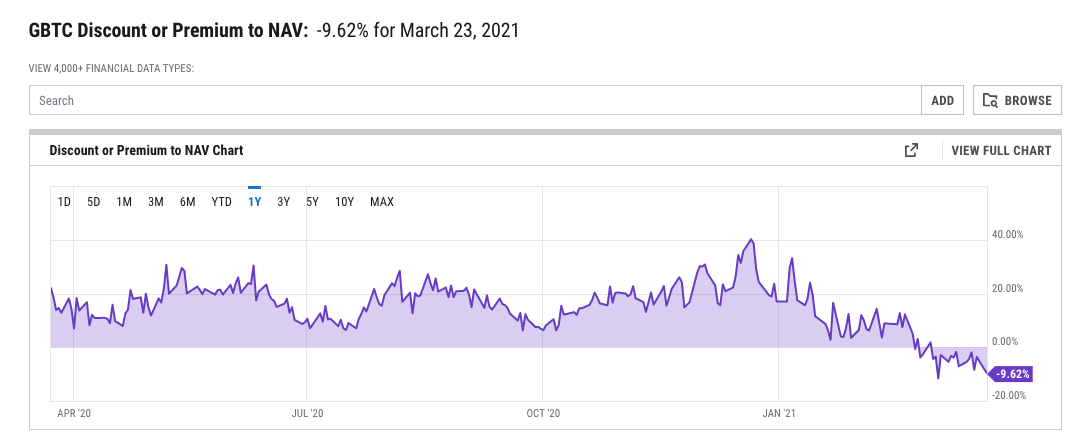

What is Up With the GBTC Negative Premium?

Understanding the GBTC Discount

Bitcoin (BTC) is holding up well and trading at support levels after making highs a few weeks back. However, traders are selling GBTC in a panic creating a large negative GBTC premium (a GBTC discount).

The answer to why is simple on one hand, it is that GBTC holders are hitting the sell button more than the buy button, which is resulting in the price going down.

Unless we can get Robinhood to ban the sell button, that is just going to have to play out while we wait.

On the other hand, things are not so simple, as there is a lot of potential reasons to point to.

For example, it is notable that many GBTC shares were created, that many Bitcoin were bought through Grayscale, that arbitrage trades who always traded the premium are now getting rekt and potentially panic selling, that new adopters with big money perhaps want cheap GBTC, that new ETFs with lower fees are more attractive so money is shifting, that GBTC’s 2% fees are priced in (other closed-end funds with high fees have historically traded at a 10%+ discount to NAV, so this isn’t unheard of), that the recent NASDAQ correction has people in a risk-off mood, that speculative plays like SPACs are down (that which was risk-on and hot, is now not), that bond yields are up, that DXY is up (that the US dollar is up against other dollars), that Elon made too many NFTs, that the market is wrong, etc.

In other words, there are many reasons why GBTC could be trading at a discount, but no one reason fully explains why someone would sell Bitcoin at a 10% – 15% discount in a bull market so quickly after it historically traded a premium.

Of all the answers though, to me, it makes sense that it is a mix, especially supply and demand and sentiment. In fact, in the past, the premium would lower when sentiment would sour (and these were also the best times to buy in most cases).

The real question here isn’t necessarily, “why,” it is, “will the premium come back?” I wish I knew, but no one does. And without Grayscale lowering fees (they say they won’t) or without buyers brought back in by a nice move up that perhaps brings the premium back, there is no promise we do get the premium back.

On the plus side, Bitcoin is 10% off right now via GBTC, which even considering a 2% a year fee is hard to see as a bad deal (maybe not a good deal, but hard to see it as bad).

Still, one has to recognize that the disappearing premium also creates extra risk for buyers and holders. We have never seen a negative premium until recently, it is really hard not to see it as bearish at the moment. If Bitcoin goes into a bear market before GBTC sorts itself out, it could mean trouble for GBTC holders. Which I’m sure is why people are panic selling their GBTC into stronger (but perhaps not wiser) hands at a discount.

NOTES: For the average person, GBTC is still the only way to get exposure to Bitcoin directly in the stock market. All other plays like Tesla, Square, and Microstrategy are proxy plays (they are companies that also hold Bitcoin… and they aren’t exactly trading at a discount either). And, while there may be ETFs in the future, or you may have access to a Canadian Bitcoin ETF as a person, the average US investor doesn’t have other choices outside of GBTC. So it is a bit hard to think the average person has exited GBTC and gone into an ETF with lower fees since that isn’t an option. Likewise, it is hard to see the market not valuing the custodial solution GBTC provides or being willing to pay for it. In short, things aren’t as simple as any one talking point might suggest. What do you think? Feel free to leave a comment below.

BTC holding support and in an uptrend.

DID YOU KNOW? One thing to consider is that BTC is actually exiting exchanges, which is bullish. Data shows people have been buying and moving their funds to cold storage. So the demand side crisis in GBTC is unique to GBTC.

BTC Supply-side crisis.

clumsy dad

i think i got screwed today, that’s what i think

Thomas DeMicheleThe Author

Well that for sure happened short term, no doubt about that. Question is, is the market wrong to offer a 10% discount (and thus it is a good buy or decent hold) or is the market right and GBTC should trade at a discount. I have a hard time thinking that GBTC should trade at a 10%. discount, but who knows.