What is the Cost of Mining a Bitcoin?

How to Understand the Cost of Mining Bitcoin

The cost of mining a Bitcoin changes over time and depends on the amount of computing power dedicated to mining and the cost of running those computers (mostly electricity and hardware costs). Thus, the average cost of mining a Bitcoin can and will change over time and changes differing depending on region.

Still, to give an idea of what it costs to mine a Bitcoin today, we can point to some historic data on the cost to mine Bitcoin over time.

In general, over time, the cost of mining has gradually increased and roughly tracked the growth in the value of Bitcoin over time.

For example, in 2018, although cost varied greatly by region due to energy cost, the cost was very roughly $6k on average according to my calculations. Meanwhile, in 2020, the average cost is a little higher, at about $6.8k according to CoinDesk.com.

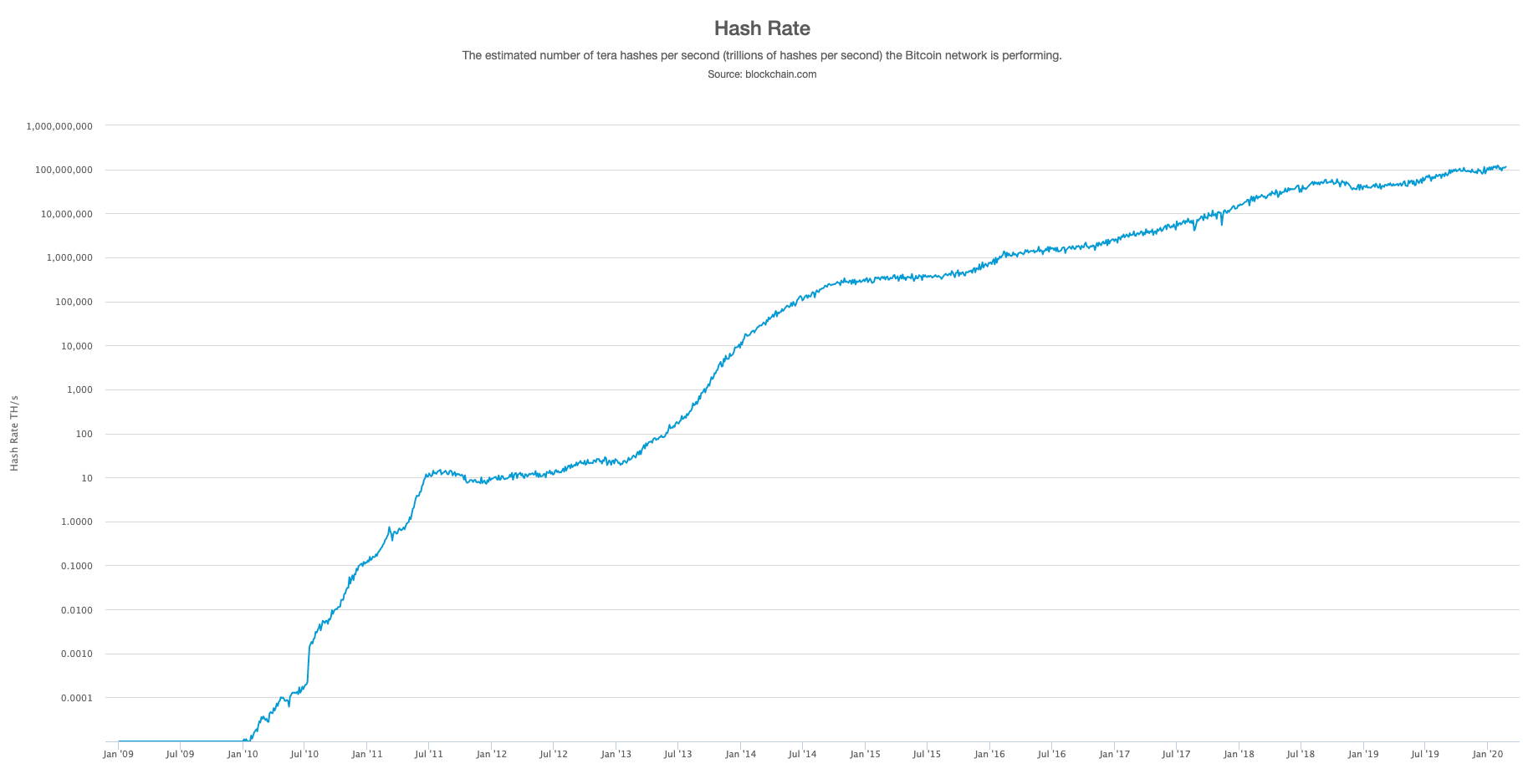

TIP: The cost of mining Bitcoin is correlated to the amount of computing power actively mining it at a given time. The more computing power, the higher the hash rate. Thus, looking at hash rate over time gives us an idea of how much it costs to mine Bitcoin. Below is a chart showing how hash rate has generally increased over time. The hash rate chart is in logarithmic scale, so the higher it goes, the less of an impact it makes on the chart. See the current hash rate in linear scale to get a better sense of how hash rate has increased with price.

FACT: The main cost of mining a Bitcoin is the cost of energy, and energy prices vary wildly across the world. Meanwhile, rent, taxes, and employee wages also differ by region. Further, hardware costs have to be considered. Further, mining rewards are a matter of probability and the difficultly of mining adjusts over time.[1]

FACT: Bitcoin’s mining difficulty is variable and adjusts dynamically to ensure a block is mining roughly every 10 minutes. Thus, Bitcoin’s difficulty will always adjust based on hash rate.

NOTE: Since the difficulty of mining a Bitcoin changes based on the amount of computer power dedicated to mining a Bitcoin, the average cost of mining a Bitcoin can and will change. So we have two things to consider 1. the difference in costs based on energy and overhead (which differs by region), and 2. the fluctuations in costs over time as more or less miners compete. This rest of this article is focused on a point and time in 2018, but the logic will apply in any year unless Bitcoin’s Proof-of-Work algorithms fundamentally change.

How to Find the Average Cost of Mining a Bitcoin

All the above factors together, namely how cost is always changing and depends on factors like hardware and electricity costs, make it impossible to offer a single answer as to what the cost of mining a Bitcoin is. However, as noted, we can look at data and help to offer a better understanding.

