Crypto and the Golden Crosses

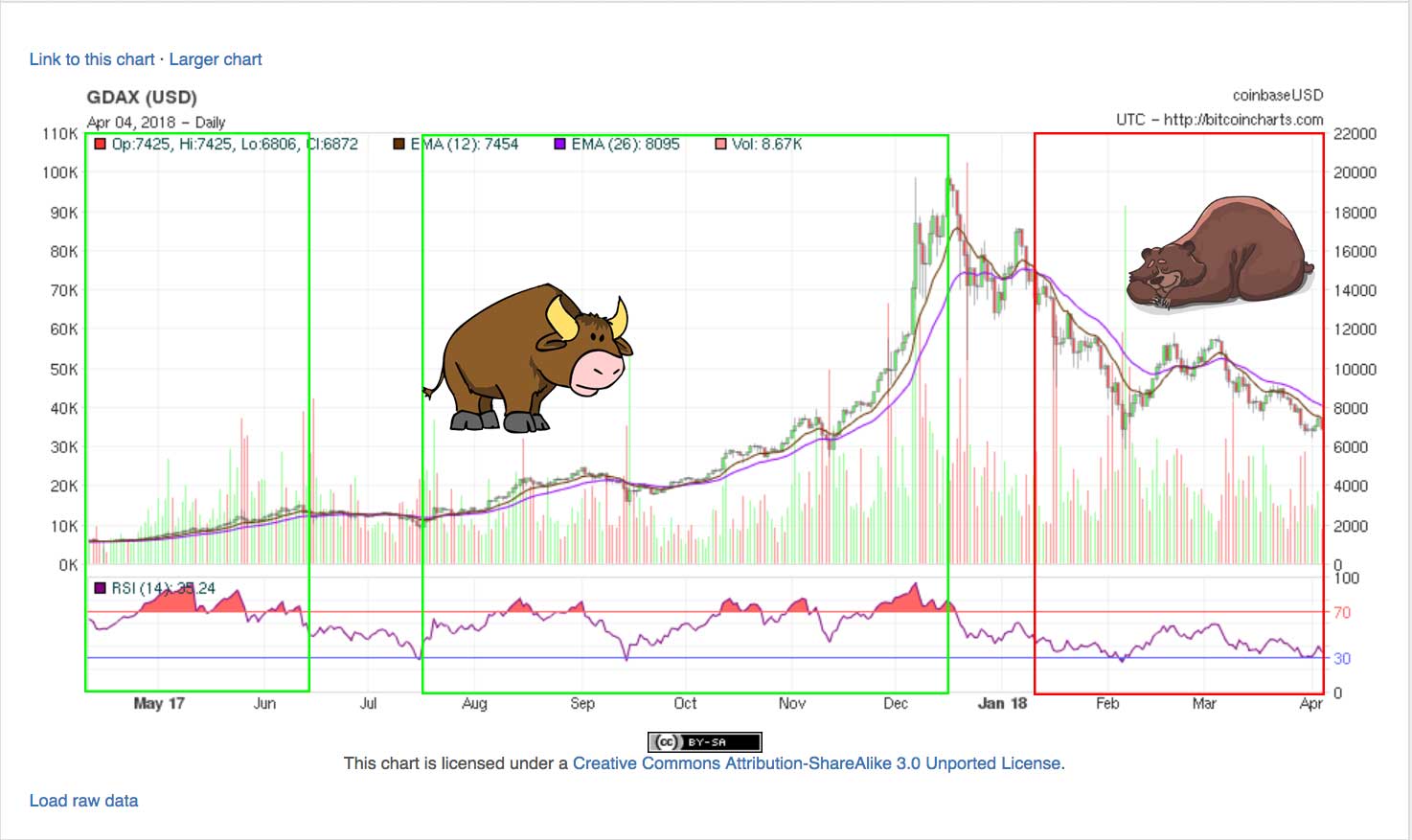

Many cryptos including BTC formed or are starting to form “golden crosses” on the popular 12 day and 26 day EMAs on daily candles.

A section focused on technical analysis. Any article that looks at charts or talks about how to look at charts can be found here.

Please note we don’t do price targets on this site, we do educational content focused on learning about the basics of technical analysis.

