The GBTC and Kimchi Premiums are Disappearing Again

The Bitcoin Premiums are Melting Away, and Historically that is a Bullish Sign

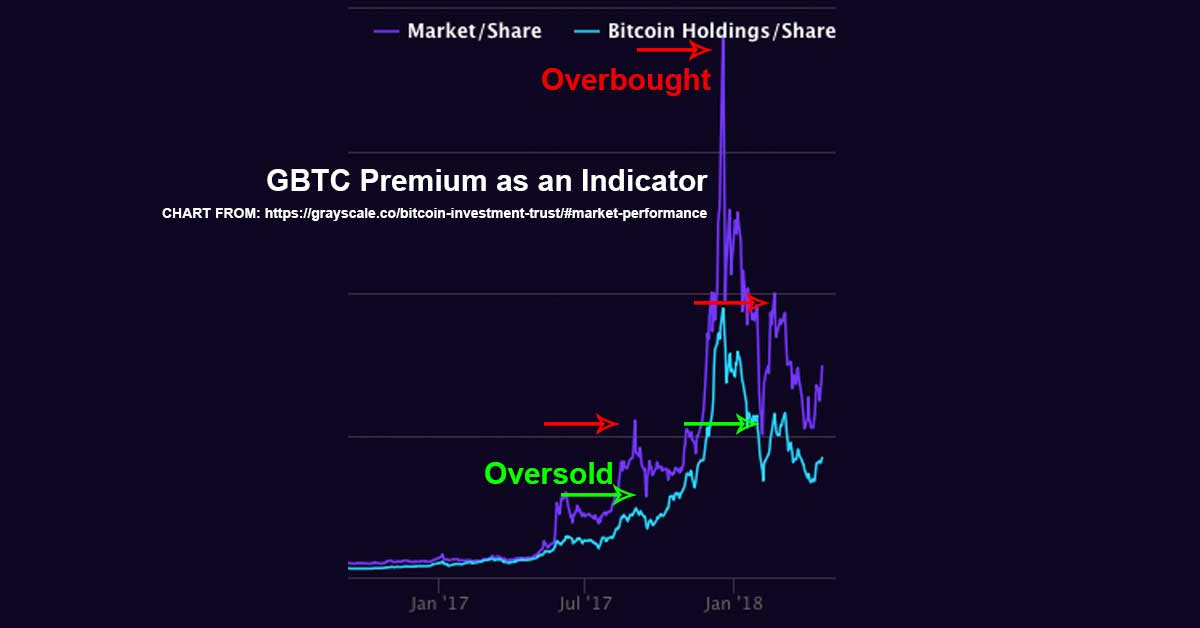

Here in late June 2018 the GBTC premium and the South Korean “Kimchi” premium are quickly disappearing. This has historically been a bullish sign that has signaled the end stages of a bear market. See some historic examples in the chart above (the above chart is educational, not current), see the current premium here, and see this article for the last time I brought this up (NOTE: it was very close to the last bottom that time; almost the literal bottom of the last cycle on April 9th, 2018).

Historically speaking:

- When crypto sentiment is bullish, GBTC and South Korean investors end up paying a premium for crypto due to investors bidding up the assets higher than Bitcoin’s USD value.

- When crypto sentiment is bearish, the “premiums” paid in both markets start to melt away.

This is generally more pronounced with GBTC, which can trade at over 100% Native Asset Value (NAV) to share value (meaning GBTC will trade like Bitcoin is $20k or more when it is $10k for example), but it is noticeable in both markets.

Today (June 27, 2018) GBTC traded like Bitcoin was $8.4k while Bitcoin’s USD value was $6.05k. That is the closest the NAV (the actual price of Bitcoin) has been to the premium (what GBTC investors pay for a share compared to what the share represents in Bitcoin’s value in USD) since the bottoms in February and April.

Meanwhile, the South Korean “Kimchi” premium has almost completely disappeared (check coinmarketcap for prices in the South Korean Won vs. USD prices to see this premium).

Historically these premiums have “melted” off right before crypto rallied. This doesn’t mean it will happen this time, but let’s put it this way:

- If you want to invest in crypto via GBTC or in South Korea, you are generally better off buying when the premium is low.

- It is basic logic. If you buy when the premium is low, and then the premium inflates again, you get the upside not only of crypto but of the premium.

- Meanwhile if you sell when the premium has come off, or wait until the premium is high, you face the logical downside of that.

No one knows where Bitcoin / crypto will bottom, but especially with GBTC (with its much more pronounced premium), if you are going to be a buyer… you should be looking at that premium for entry points. Meanwhile, if you want an indicator for what the bottom of a crypto correction looks like, there are worse places to look than both the GBTC and Kimchi premiums.

If the market is ever so bearish as to bring the GBTC premium down to its NAV, I would consider it a very bullish sign. If it ever brought it down lower, it would consider it a fire sale.

Right now We have $8.9k GBT and $6.1k BTC, so already the market has assigned a $500 worth of Bitcoin value to a $50 move. Hopefully from this it should be clear that your window for taking advantage of these quick GBTC sales can be VERY small (I write fast, and while I wrote this the market added in $450 worth of premium to GBTC… hahah; man, I should have been day trading).

Anyway, point of all this being: 1. the lower these premiums get, the better value GBTC, 2. premiums are declining right now, and 3. the lower these premiums get, historically the closer to the bottom we are.

Do we need to hit the NAV before we see a recovery? Will this time be different? I don’t know… I can tell you about facts and about the past, but I still have not mastered the art of seeing into the future (“srying”).

The moral: when you see GBTC die, don’t cry, it might be bullish, but no one knows, because no one can scry, not even I.