Grayscale Plans to Move GBTC to an ETF and Lower Fees

Grayscale has made it clear that their plan is and always has been to lower GBTC fees and move it to an ETF.

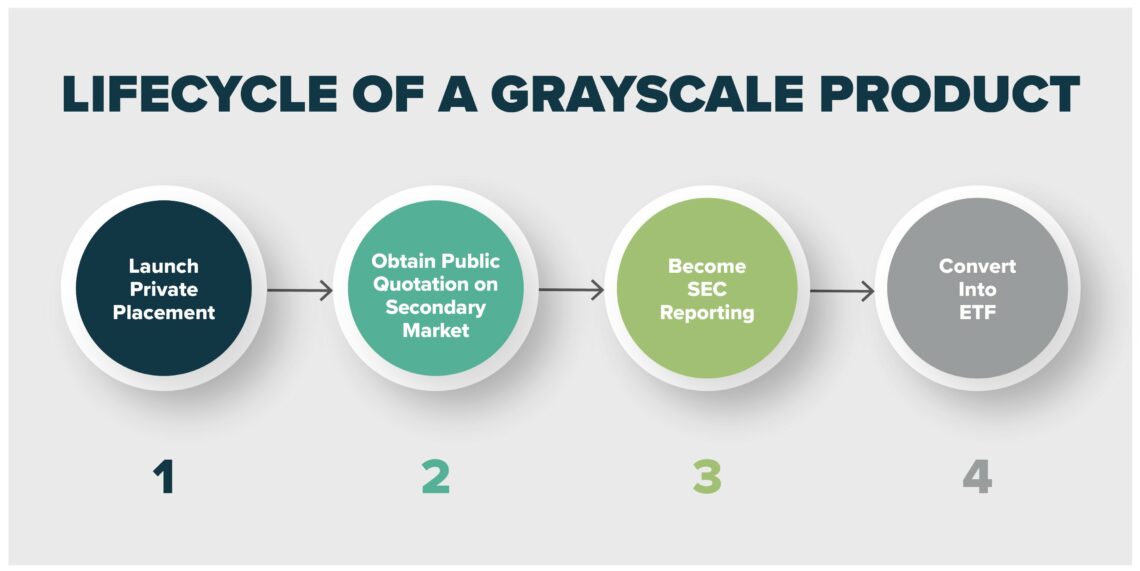

So far the US has not allowed crypto ETFs, so instead, we get GBTC. A closed-end trust with high fees. That had never seemed to bother the market, but recently the market began to trade GBTC at a discount. The discount and complaints sparked a response from GBTC’s owners Grayscale who have made it clear that the path toward an ETF and lowering the fees is still the plan.

Anyone holding GBTC when it becomes an ETF will get the ETF (which is likely to trade at NAV) and the ETF will have lower fees. This means the discount might start seeming more attractive to those looking for Bitcoin exposure with none of the hard work and at a lower price.

For more, see Grayscale’s, “Grayscale’s Intentions for a Bitcoin ETF.”

TIP: The same logic applies to ETHE, although the discount on ETHE isn’t as notable.