Alts See Sell off While Bitcoin Attempts to Hold $6 Again

Bitcoin has resisted dropping below $6k yet again, unfortunately most altcoins from Ethereum down are mostly in panic mode with Ether taking an usually big hit.

Cryptocurrency opinions, op-eds, speculation, and insights. Oh, my!

Bitcoin has resisted dropping below $6k yet again, unfortunately most altcoins from Ethereum down are mostly in panic mode with Ether taking an usually big hit.

Many alts are falling toward their resistance levels from the second half of 2017. If those levels don’t hold, it could take altcoins down to uncomfortable lows.

There is a ton of Bullish news, from ICE’s Bakkt, to Coinbase updates, to news about Coinbase, Stellar, and Facebook, to Volkswagen’s Blockchain project, to IBM’s blockchain projects, etc. Yet prices of most cryptos are the worst in 2018 so far.

Yet again in the history of crypto, a crypto bubble is popping and Bitcoin’s weakness is rubbing off on alts (most of which are exaggerating Bitcoin’s losses over time). In these times it helps to zoom out to look at how crypto holders made gains over time despite events like this in the past.

One could argue that most crypto charts, in most trading pairs, are forming giant falling wedge patterns (a bullish reversal pattern). This wouldn’t be the first time this sort of pattern has occurred in crypto and resulted in the start of a new market cycle.

The sell-off in crypto today is a good case study in crypto markets. I’ll quickly review what happened and why. Hopefully this will help you to understand the nature of the crypto beast.

The crypto markets are in a downtrend, and large sell orders are aggressively being placed, yet crypto had one of the most bullish announcements in all of its history (Bakkt). It almost looks like the bears are, for lack of a better term, “panic dumping.”

According to eToro Research Litecoin (LTC) is trading at a massive discount to what it should be worth considering its supply, transaction speeds and fees, longevity, and close relation to Bitcoin.

There is a ton of bullish news for crypto this week (for example Starbucks entering the crypto space) despite a correction that started over a panic over a Winklevoss ETF no one cared about until it was suddenly rejected again.

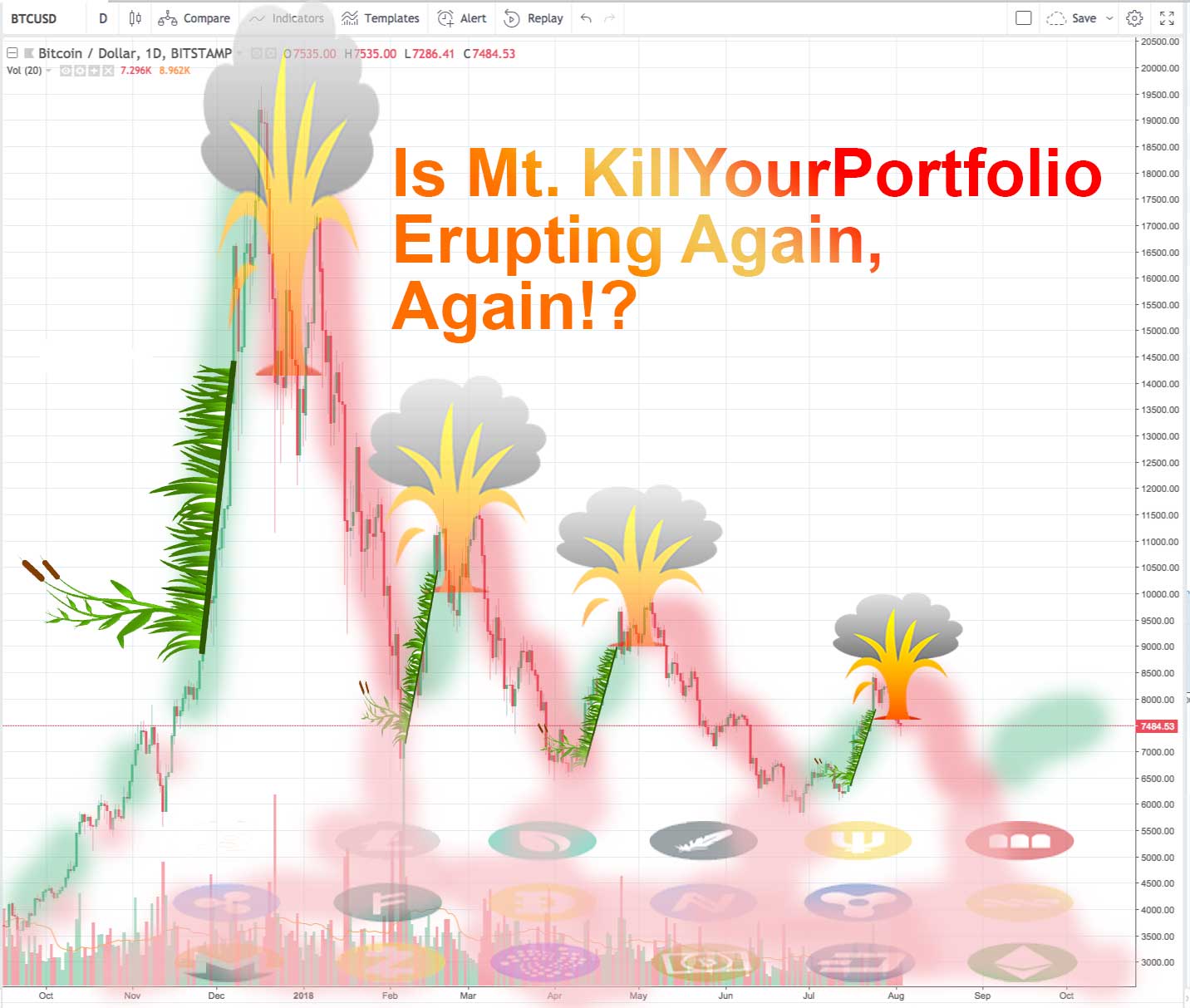

It looks like Mt. KillYourPortfolio (Bitcoin) could be erupting for a fourth time this year, once again covering the citizens of cryptoland (altcoins) in a sea of red lava (red candles). This natural cycle helps to create fertile lush green mountains (green candles), but that is little consolation to those who haven’t sought shelter (HODLers).

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.