Bitcoin Dominance is at an All Time Low; What Can This Tell Us?

What We Can Learn From Looking at the Short History of Market Capitalization and Bitcoin / Altcoin Dominance

The total market cap of cryptocurrency is near an all time high, Bitcoin dominance is at an all time low, and altcoin dominance at an all time high. What can this tell us?

Too long didn’t read; it tells us “be bullish on altcoins” but don’t forget that crypto likes waves and patterns, and the patterns are pretty clearly pointing to an altcoin pullback and Bitcoin boom at some point in the future (weeks or months). <—- not FUD; just something to keep in your grey matter when you get FOMO and want to buy the top of some random altcoin that just went up 50,000% in a few weeks.

Back to the question, what does the decline in Bitcoin dominance and rise in alt dominance, paired with the near all time high of the crypto market cap, tell us?

Well, on the surface it might paint a simple picture, that picture being: “as more people embrace cryptocurrency, Bitcoin is becoming less relevant and desired and altcoins are becoming increasingly sought after.”

However, that simple picture has been painted more than once before, and in the past it wasn’t exactly right.

Take a moment to read this Medium article from May 8th titled “Why The Bitcoin Dominance Index Is Deceiving” in which Jimmy Song tried to explain why Bitcoin wasn’t dead despite the alt surge and Bitcoin market dominance pullback that was occurring a the time. Notice how the dominance chart from that time looks a lot like the chart we see today? That is the key here!

The simple picture wasn’t right when Jimmy Song tried to warn us in May, and it is likely the simple picture doesn’t fully explain what is actually happening this time either (it likely only tells us what is happening in the moment, not in general).

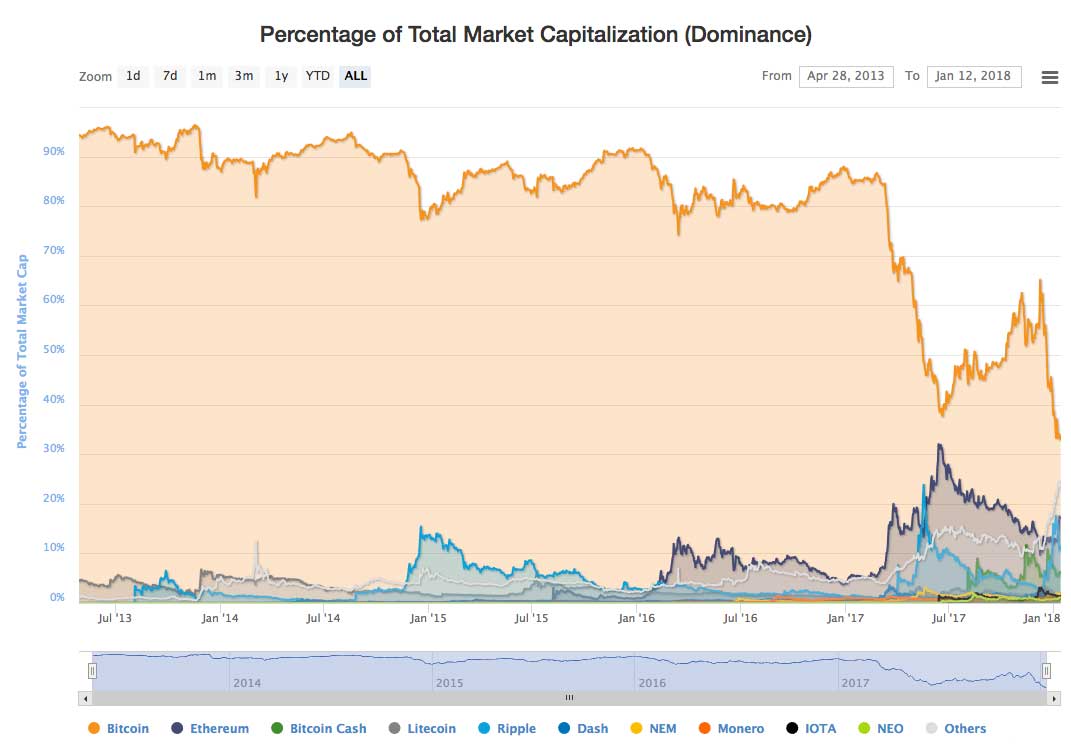

If we want to fully understand what is going on from a 10,000 ft view, we should look at the patterns present on chart at the top of the page.

