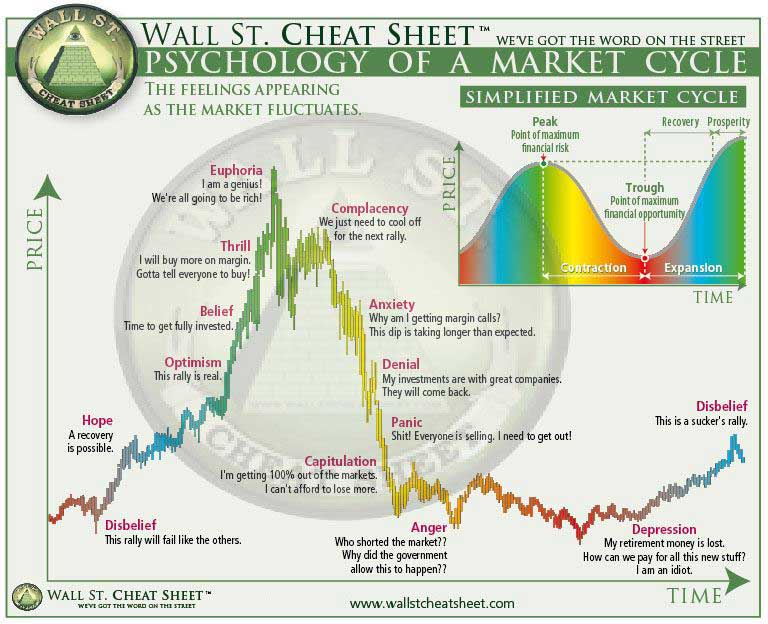

Wall Street Cheat Sheet Suggests We Could be Near the end of the Bear / Start of the Bull Cycle

Is it just me, or does this wall street cheat sheet chart look a lot like many alts and even BTC itself.

If it is the case that this semi-famous meme-like chart is correct, it could be that we are nearing the end of the bear market and start of a new bull.

That doesn’t mean go all-in now (as it doesn’t mean this is the literal end of the bear), it means be smart, build a position in a way that works for you, and get ready to start buying the dip.

For all we know crypto could present one last trip or two down before it goes up for real, and it would be really nice to be able to buy that of course… but if not, you should really think about how you enjoy the ride regardless.

There was a time when listening to bears and traders paid off and listening to hodlers didn’t, but times change. Know when the market cycle is changing, and know when to switch your strategy.

Crypto may not have been the thing for the last 12 months, but many of us believe it is the future. Of course, crypto is also very volatile, so even if you are bullish like me long term, we still have to be smart and tactical with how we build our positions. And, if you are a short term trader and not an investor, then you have to get even smarter. Still, from any perspective, it is good to know about market cycles and know when you have to switch out of bear mode and into bull mode again.

Bears who stay bearish in a bull market, tend to get Ashdrake’d. And believe me, some of the popular talking heads on social media are bound to be the Ashdrakes of the next cycle. Don’t let that be you, the trend is your friend.

🙂

TIP: Learn more about market cycles in crypto.

TIP: Of course it is tempting to jump into that coin that is doing well already, but what about those coins that haven’t moved much like NEO and ETH? If you are unsure, play a spread… but for me, I always like finding underdogs with good fundamentals more than chasing runs. If everyone already made a fortune on RVN, maybe the one that hasn’t popped yet is actually a better play? Or maybe you can’t make up your mind so you buy both on the dip or buy both with stops or average in? Really depends on you! I can’t make your choices for you, but hopefully my words help give you ideas for your own strategy.