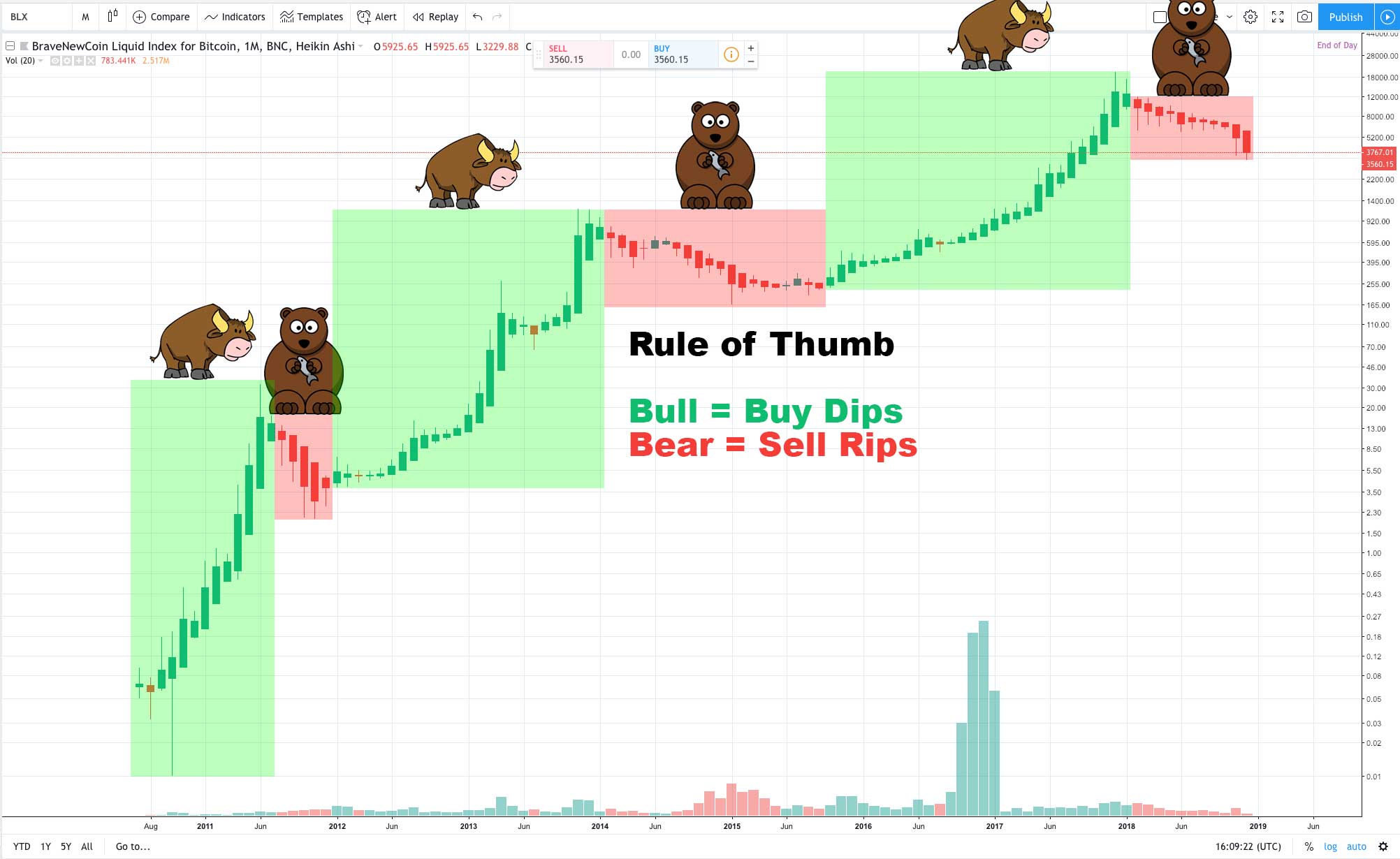

Bitcoin, bull vs. bear. 2011 – 2018.

Bitcoin corrections since 2010.

Bitcoin price and search interest correlation since 2010.

Tech bubble infographic

Market Cycles in Cryptocurrency, originally published on http://wallstreetcheatsheet.com/

Bitcoin Bubbles since 2010. So it has always been like this? Interesting.

Possible BTC Wyckoff pattern by Cryptowolf.

If BTC 2018 – 2021 repeated the pattern from 2014 – 2016, it might look something like this.

Dogecoin doing well seems to correlate with major crypto corrections.

TIP: Above you can see Dogecoin market cycles 2014 to early 2018, notice there are many and they repeat. Most alt charts look like this, and I’m using this one chart to illustrate the pattern of substantially all alts that stand the test of time. They don’t always get back to the high, but the ones that stand the test of time do tend to make nice runs either in USD or BTC prices at regular intervals. Go to coin market cap and zoom out, you’ll notice this is true for most coins with longevity… but do be aware, some coins can and will go the the graveyard.

Will this time be different? No one knows. Bitcoin has never been more popular and regulators have never been more aware. So far that has generally been good for crypto (the crash of 2018 aside), but maybe the end result is some horrific set of events? Something like that could stop Bitcoin from ever going back to its heights, although I suspect crypto will continue to thrive in some form as long as the internet exists.

Potential problem: If Bitcoin falls to a very low price, and then it goes back up, it could still end up lower than it is now. In a situation like this HODLers would be in a pickle, but those who invested lower could be very well off. It should be clear that that is possible, but I just wanted to make sure it was noted. Are your ready for a situation like that?

Bottomline: There is really no limit to how far Bitcoin can fall, certainly it doesn’t have to take a bullish path like it did in the past and thus manifest some of the potential worlds illustrated above… however, if history does repeat to any extent then “yeah, Bitcoin will go back up again, at some point.” Now, does it go back to $20k? Literally no one knows. I wish I could tell you yes, but that would be pure speculation. Anyway, going back to $20k really shouldn’t be anyone’s first goal. The first goal for HODLers and bulls is to stop bleeding out, and to end the bear part of the current market cycle so we can set the stage for the next cycle… which ideally will be a thing.