For the purposes of this page we will look at the costs of mining Bitcoin in 2018 (although we could look at other years to get the same general task accomplished).

According to a 2018 study by Elite Fixtures (a furniture company who ran a study to get attention, but seems accurate enough based on what I know about energy costs), in terms of energy alone the spread is between $500 (Venezuela; free energy) and $25k (South Korea; very expensive energy).

Right here we can see the main cost is electricity, but there are other costs that matter as well. Those costs include rent, employee wages (if you run a team), taxes, and hardware.

Those costs differ wildly by region, compare say London and rent in Venezuela, and we can see why a singular answer is elusive.

Still, even with it being hard to calculate, I would suggest that $6k is a reasonable rough answer for the average cost of mining in 2018, while $4k – $8k is a reasonable rough range.

The reality is no one is going to go to South Korea to open a mining operation due to the costs, and meanwhile the places where it is really cheap to mine tend to have their own drawbacks. So most people are going to mine from places where their cost will be about $4k – $8k.

Meanwhile, in a market where the average price of Bitcoin is $8k for example. like it was during this analysis, mining is going to consolidate to places where the cost is closer to the $4k – $6k range or below.

The Variable Cost of Mining and the Potential Impacts of Price Changes

If more miners fire up their computers, at a loss or not, the difficulty will go up and the costs of mining will go up. If people are driven out of the market, then mining risks becoming more centralized, but the cost of mining is likely to go down (the theory is miners will only operate at a loss for so long, but bigger operations have more ability to do so, thus mining becomes centralized as miners drop out).

Miners ensure the Bitcoin system by processing transactions, the system will break if the price goes low enough, however it is unlikely to go low enough to break the system. The worst that will happen is that mining will be consolidated into places like Venezuela where energy is cheap.

Ideally Bitcoin’s system is healthier when different miners across the world compete, and thus it is important to have a market price that supports this… but we live in a real world, not an ideal one, and thus the future may consist of mining consolidated into the hands of those who can afford to mine for low costs but at higher difficulties.

NOTE: We would all like to think that the price of Bitcoin will stay at a place where it is profitable for miners, but that isn’t necessarily the case. 1. a group of miners in a country with low energy costs can dump the market to push out competition, 2. speculators often drop the price of metals and oil and such much to the displeasure of miners in other markets, and 3. 2014 was pretty rough for miners and yet here we are. It is an important fundamental, but it is only one factor.