Market Cycles in Cryptocurrency

An Introduction to the Concept of Market Cycles (In Cryptocurrency and in General)

Market cycles are a natural advent in any market. However, because the cryptocurrency market moves so quickly, market cycles are especially important to understand in cryptocurrency specifically.

Given that, let’s go over the very simple version of what a market cycle is.

A market cycle is the period between a high and a low, and more broadly the stages in-between.

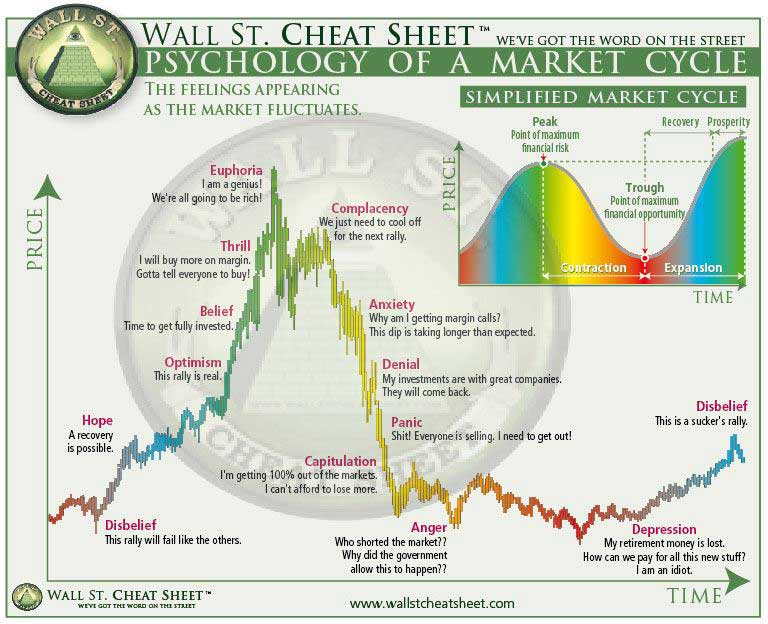

Here is one of the more useful infographics on the stages of a market cycle, or phases of a market cycle, from wallstreecheatsheet.com (also used on this great page from CryptoPotato).

Market Cycles in Cryptocurrency, originally published on http://wallstreetcheatsheet.com/

Above is what a market cycle looks like on a chart. With Bitcoin specifically, using the terms that describe the phases of a market cycle from the above chart (not official terms, but useful terms) it might look like this:

- Smart money, institutional investors, early adopters, etc accumulate Bitcoin low (they accumulate during a lower period that looks like anger and depression to those who held from the last peak).

- Bitcoin goes up (it is wise to HODL through disbelief and hope – buy the dip at support).

- People get excited and the price goes up even quicker as many FOMO buy (those who bought lower start to distribute some as they mark up the price; it is wise to HODL and/or SELL through belief, thrill, and finally euphoria – start closing longs here).

- Bitcoin is distributed high (this phase consists of the price action near the top all the way until complacency; SELL).

- Bitcoin goes down (anxiety and denial; SELL if you haven’t, SHORT and play BOUNCES – short the rip at resistance).

- People get sad and panic (anxiety to panic; SHORT).

- Bitcoin goes down even quicker as people panic sell (play BOUNCES – start closing shorts here).

- Bitcoin bottoms out in a messy pattern that can see a gradual grind down of the rest of the market (anger and depression; this is the accumulation phase; range trade and accumulate).

- Repeat.

Or in simpler terms: accumulation, greed (AKA Bullish Cycle), distribution, fear (AKA Bearish Cycle), repeat.

If you could suss out all emotion and get it right every time, all you would do is buy at the bottom (accumulate), ride the wave up, sell during distribution, and then exit or short the market on the way down.

Simple as that really. Be we talking about a 100-year cycle, 10-year cycle, 1-year cycle, or cycles that happen within days, weeks, and months, the concept is the same.

The concept being that human emotions and market mechanics create bubble-and-bust cycles called “market cycles.”

In other words, a market cycle is the natural wave-like pattern that all assets form as people speculate and react to the associated fundamentals, emotional states, and chart patterns that result on a mass scale.

The classic economic bubble is an example of this playing out in drastic form (it doesn’t always have to be so drastic), and the Wyckoff Price Cycle is an example of this being analyzed and tactics to deal with it being created (Wyckoff can apply even to shorter more subtle cycles within larger cycles).

NOTE: See an overly simple example of a Wyckoffian market cycle below where LTC/BTC’s four main phases of a market cycle (Accumulation, Markup, Distribution. Markdown) occur.

Further, one can stretch this concept in a few different directions to discuss other aspects of markets (for example I would consider the rotation of which cryptos or types of cryptos that are doing well at any one time to be a part of the overarching market cycle, I would consider volume and liquidity trends to be part of the market cycle, and I would consider the historic relationship between alts and Bitcoin to be types of market cycles, etc).

Anyway, that is the basic concept. That is, the “market” goes in “cycles.”