This chart from CoinMarketCap.com shows the dominance of each of the major coins and “others” (all other altcoins) over time. In other words, it shows”Percentage of Total Market Capitalization (Dominance).”

In this chart we see that the simple picture noted above has truth to it, but that this is happening in waves (waves with peaks and crests).

It isn’t that alts are taking over, it isn’t that Ripple, Ethereum, or Bitcoin Cash is replacing Bitcoin, it is that this is all occurring incrementally in wave-like patterns as Bitcoin makes headway and then enters a periods of correction (periods in which all other coins thrive).

This pattern has repeated a few times since 2013, and we can see this very clearly on the market dominance chart.

This period is especially well pronounced and defined because of the other factor, the total market cap of cryptocurrency being at an all time high.

The market cap growth looks parabolic on a linear chart, in fact the chart looks like a classic bubble when we zoom out and look at the market cap growth since 2013. Thus, everything that happens here in this current high market cap stage is extra pronounced.

However, on a log scale, and compared to the graph that shows market dominance, the patterns are a lot more obvious.

What is likely occurring is that we are part way through an alt boom. New money coming in since November – December may have started with Bitcoin, but is now looking to make 1,000% gains like those who invested in Bitcoin before them.

The logic is there to explain all this… but we have to keep in mind, this isn’t the first time these set of events have played out.

Look closely, this set of events played out during a recent wave of mass adoption of crypto, back in May – June 2017 (just like it occurred a few other times before it).

In May – June we saw articles saying “Bitcoin Dominance at all time low” “lack of scaling solutions causing chaos” “will Etehreum replace Bitcoin” “will Ripple replace Bitcoin” “is Bitcoin dead” “Is this the rise of the alts?”

The arguments in those times were interesting. Many were eager to declare a new king, to plant an altcoin flag on the moon and celebrate the start of a new era.

They were right, it was a new era. For a moment it was an era of alts. However, the real benchmark of that era was not the rise of alts, it was the start of one of Bitcoin’s biggest jumps in price and market dominance in its history.

What happened was that starting in July – August Bitcoin began outpacing all other coins. Ethereum and some top alts came along for the ride in terms of dollar values, but they couldn’t keep up pace in Bitcoin value (in terms of BTC). After a crash in early September, it got worse, much worse, for every coin that wasn’t Bitcoin.

Many alts stopped moving at all in terms of dollar prices, and even the top alts like Ethereum stopped moving. Then for months Bitcoin and Bitcoin alone gained back value and dominance.

The fiat to crypto charts didn’t look so bad, but the altcoin to Bitcoin charts in that time, they did not look great. Ethereum went from .15 BTC to .025 BTC from June to December… today it is at .09.

Where did the money come from the fuel this epic Bitcoin run? Well it partly came from outside the crypto space in cold hard dollars (that is one way in which the market cap grew) however it also came from altcoins. People used their alts, Ripple, Ether, etc to buy Bitcoin as it rose.

If Bitcoin was dead, then why was everyone trading their precious alts to buy into it?

The answer is the same that one can give to the opposite question (that is, why is everyone trading their precious Bitcoin for alts). The answer being, “because people want to make money, so they rotate to the coin or set of coins that is doing well and way from the coin that just made an epic run.”

If you look at the charts you’ll see that the top coins rarely go back to square one. Instead they tend to take two steps forward and ones step back. BTC goes from $1k to $5k, but then to $3k. Ripple goes from .25 cents to $3.50, but then to $2. Those who hold long term are fine, but those who buy in at the top, then panic sell during the correction or months long bear market aren’t so lucky.

Thus we want to understand what the chart is telling us, as it’ll clue us in to when to buy, when to hold, and when to fold em’ (unless you have a coin that can’t withstand the test of time, selling low is generally not a good idea).

