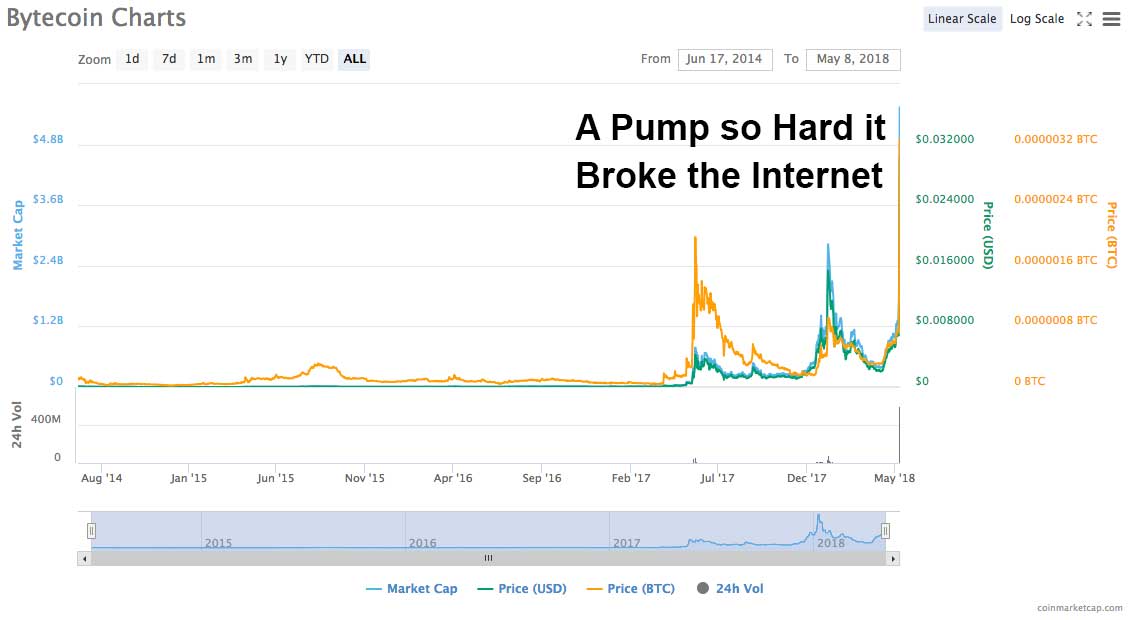

Bytecoin (BCN) Pumped So Hard it Crashed the Network

The Bytecoin Pump that Broke the Internet

Bytecoin (BCN) got pumped so hard after being listed on Binance that it essentially crashed the Bytecoin network.

The story is illustrated well by the following Bytecoin Tweets from May 8 – 9:

I’m so proud to announce that Bytecoin is listed on @binance!!! A million thanks to everyone who participated in the integration process! And a huge thank you to our community for staying with us for all this time! @jnfgoldberg #BCN #binance #ByteCoin

— Bytecoin BCN (@Bytecoin_BCN) May 8, 2018

Bytecoin Development team is working hard to fix all the network issues. Most of the problems have already been fixed. The fixed software is going online so be prepared to update your Bytecoin clients.

We will update you right after the software will be available for download.— Bytecoin BCN (@Bytecoin_BCN) May 9, 2018

Dear Community. We’d like to clarify situation with the Binance/ #Bytecoin price. We don’t have any influence on one or the other’s price. We are responsible for only our software and all we are doing now is trying to fix everything ASAP, please excuse us for any inconvenience.

— Bytecoin BCN (@Bytecoin_BCN) May 9, 2018

I am assuming the network issues were a result of every Bytecoin holder who had been holding bags from the last few pumps rushing to take their insane and nearly instant gains, but that is just an assumption.

This event must have been a bittersweet moment for the Bytecoin team. On the one hand, they all became insanely rich on paper very quickly, on the other hand, that short period of glory was filled with them working to update their network as it began to lag and freeze up due to the rapid influx of usage. This all happened so quickly that it must have been like a blur for them.

To be fair, Bytecoin doesn’t control the price on Binance, only traders do. Sometimes traders will bid up a coin when it is first listed on an exchange, and once in a blue moon, they have a little help from pump groups.

The reality is, Bytecoin fixed their issues quickly and did a good job of communicating what was happening. Fingers crossed they are able to get some sells in before prices settle.

This series of events is a good reminder of a few important lessons, they are:

- If you want a lambo, find coins that have been dumped hard, buy them, pray, and then get ready to sell them really quickly if and when they get pumped. Most will likely do nothing, but once in a while, you might hit the lotto.

- If you want to keep your existing money, avoid buying coins that have just been pumped and those that you didn’t bother to research.

NOTE: There is nothing wrong with Bytecoin as a coin, check out their Twitter. There is nothing wrong with speculating and jumping in and out of a pump and dump (I’m fairly certain running a pump and dump is illegal on paper, but like “illegal” in theory has little bearing on the reality of the crypto space). The main point of this article, aside from bringing awareness and perhaps a chuckle, is this: if you are new to the crypto space, and you don’t know what a pump and dump is, or don’t understand that they can occur when low volume coins get listed on exchanges, try to figure it out. Listen to others or watch the exchanges. Do not by buy the top of some crazy pump and then HODL into the ground.

TIP: Bytecoin went from $0.00004 a year ago to $0.002 in April to $0.03 on May 8th. Before you scoff, consider that this isn’t that uncommon in crypto. Bitcoin used to cost a penny. Sure, the Bytecoin pump was extraordinary, but it really wasn’t so unusual. In fact, Bytecoin itself was pumped a considerable amount in May, 2017. In low volume coins, the effects tend to be a little crazy, but if you want to be honest with yourself, go back and open up ANY crypto chart. XRP is a good example of major high-volume coin that has a story not so different from Bytecoin (minus the breaking the internet part). Crypto is like the Wild West, but instead of a Sheriff, you get John McAfee on bath salts. I’m half joking.

Dogecoin doing well seems to correlate with major crypto corrections.