The Mood of the Market Changes

The mood of the cryptocurrency market isn’t static. It changes and goes in cycles.

Cryptocurrency opinions, op-eds, speculation, and insights. Oh, my!

The mood of the cryptocurrency market isn’t static. It changes and goes in cycles.

Here is an informal speculative theory, “Dogecoin acts as a crypto correction indicator; historically, when Dogecoin is very doing well, an altcoin correction is imminent. Thus, the next time Dogecoin does very well, be wary of a correction.”

People always want to know what will happen next in cryptocurrency. No one has a crystal ball, but the analysts on TradingView.com offer the next best thing.

After Bitcoin’s rapid rise from $1,000 to nearly $20,000, and then a rapid rise of altcoins following that, cryptocurrency is seeing a correction (not a crash). That isn’t fun, but it is common.

For reasons that aren’t fully clear, but likely relate back to the recent alt boom and South Korea news, cryptocurrency entered a correction period.

In cryptocurrency which coins are doing well tends to rotate. At the start of the year it was XRP, XLM, ADA, then it went to NEO and ETH, before that it was clearly BTC.

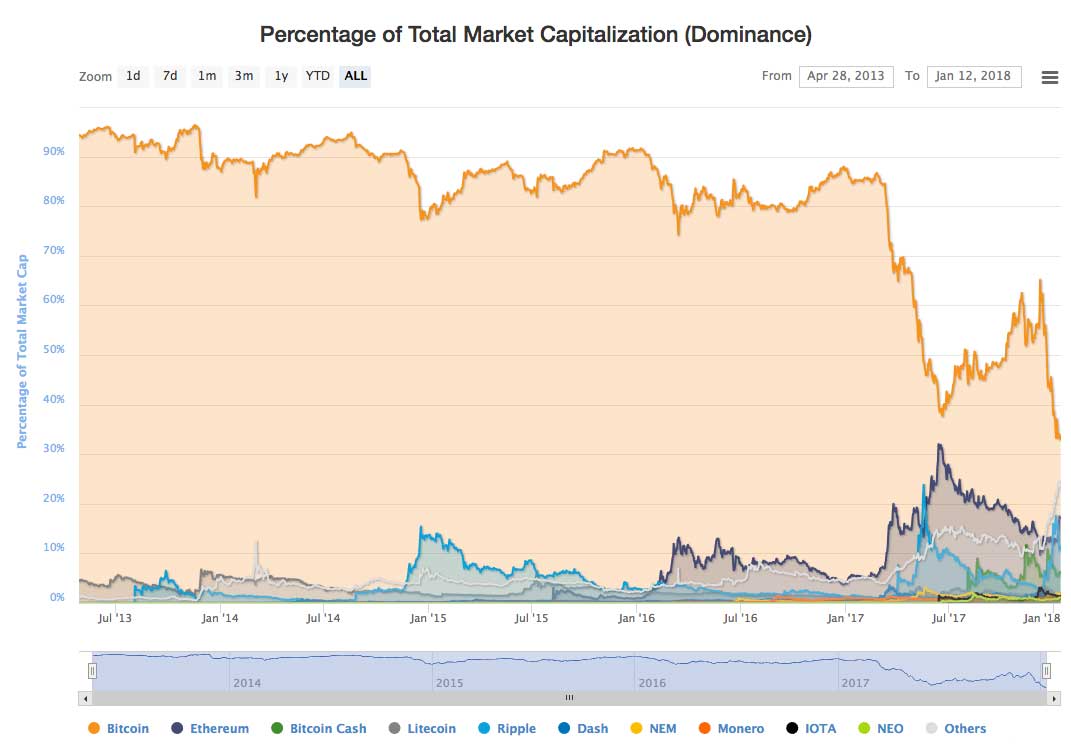

The total market cap of cryptocurrency is near an all time high, Bitcoin dominance is at an all time low, and altcoin dominance at an all time high. What can this tell us?

Ether (ETH) hit an all time high on January 9th due to a series of events explained below. Unfortunately, most of the rest of the market suffered a correction.

Many altcoins came down from all time highs between Jan 3rd and 5th as Bitcoin made its way from the $14k to $16k zone. This helps us see some historic patterns. NOTE: A historic pattern doesn’t have to occur again, the past can tell us what to look for in the future, but no one… Read More

In general, when Bitcoin stagnates it gives altcoins a chance to run. The Bitcoin stagnation that started in December 2017 set the stage for an altcoin boom like few before it.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.