Here I’d warn you that knowing is half the battle. Actually making good investment choices based on all this information is way harder than knowing it all conceptually, because you are human, and thus you will be exposed to pressure to buy high (FOMO/Greed) and sell low (Fear).

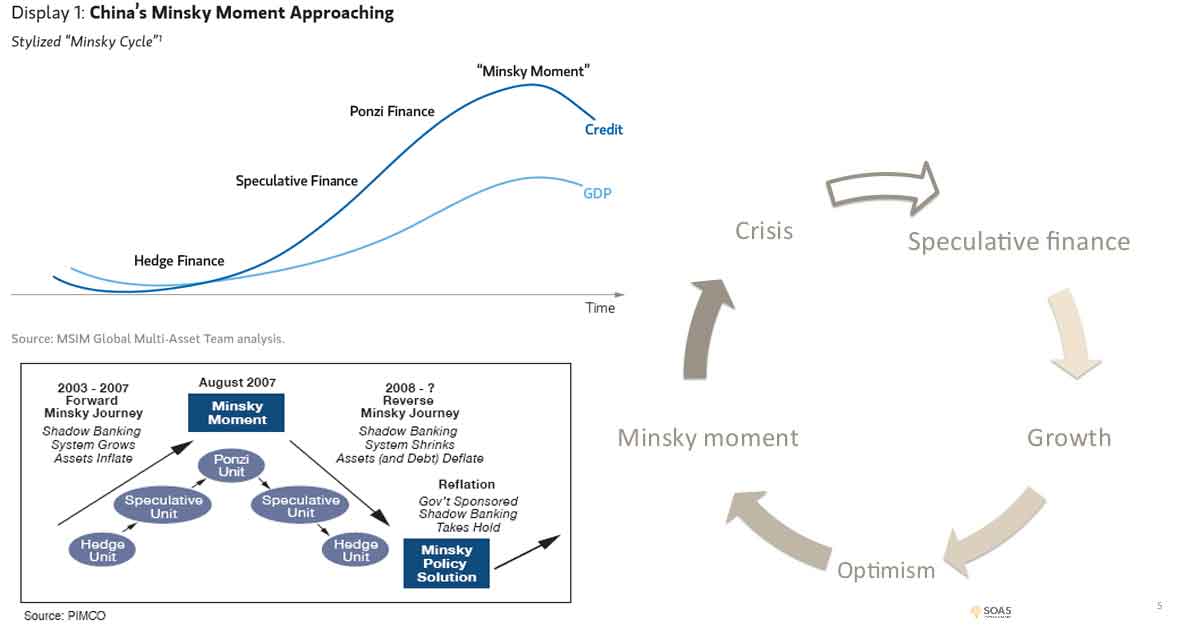

With that introduction covered, I’d urge you to learn by reading the works of others (since I grabbed this concept from others). On the short list of things to do are, read the article “Do you know about crypto market cycles? You should,” study economic bubbles (very, very useful; check out Minsky), or study Wyckoff (I strongly suggest that as crypto is well understood via Wyckoff).

All those will leave you with the same answer as to what you should do: Accumulate when everyone is sad and fearful, distribute (sell) when everyone is happy and greedy, refrain from using credit speculate at the top (unless you are shorting the market), and then be ready to do some summersaults when a fake-out occurs and everything suddenly goes the other way.

Seriously though, the more you key into the repeating cycles and patterns and waves of cryptocurrency, the less stressful it’ll be when you lose 50% of your money on paper. Or, better yet, the higher percentage chance you’ll notice we are in an obvious accumulation or distribution cycle and react accordingly.

TIP: Unless you have a magic ball or are very confident in your TA or FA, I strongly suggest you average and scale in and out of positions. This will help you to avoid mistiming the market. Someone always has to be the one to buy high and sell low, try not to do both of those… and if you do, try not to repeat that mistake too frequently!

TIP: Market cycles can end, for example, if a given cryptocurrency goes to the graveyard and its price grinds to zero. You can’t just always buy the dip and expect the next cycle to fire up tomorrow. Remember 2014 – 2015 took a long time to play out (it was a slow bleed, with a lot of fear; AKA a long accumulation period in which everyone who accumulated and held their investment is now essentially rich… and who do you think accumulated? The answer is, crazy people, true believers, and people who understand market cycles).

TIP: Below are just some images I’ve used for the site in the past that happen to illustrate market cycles (thus I’ve dropped them in here). Honestly, it isn’t hard to find examples, given that most images on this site are dealing with crypto, and crypto is constantly going through cycles at a rapid pace due to its highly speculative 24/7 markets.

The crypto consensus price chart 2015 – 2018. As seen on “the internet.”

If this is anything like the .com bubble. It is the next part of the chart we want to keep our eye on. Hello, fractals.

Cryptocurrency loves patterns. One pattern to note is the January correction.

The 2017 – 2018 Bitcoin Bubble popping.

Dogecoin doing well seems to correlate with major crypto cycles (often running at the start or end of a cycle).