Ethereum Is Back Below $300, Should You Panic Sell, FOMO Buy, or Neither… That is the Question

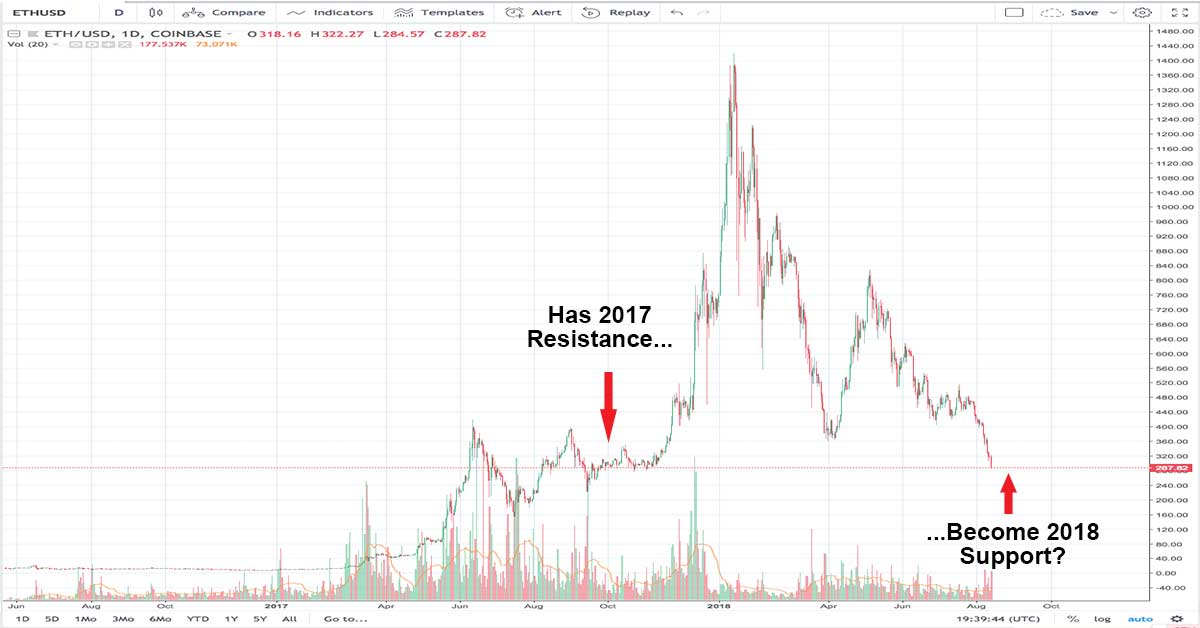

Ethereum is trading under $300 at roughly $285. That is the low range of where it traded in the fall. With 2017 resistance now acting as support the questions become, 1. “Why did this happen,” and 2. “Should I panic sell, FOMO buy, or just hide under a rock?”

Before I discuss any of that, I want you to read an article I wrote November 1st 2017. It is called With BTC at $6.5k, One Might Ask, “Is Ether a Good Buy at $300?” Ok, did you read it? What is the takeaway? To me it is 1. Bitcoin was a better buy for about 1 month, and then after that Ether was an insanely good buy, as was every alt you could get your hands on, 2. man I was playing with fire selling my BTC at $6.5k, glad I bought back in on the dip shortly after that article, and 3. Ironically we now have the same question to ask, but under different circumstances (the circumstances of a bear market of 2018 vs. a bull market of 2017).

Since I can’t answer the question “is Ether a good buy at $300-ish” I’ll move onto questions I can answer.

So, to the first question “why did this drop in Ether happen?” The answer is simple:

- People panic selling Ether and speculators offering a helping hand.

Half-joking. The answer is actually unclear to me. That said, I have some guesses. Here they are:

- Speculators are panic selling Ether because, “what if the first-to-market popular distributed computing system that a large chunk of cryptos are hosting on is no good?”