Here is what we need to know then, historically speaking:

When we see a strong pull back of a coin on the dominance chart, or when we see a steep rise, it likely is not telling us about how it will be from now on. Rather, it is telling us that a wave is forming. All we really need to know is what part of the wave we are on. We can guess and trade, or we can sit tight and hold. No one can time the market perfectly, so we don’t need to try. We rather just want to make sure we are setting ourselves up to ride the next wave (and that we are willing to hold current coins for months if needed while they lose value against another coin).

When we see Bitcoin pull back in market dominance, and when we see Ripple, Ethereum, and Alts rise, it isn’t necessarily a sign that Bitcoin is ending. Instead, it is a sign that alts have a limited window to thrive before Bitcoin comes back with a vengeance. Likewise, when we Bitcoin dominance rise and altcoins fall, it isn’t a sign they are ending, it is a sign that we have a limited window before Bitcoin corrects.

The market seems to forget this every time the rotation shifts. And one day those who claim Bitcoin, altcoins, or crypto in general dead may be right… but historically, they were never right. When Bitcoin looked dead, it was simply an extended bear market. When Bitcoin looked like it would be the only crypto, alt coins came back stronger than ever. Now here altcoins look like they will take over. Let’s not be so stubborn as to ignore history.

If Bitcon’s chart is wave-like, and if it is pattern based, and if its dominance chart is the same, if this is true for Ripple and Ethereum, and if this is true generally for alts, and if this has been true every time so far… then we should take seriously the idea that this current boom of Ripple, Ethereum, and alts isn’t “just how it will be from now on” but is rather a sign that we are on a current wave.

If I thought I could be on a wave I would want to do a few things:

- I’d want to ride the wave and enjoy the surf. So I’d be in Ether, XRP, and a range of alts (especially those low priced alts and recent ICOs that might moon).

- I’d want to understand what part of the wave I was on. Is this the part where everyone goes after low priced alts, or is everyone into privacy coins at the moment? Or is this near the end where everyone holding alts is going to be in a rough spot for a few months or so? Are we entering a bear market, or is this the start of an epic run?!

- I’d want to be creating positions in coins that looked bleak. On this wave Bitcoin and Litecoin look bleak. These mainstay simple transfer coins that trade on Coinbase have seen better days. However, some of those better days have been really impressive. Let’s build an average position for the next wave while they are “cheap.”

- Most of all, I’d want to have a strategy that accounted for my own limitations as a mortal. I don’t know if XRP, ETH, BTC, BCH, LTC, SC, TRON, VERGE, DOGE, XMR, XLM, etc, etc will do well or not. Clearly either ETH, XRP, BCH, BTC, or “other” stands a very good chance of being part of a future cycle, so I can be fairly certain that I can build positions and hold for as long as crypto is a thing. Thus, I can buy those coins on the dips, be generally aware of the waves, and maybe do a few ICOs I like here and there and try to be ready for whatever comes next. That plan won’t make me rich tomorrow, but it’ll probably be more rewarding than backing a single horse and expecting it to do something no coin has ever done in the history of cryptocurrency, that is preform well consistently.

The only general point I’m trying to make here is this, “BTC market dominance looks bleak, altcoin dominance looks strong, and the market cap of crypto is high. Thus, basic logic will tell you to flood into alts in a FOMO induced rage and declare Bitcoin dead. However, if history repeats, then the winners next cycle won’t be those who flooded into alts, it’ll be those who built in average position in Bitcoin and waited (while they enjoy the current altcoin boom). Meanwhile, if you don’t think you are smart enough to time this all, just build average positions in all the top coins over time and HODL. The patterns don’t just tell us Bitcoin will come back, they tell us all good coins will come back, and many quality alts will too.”

UPDATE NOV 2018: Just so we are crystal clear, it was telling us that BTC was about to regain dominance. Worse than that however, the crazy alt action was telling us that we were about to enter a long term bear market. YIKES! As for the insight above, it isn’t wrong. You were much safer in BTC than alts when that wave ended, and meanwhile, although you are sure down now if you did, we can generally over the long history of crypto say building average positions and HODLing through even the harshest crypto winter is always an option (assuming you picked solid coins). So next time we hear that BTC is dead and alts are king, what are we going to do? Well, we don’t know what the future will bring, but we sure want to proceed with caution, right?