With that in mind you’ll find two types of content here:

Discussions about the fundamentals of the technicals and resources. Things like “what is technical analysis,” “how to use Trading View,” and “how to use moving averages in crypto.”

Educational and informational looks at historic, current, and potential crypto charts (sometimes compared to non-crypto charts). So things like “a comparison of 2014 and 2018,” or comparing the tech bubble to the crypto bubble,” or “bulls need to ward off this death cross or it won’t be a good look technically speaking; Let’s take a look at what death crosses mean.”

NOTE: This content is meant to be informational and educational; it is not investing advice. That said, here is some free life advice, as a general rule of thumb don’t make important financial decisions based on information you find on the internet… ?

Many cryptos including BTC formed or are starting to form “golden crosses” on the popular 12 day and 26 day EMAs on daily candles.

Here is a list of everything you need to get started trading and investing in cryptocurrency along with specific suggestions on products for beginners. In other words, here is a cryptocurrency investing starter kit.

There is a pattern so common in cryptocurrency trading that it has been nicknamed the “Bart” due to it looking the head and hair of an iconic character.

Cryptocurrency believers are arguably right to believe in the future of cryptocurrency. But in terms of price, 2017 was a bull market and 2018 thus far been a bear market.

In cryptocurrency trading, Technical Analysis (TA) tends to be dominant. However Fundamental Analysis (FA), the news of the day, a basic strategy, a knowledge of the market, and other factors are also extremely important to consider.

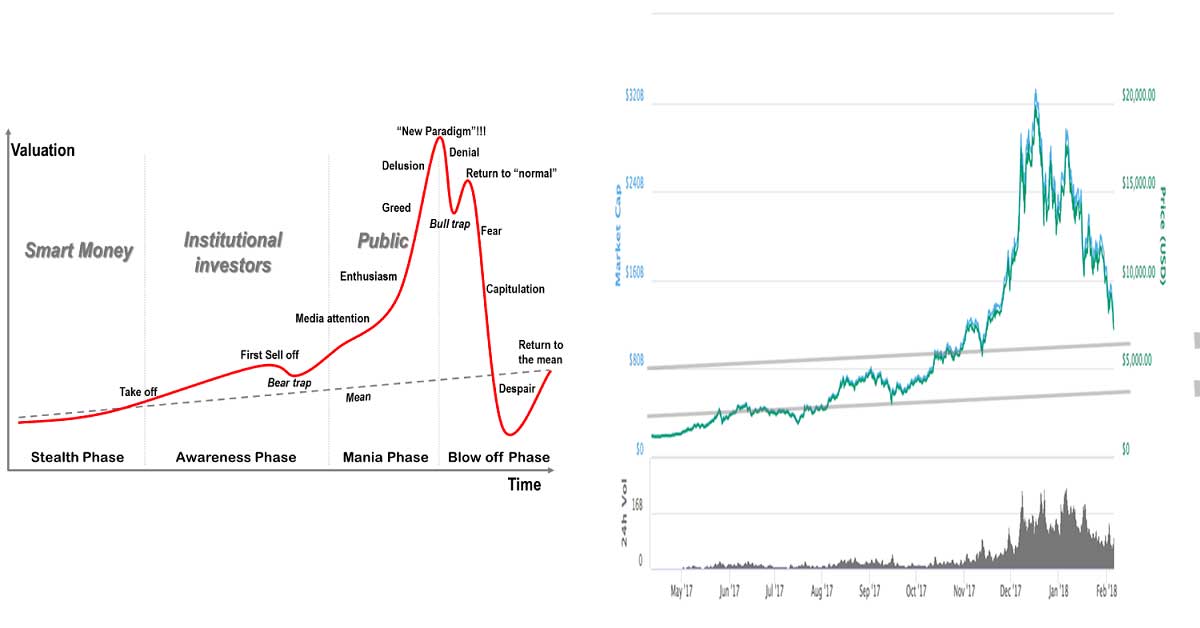

Clearly cryptocurrency went through a price bubble phase and now the bubble has popped. However, this is only one phase in the history of crypto.

Here is an informal speculative theory, “Dogecoin acts as a crypto correction indicator; historically, when Dogecoin is very doing well, an altcoin correction is imminent. Thus, the next time Dogecoin does very well, be wary of a correction.”

Technical Analysis (TA) describes analyzing historic price and volume trends to predict the future price movements of assets.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.