The CNBC Fast Money Counter Indicator

Cryptocurrency traders have decided CNBC Fast Money’s Twitter calls work as a counter indicator. Meaning if the tweet is bullish, go short, and if the tweet is bearish, go long.

Bitcoin is the most commonly known cryptocurrency. It’s a decentralized digital currency that is secure and private and can be used in transactions worldwide. It carries with it a number of pros and cons and is currently rather volatile.

In this section we discuss everything Bitcoin including how it works, what it’s worth, how you can “mine Bitcoin”, and more.

Cryptocurrency traders have decided CNBC Fast Money’s Twitter calls work as a counter indicator. Meaning if the tweet is bullish, go short, and if the tweet is bearish, go long.

Bitcoin just flash crashed right before CBOE futures expire (09/19/2018). For the most part alts didn’t seem to be buying it, as they mostly refused to panic and drop against Bitcoin.

Bitcoin (BTC) has been trapped under a few important moving averages for most of the 2018 bear market. These Moving Averages have mostly been acting as resistance. To start a new bull trend and ward off more bear, we need to turn these resistances into supports.

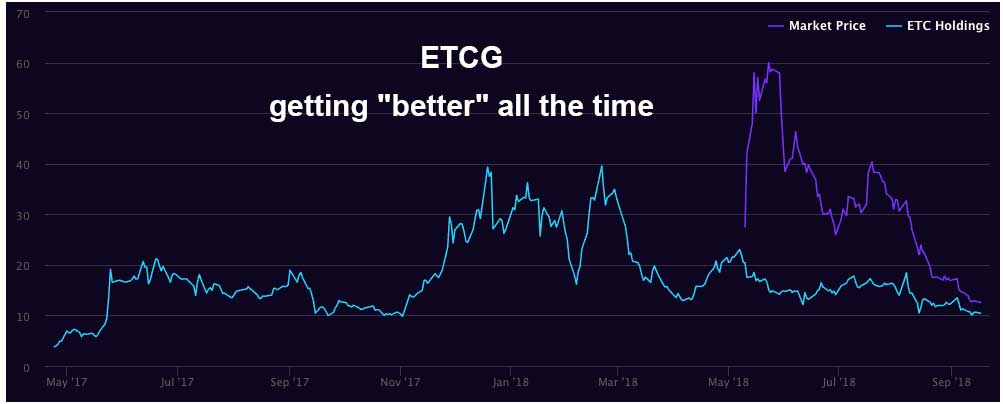

The premiums on GBTC and ETCG just keep getting lower and lower as the crypto bear market drags on. If crypto recovers, finding the bottom of these could be epic.

Bitmex is a crypto derivatives exchange that uses high leverage and margin trading and is open to many non-U.S. citizens. They have been the highest volume exchange in the 2018 bear market.

There is yet another x-financial institution working on Bitcoin product rumor from insider, yet again according to Bloomberg. Today’s rumor, Morgan Stanley is preparing to offer Bitcoin swap trading.

Here is a simple explanation of Bitcoin: Bitcoin is digital money on the internet. It works like online banking without a bank.

The Winklevoss Twins’ Gemini Trust has launched the world’s first regulated stablecoin. The coin is an Ethereum-based asset pegged to the U.S. dollar.

A rumor spread by Business Insider that Goldman Sachs was abandoning plans to launch a cryptocurrency trading desk is “fake news” according to Goldman CFO Martin Chavez.

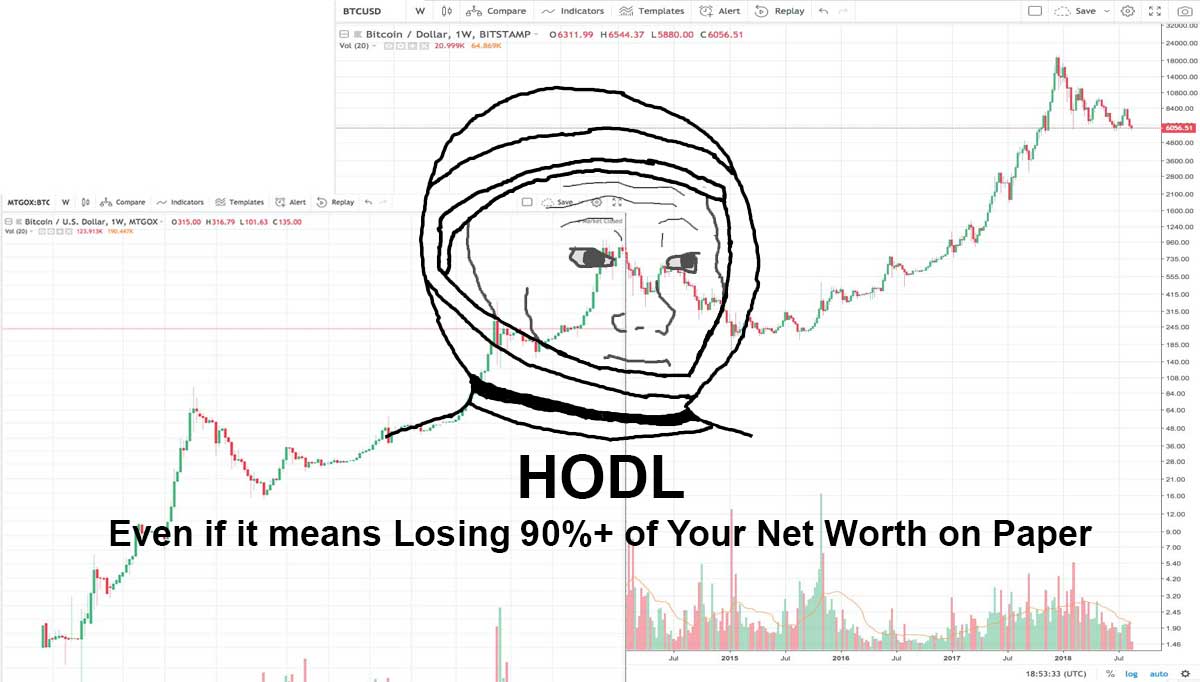

The term “HODL” is a misspelling of “hold” that comes from a December 2013 BitcoinTalk forum post called “I AM HODLING.”

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.