- Those who bought between last summer and now are panic selling because Ether is close to dropping below where it traded at for the second half of 2017 (and below that is much lower prices).

- Bears are having trouble dumping Bitcoin past $6k at a profit, so they are dumping alts to profit from short positions in alts (and likewise, bulls are stepping aside to get some buys in at those lower levels and test supports in those areas).

- Speculators and those in the market for a while are anticipating the historic crypto market cycle where Bitcoin outperforms Ether and other alts before alts make their grand return at some future point. So it would be out of alts for now while they decline in price, and then a mad rush back into them at some future point.

- Ethereum is the platform that many other cryptos are hosted on, specifically many tokens that started as ICOs are built and hosted on the Ethereum network. Anyone who ran an ICO from mid-2017 until now is potentially sitting on losses or is back where they started in Ether and down in their ICO token. Thus there is potential for those who ran ICOs to be selling off their Ether in a panic, selling off their ICO tokens in a panic, and thus generally pushing the market down in a panic. They got their Ether “for free,” now they are selling it (and the market is not willing to absorb it all at higher levels).

- Ethereum is getting closer to the point where it will need a long awaited upgrade, perhaps the market is waiting to see what happens with that.

- Or, it could always be because crypto is actually dying this time and every coin that isn’t Bitcoin is going down first for obvious reasons like “other cryptos have less volume.”

Now onto the second question, “Should I panic sell, FOMO buy, or just hide under a rock?”

This one is more a matter of personal taste than anything.

Some people are willing to mistime the bottom to build a position in cryptos they think will do well in the future, some people aim to only make winning trades, and some people just want to return to the safety of rock-like shelters to avoid the chaos.

As a general rule of thumb, if you only want to win, you can’t go around guessing the bottom and instead should wait for bull trends to resume before taking long positions.

As a general rule of thumb, guessing the bottom is impossible, so if you want to be in before trends resume you’ll either need to average in and mistime a bit or wait for things to steady out (and hope they steady out around an area that in retrospect ends up looking like a bottom).

As a general rule of thumb, if you don’t want the crypto markets to destroy your net worth, then hiding under a rock is a solid option.

Ethereum may be a first to market decentralized distributing computing system poised to change the world with its smart contracts, popular token, and DApps…. and it may be the center of the crypto ecosystem alongside Bitcoin (not just as a platform other coins and exchanges live on, but as a top trading pair)… but it is also “at the center of the crypto economy” and the crypto economy is a bit of a dumpster fire right now. So, one really has to factor that in to their investing strategy.

Ultimately it all boils down to the following questions:

- Do you believe in crypto?

- Do believe in Ethereum’s roll in the crypto space?

- Are you willing to mistime the bottom?

If the answer to all three of those questions is yes, then Ether might be the right play for you. If the answer to any of those questions is no, you might want to look into this lovely rock…. as for panic selling, $285 is better than zero, but way worse than $1,400.

UPDATE/NOTE: If you are seriously trying to gauge your risks in Ether, check out the logarithmic chart below which shows ETH/USDT. You can see 2016 – 2017 looks a bit like a fractal of 2017 – 2018. Eventually ETH’s direction was up, but it sure looked like it could head down many times in 2016 and in that year it was relatively flat compared to the rest of the chart. Looking at the chart, if history is going to repeat, I would say anything between $100 and $250 is a possible 2018 bottom and it would still roughly be “2017 resistance as 2018 support” (I wrote this article yesterday when ETH was $285, now it is $250-ish, I wanted to offer the update but clearly $285 can’t be the bottom if we are already lower, that is why this chart has a different price). If history were not to repeat, and instead we see a real crash here, then we have to look at lower supports, that means anything including: $30, $10, $5, $2, $0.50, and $0. These aren’t price targets, these aren’t what will happen…. these are simply places ETH traded at in the past, as you can see on the chart.

ETH/USDT log chart 2016 – 2018