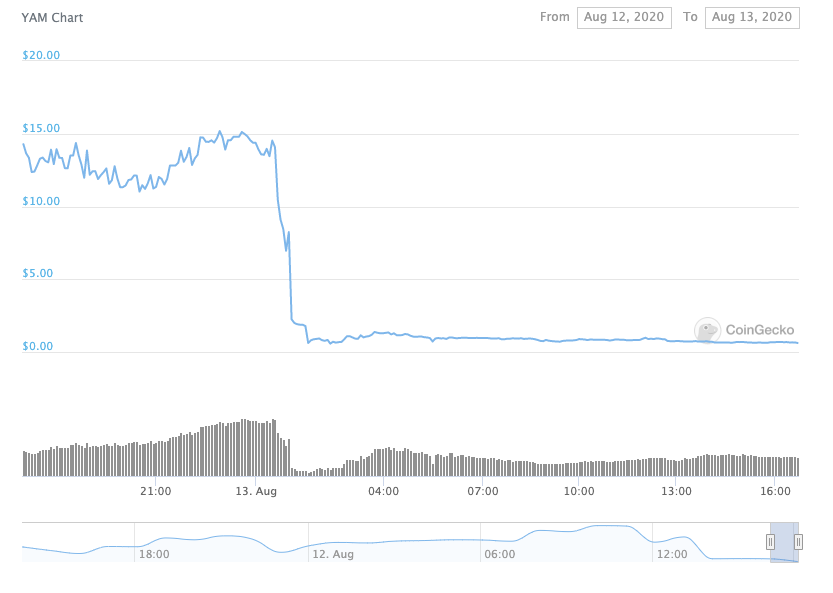

Yams Goes from $60m to $0 in Moments as Bug Fix Vote Fails

The new hot DeFi coin Yams was supposed to earn everyone 2% a day. But the hype train go derailed when the rushed project crashed to $0 after a key vote to fix a bug failed.

Ok, so with that, you are probably asking “what is Yams” if not “what is DeFi and what is Yams?”

NOTE: Yams went to $0, but they seem to have inched back. They are supposed to be worth $1 and they are meant to rebalance to $1… although given the bug, it is unclear what will happen.

- DeFi: Decentralized Finance, AKA lending, borrowing, interest-bearing systems, generally on the Ethereum network.

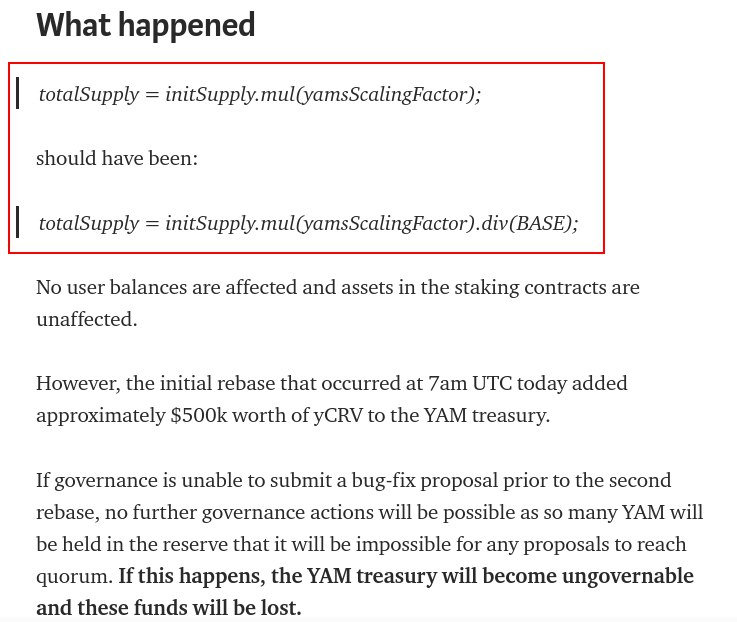

- Yams: A project that some people whipped up in 10 days that had an unaudited contract that was supposed to earn people 2% a day for locking up DeFi coins like Maker, Compound, Balance, and Link… but, surprise, had a bug in it.

- What happened: A bug fix was needed to patch bug. The patch required a vote. People had to use their Yams token (what you earned from locking up other tokens) to vote, but not enough people voted and the bug became permanent.

- Why didn’t the vote happen? Likely because gas fees are high and people were busy selling their Yams on Uniswap instead of voting with them.

- What is Uniswap? It is a liquidity matching smart contract-based system that lets people trade any ETH token, even some unaudited new coin that just came out called Yams. Once demand goes away, coins can go to $0 quickly. This is called a “rug pull.”

- What is the Lesson? The lesson is what we all already know… if something is too good to be true, you should take your money out of Uniswap quickly.

- Wait, is the collateral safe? Yes, collateral is SAFU, just Yams went to $0 is all.

- Will Yams come back? Maybe… YAM 2.0 is said to be on the way. However, this was a rushed project that was a Compound fork with Y finance branding, so likely people will stick to those other more established and audited projects given all of this. The reality is though, usually coins like this go to the graveyard after this level of flop.

For more on this story, see CoinDesk’s “YAM’s Market Cap Falls From $60M to Zero in 35 Minutes.”